Description

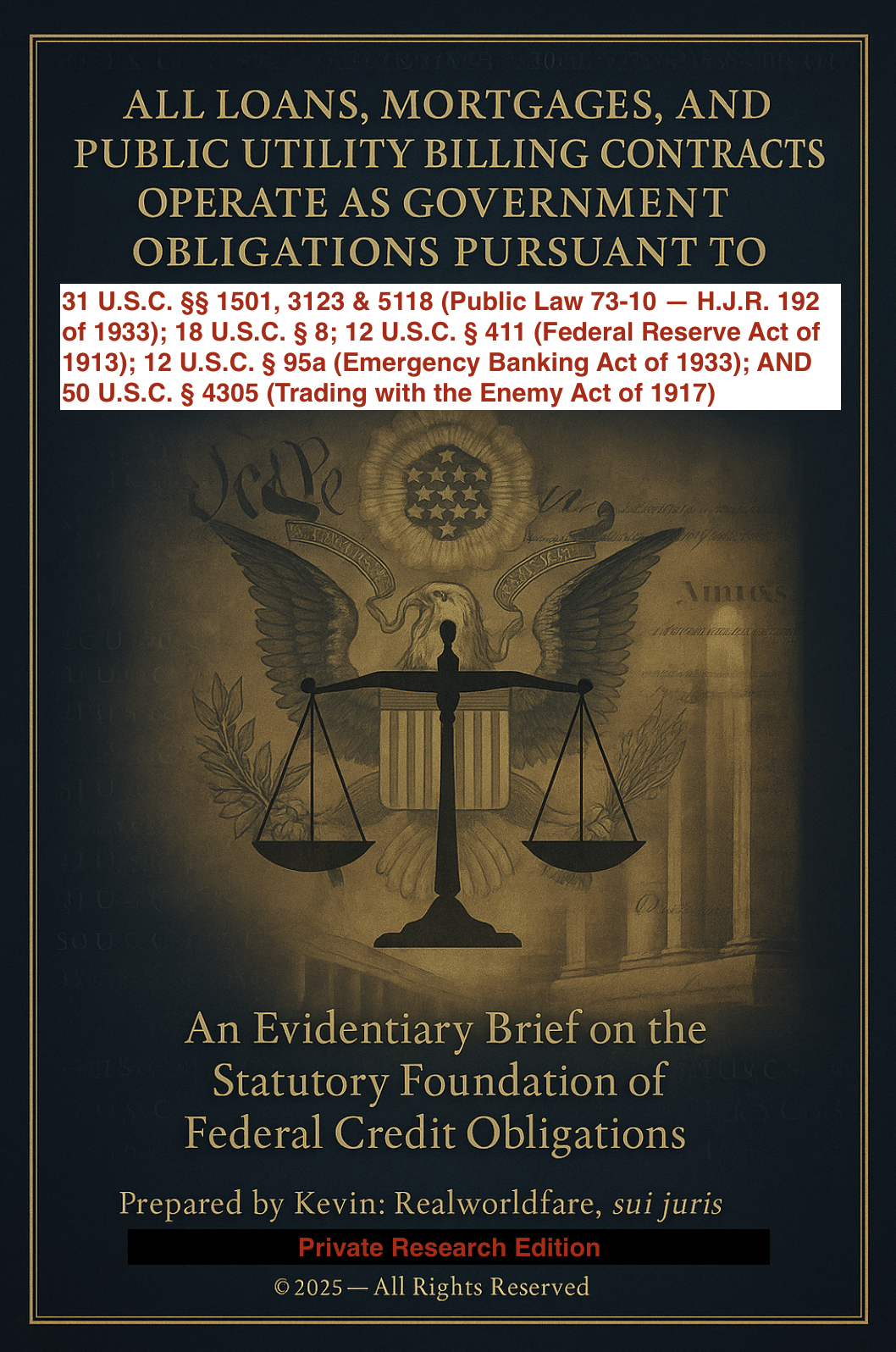

modern loan, mortgage, deposit, and utility bill operates as a recordable government obligation under the credit of the United States. It cites 18 U.S.C. § 8, 31 U.S.C. §§ 1501, 3123 & 5118 (Public Law 73-10 / HJR-192), 12 U.S.C. §§ 83 & 411, 12 U.S.C. § 95a, and 50 U.S.C. § 4305 to show that banks cannot lend their own funds and that all commercial performance is settled through Treasury-issued public credit. This brief dismantles the illusion of private debt and exposes how every transaction is underwritten, guaranteed, and discharged by federal law.

Reviews

There are no reviews yet.