Description

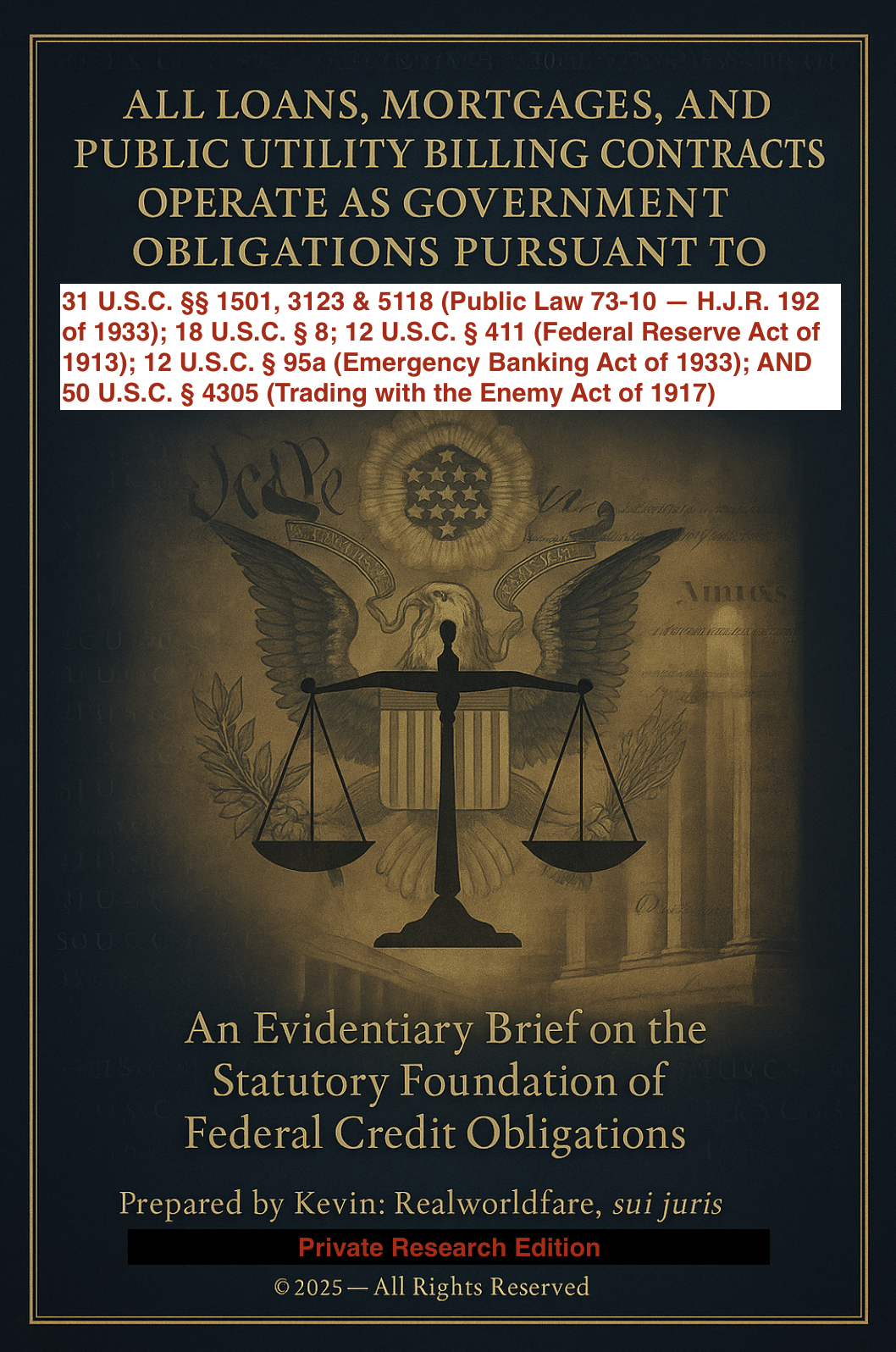

This groundbreaking legal study exposes the post-1933 commercial reality: all money is debt, all obligations are securities, and all debts are lawfully discharged by indorsement. It meticulously documents how House Joint Resolution 192 (Public Law 73-10) abolished gold payment, converting all public and private obligations into dischargeable securities — governed by 12 U.S.C. §§ 411–412, 31 U.S.C. §§ 3123 & 5118, 31 C.F.R. Part 328, and UCC §§ 3-601, 3-603, and 3-311.

Inside, you’ll learn how Federal Reserve Notes are not money but obligations issued solely upon collateral securities; how all contracts are now settled in credit through trust-administered securities systems; and how a properly signed or indorsed instrument — even a billing coupon — constitutes lawful tender for discharge. Supported by the Emergency Banking Relief Act, the Trading with the Enemy Act, and the Securities and Trust Indenture Acts, this guide shows how banks and courts are fiduciary agents duty-bound to honor lawful tenders. Any refusal to process such tender constitutes commercial dishonor, fraudulent conversion, and breach of fiduciary duty.

Outcome:

Gain a clear, evidence-backed understanding of how to leverage commercial law to discharge obligations lawfully — and hold financial actors accountable when they obstruct your lawful right to settle in credit.

Reviews

There are no reviews yet.