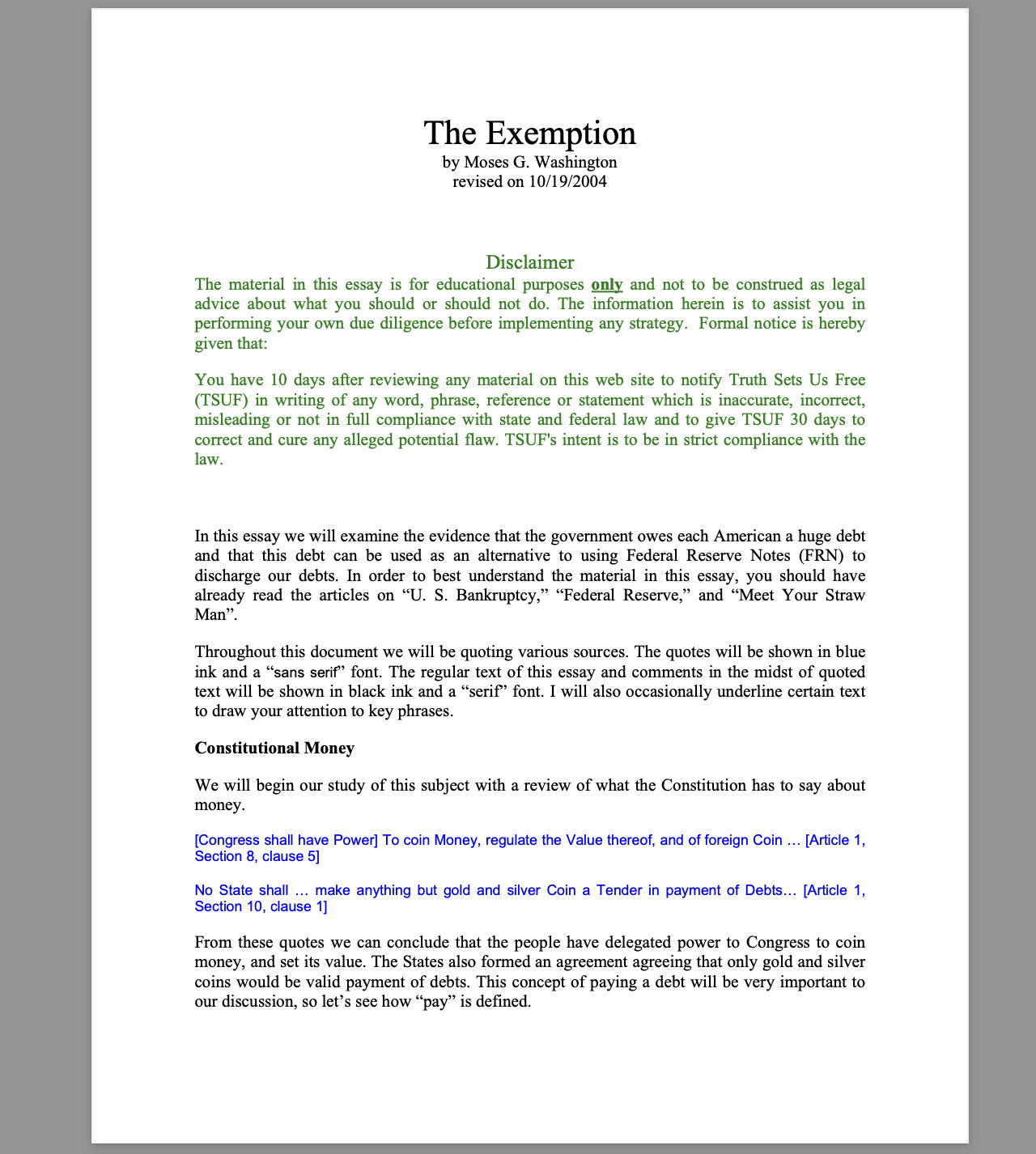

Description

Pages total: 19

Disclaimer

The material in this essay is for educational purposes only and not to be construed as legal advice about what you should or should not do. The information herein is to assist you in performing your own due diligence before implementing any strategy. Formal notice is hereby

given that:

You have 10 days after reviewing any material on this web site to notify Truth Sets Us Free (TSUF) in writing of any word, phrase, reference or statement which is inaccurate, incorrect, misleading or not in full compliance with state and federal law and to give TSUF 30 days to correct and cure any alleged potential flaw. TSUF’s intent is to be in strict compliance with the law.

In this essay we will examine the evidence that the government owes each American a huge debt and that this debt can be used as an alternative to using Federal Reserve Notes (FRN) to discharge our debts. In order to best understand the material in this essay, you should have already read the articles on “U. S. Bankruptcy,” “Federal Reserve,” and “Meet Your Straw Man”.

Throughout this document we will be quoting various sources. The quotes will be shown in blue ink and a “sans serif” font. The regular text of this essay and comments in the midst of quoted text will be shown in black ink and a “serif” font. I will also occasionally underline certain text to draw your attention to key phrases.

Constitutional Money

We will begin our study of this subject with a review of what the Constitution has to say about money.

[Congress shall have Power] To coin Money, regulate the Value thereof, and of foreign Coin … [Article 1, Section 8, clause 5]

No State shall … make anything but gold and silver Coin a Tender in payment of Debts… [Article 1, Section 10, clause 1]

From these quotes we can conclude that the people have delegated power to Congress to coin money, and set its value. The States also formed an agreement agreeing that only gold and silver coins would be valid payment of debts. This concept of paying a debt will be very important to our discussion, so let’s see how “pay” is defined.

Pay. To discharge a debt by tender of payment due; to deliver to a creditor the value of a debt, either in money or in goods, for his acceptance. [Black’s Law Dictionary 5th Edition]

While the above definition uses the word “discharge,” we do not believe that “pay” and “discharge” carry the same meaning. You will notice that pay carries with it the concept of “deliver to the creditor the value of a debt, either in money or in goods.” This means that “pay” includes the concept of “exchange.”

Exchange. To barter; to swap. To part with, give or transfer for an equivalent… [Black’s Law Dictionary 5th Edition]

So the idea of an exchange is one in which two parties transfer items one to the other for like value. We conclude from this definition that an exchange pays a debt in full. Both parties received something of equal value. Now let’s look at the definition for “discharge.”

Discharge. To release; liberate; annul; unburden; disencumber; dismiss. To extinguish an obligation; … [Black’s Law Dictionary 5th Edition]

It is clear from this definition that “discharge” is very different from “pay”. It is evident that there is no exchange of equal value occurring when a debt is discharged.

The system that was set when our republic was founded allowed people to “pay” their debts. Gold and silver both are substances that have been recognized to have intrinsic value for thousands of years. If someone wanted to buy a cow and a price of $20 was agreed to between the buyer and the seller, an exchange takes place between the parties when the buyer exchanges the $20 gold piece for the cow.

Our concept of money has changed from the founding of our country from being gold and silver coins to paper money not backed by gold (fiat money). These concepts began to change after the Civil War.

Legal Tender Cases

During the Civil War, the US government issued “green backs” which was money backed by nothing, fiat money. This was a significant change from the systems that was established in the Constitution. These green backs were very similar to our current Federal Reserve Notes. There were a number legal cases that ruled on the constitutionality of the green back currency. In each of the initial cases, the courts ruled that the green backs were unconstitutional. But the Knox v. Lee case reversed the prior decisions of the Supreme Court. This case decided that the government could issue “legal tender” that is not backed by gold and silver thus paving the way of the Federal Reserve Bank in 1913 and the “confiscation” of the gold in 1933………………….