Description

Secure your name. Assert your claim. Protect your estate.

This advanced package is designed for private individuals who are ready to lawfully take control of their legal estate, perfect their secured interest, and structure their affairs through a private trust — all under the commercial and equity frameworks recognized by law.

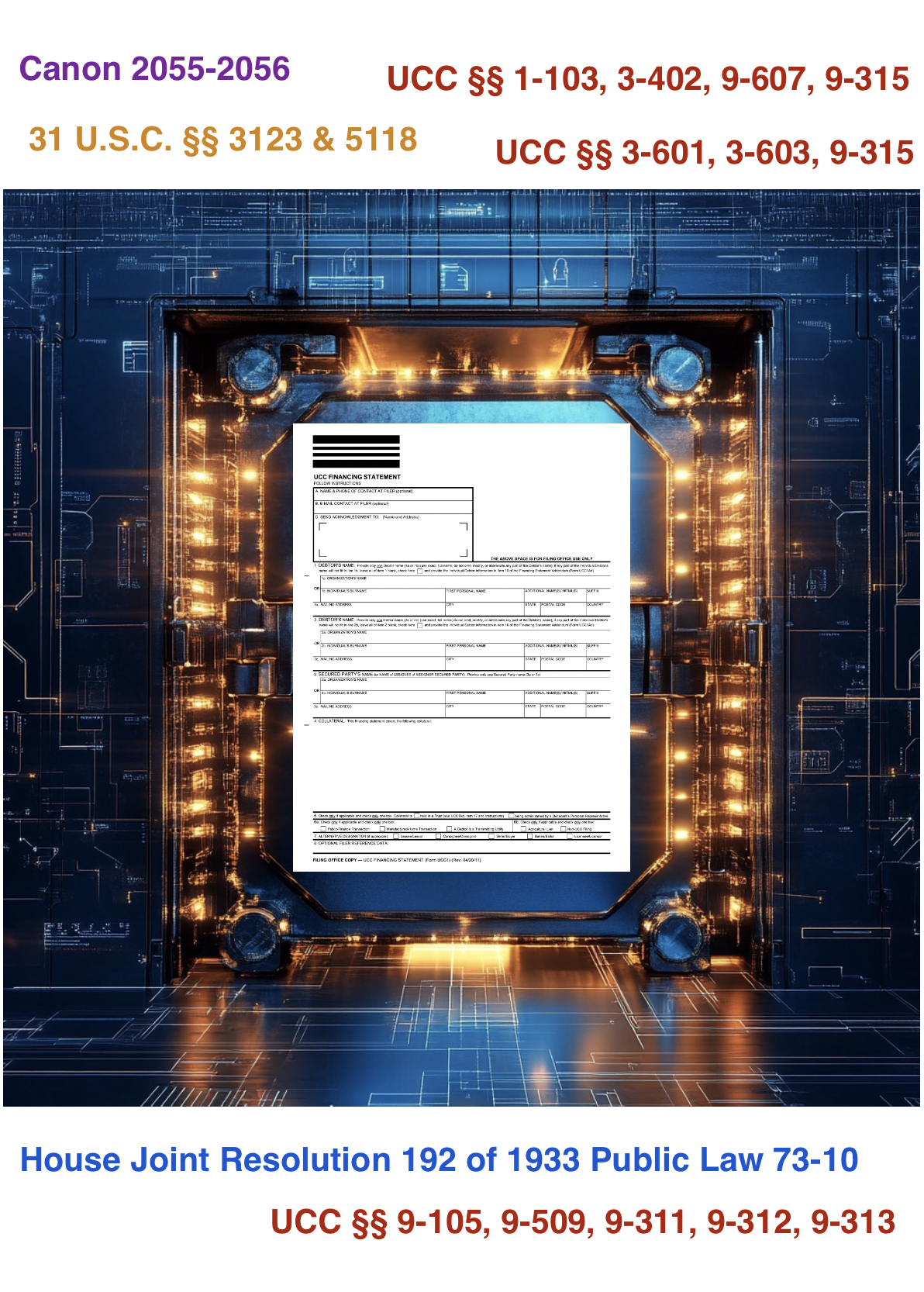

You are not the NAME — you are the living man or woman. This process distinguishes you from the legal fiction and places actual and constructive notice into the public record, rebutting all presumptions of wardship, abandonment, or corporate subjugation as defined in Canon 2055–2056.

📦 What’s Included:

-

UCC-1 Financing Statement

Initial security interest notice establishing perfected claim over the estate and all assets. -

Affidavit of Power of Attorney In Fact

Reclaims legal authority over the NAME and estate and affirms you as the authorized representative. -

Trademark and Copyright Agreement

Declares lawful ownership of the NAME, likeness, and identity as private intellectual property. -

Affidavit of Truth & Status

(Including Minimum Contacts, Contract Rebuttal, Jurisdictional Standing, Constitutional Claims, Full Asset Claim, and Revocation of Power of Attorney)

Asserts lawful status, rebuts federal jurisdiction, and revokes prior unrebutted presumptions of consent or citizenship. -

Hold Harmless and Indemnity Agreement

Protects the estate, secured party, and trust against third-party liability, fraudulent claims, or commercial intrusion.

✅ Key Benefits:

-

Assert a lawful and equitable claim over your estate, name, and property

-

Establish a perfected first-position security interest in all assets, present and future

-

Organize your affairs through a private trust structure for asset protection and administration

-

Lawfully rebut presumption of commercial personhood or public debt liability

-

Assign all alleged debts to the U.S. Treasury for lawful discharge and settlement

![IT’S TIME TO CLAIM YOUR ESTATE. You’re not lost at sea. You were declared lost—so someone else could control the cargo. Your LEGAL NAME became a transmitting utility. Your BIRTH CERTIFICATE? A warehouse receipt. Your SSN? A CUSIP. Your estate? A trust. And you? Presumed the debtor... unless and until you rebut the presumptions. But here’s the truth: [Canon Law 2055–2056]: A man or woman may claim rightful dominion over their name, estate, and trust when presumption is rebutted and proof of life is given. [18 USC § 8] – Defines obligation of the United States as including “bonds, certificates of ind IT’S TIME TO CLAIM YOUR ESTATE. You’re not lost at sea. You were declared lost—so someone else could control the cargo. Your LEGAL NAME became a transmitting utility. Your BIRTH CERTIFICATE? A warehouse receipt. Your SSN? A CUSIP. Your estate? A trust. And you? Presumed the debtor... unless and until you rebut the presumptions. But here’s the truth: [Canon Law 2055–2056]: A man or woman may claim rightful dominion over their name, estate, and trust when presumption is rebutted and proof of life is given. [18 USC § 8] – Defines obligation of the United States as including “bonds, certificates of ind](https://realworldfare.com/wp-content/uploads/2024/05/GpJwP3La4AIoo15.jpeg)

📜 Foundational Authorities Behind the Estate Claim Process:

UCC § 1-103 – Common Law and Equity Preservation

Ensures that the Uniform Commercial Code does not override common law, equity, or constitutional rights. This provision confirms that private rights, trusts, and equitable interests remain enforceable alongside commercial statutes.

🔹 This is your anchor to equity jurisdiction and lawful standing outside of statutory presumptions.

UCC §§ 2-204, 2-206 – Formation and Acceptance of Contracts

Establishes that a binding contract exists through conduct, performance, or partial agreement — not just signatures.

🔹 This justifies the enforcement of your private trust, lien, or security agreement — even if the other party never signed it — as long as they’ve benefited or failed to rebut your terms.

UCC §§ 9-105, 9-509, 9-311, 9-312, 9-313 – Collateral Description, Authorization, and Perfection

These sections govern how to describe, authorize, and perfect a security interest in both tangible and intangible property, including names, estates, birth certificates, and trust assets.

🔹 You are establishing public notice that you now control all property linked to the NAME and estate — and that your interest is perfected under law.

UCC § 9-315 – Proceeds and Continued Interest

Confirms that your security interest follows the property, even after it is sold, transferred, or converted.

🔹 This means you still have lawful claim to money, property, or proceeds derived from your secured collateral — such as your name, trust, or estate.

UCC § 9-607 – Enforcement Rights of the Secured Party

Authorizes the secured party to collect directly from obligors, enforce liens, and recover proceeds without needing court permission.

🔹 This affirms your lawful right to enforce your claim, issue demands, or collect against any party exploiting the estate without proper authority.

UCC §§ 3-601, 3-603 – Discharge and Tender of Obligations

States that a debt is discharged when proper tender is made and not accepted — or when discharge is offered through lawful process.

🔹 When you assign the obligation for discharge, you’re legally resolving the debt even if the system refuses to acknowledge it.

UCC § 3-402 – Liability in a Representative Capacity

Clarifies that liability attaches to the person acting on behalf of a principal — unless properly disclosed.

🔹 This supports your assertion that you act as the authorized representative of the NAME/estate, and that liability belongs to the entity — not the living man.

31 U.S.C. §§ 3123 & 5118 – Treasury’s Obligation to Discharge Debt

Federal law confirming that public debt must be paid, and that obligations cannot demand gold or real money due to abandonment of the gold standard.

🔹 This aligns with the process of assigning all estate-related debts to the Treasury for lawful discharge in accordance with statute.

18 U.S.C. § 8 – Definition of “Obligation” Under Federal Law

Defines an “obligation” as any instrument backed by the United States, including bonds, notes, or commercial paper.

🔹 This supports your claim that all contracts and debt instruments tied to the NAME are federally recognized obligations subject to discharge.

House Joint Resolution 192 of 1933, Public Law 73-10

Abolished the requirement to pay debts in gold and placed the burden of debt discharge on the federal government.

🔹 This is your foundational authority for assigning the alleged debts of the estate to the Treasury — as a matter of public policy and law.

🔐 Assignment of Debt for Discharge:

All alleged debts, obligations, and liabilities tied to the NAME or estate are formally assigned to the Secretary of the Treasury for discharge in accordance with commercial law and federal statute — reflecting your lawful status as the Secured Party Creditor, not debtor or surety.

🚨 Final Step: Enforcement (Not Included)

While this package establishes your legal position, files your claims, and secures your estate, enforcement is a separate and critical step. If you fail to enforce your perfected interest, the system presumes waiver or abandonment.

Please note: Enforcement actions — including lien enforcement, demands for performance, or administrative claims — are not included in this package.

However, we do offer private support and strategic assistance for those ready to pursue enforcement through lawful channels, upon request.

🧠 Summary:

You either control the estate — or it is controlled for you.

This package provides the lawful tools to stand in your authority, declare your interests, and reclaim your estate with precision, equity, and legal standing.