San Diego County Credit Union (SDCCU) and Shannon Peterson and Alejandro Morreno with law firm Sheppard Mullin Richter & Hampton LLP now find themselves under intense legal scrutiny with a “Demand/MOTION for Summary Judgment Without Hearing Based on THREE UNREBUTTED AFFIDAVITS, Binding Conditional Acceptance, and NO Material Dispute of Fact,” filed against them.

The motion, bolstered by extensive evidence including three (3) unrebutted verified commercial affidavits, serves as prima facie evidence against both SDCCU and Sheppard Mullin with a host of serious offenses, including fraud, embezzlement, identity theft, treason, monopolization of trade and commerce, false pretenses, bank fraud, theft, racketeering, embezzlement, extortion, and, most gravely, conspiracy against Constitutional rights. Central to this case is the assertion that these actions were knowingly and willfully committed against a party protected under national and international law, raising the stakes considerably.

Evidence-Based Claims: Unrebutted Affidavits and an Ironclad Case

The case builds its case upon three (3) unrebutted verified commercial affidavits, each unrebutted and accepted as truth under contract and commercial law principles. These affidavits, now exhibits in the case, represent unsworn declarations (See 28 U.S. Code § 1746 – Unsworn declarations under penalty of perjury) detailing alleged admissions of guilt by SAN DIEGO COUNTY CREDIT UNION (SDCCU) and Sheppard Mullin. The evidence affirms that these affidavits document clear acknowledgments of their Defendant’s willful and intentional criminal behavior, ranging from fraud and embezzlement to direct constitutional violations. Under both common and commercial law, unrebutted affidavits become binding as factual evidence, effectively making them judicial admissions.

As evidenced by legal maxims:

-

-

- ALL ARE EQUAL UNDER THE LAW. (God‘s Law – Moral and Natural Law). Exodus 21:23-25; Lev. 24: 17-21; Deut. 1; 17, 19:21; Mat. 22:36-40; Luke 10:17; Col. 3:25. “No one is above the law”.

- IN COMMERCE FOR ANY MATTER TO BE RESOLVED MUST BE EXPRESSED. (Heb. 4:16; Phil. 4:6; Eph. 6:19-21). — Legal maxim: “To lie is to go against the mind.” Oriental proverb: “Of all that is good, sublimity is supreme.”

- TRUTH IS EXPRESSED IN THE FORM OF AN AFFIDAVIT. (Lev. 5:4-5; Lev. 6:3-5; Lev. 19:11-13: Num. 30:2; Mat. 5:33; James 5: 12).

- IN COMMERCE TRUTH IS SOVEREIGN. (Exodus 20:16; Ps. 117:2; John 8:32; II Cor. 13:8 ) Truth is sovereign — and the Sovereign tells only the truth.

- AN UNREBUTTED AFFIDAVIT STANDS AS TRUTH IN COMMERCE. (12 Pet. 1:25; Heb. 6:13-15;). “He who does not deny, admits.”

- AN UNREBUTTED AFFIDAVIT BECOMES THE JUDGEMENT IN COMMERCE. (Heb. 6:16-17;). “There is nothing left to resolve.”

- HE WHO LEAVES THE BATTLEFIELD FIRST LOSES BY DEFAULT. (Book of Job; Mat. 10:22) — Legal maxim: “He who does not repel a wrong when he can occasions it.

-

The plaintiff’s legal team emphasizes that, without rebuttal, these affidavits alone fulfill the evidentiary burden for summary judgment, especially when paired with further exhibits. To deny summary judgment, the plaintiff argues, would be an act tantamount to “war against the Constitution,” disregarding fundamental rights and protections outlined therein. The motion asserts that the defendants’ silence in the face of these affidavits is express admission, tacit admission, intentional acquiescence, and thus tacit procuration, substantiating the plaintiff’s claims.

Constitutional Stakes: An Appeal to Uphold Justice and Accountability

In this motion, the plaintiff contends that by failing to grant summary judgment, the court would essentially disregard the Constitutionally protected rights of men and women against coercive, fraudulent, unconstitutional, and exploitative practices. The plaintiff argues that this case is more than a mere legal dispute; it’s a Constitutional matter that centers on fundamental protections, invoking a sense of duty on the part of the court to hold the defendants accountable. The evidence, which includes extensive documentation and unrebutted commercial affidavits, underscores claims of Constitutional violations and intentional and willful misconduct by SDCCU and Sheppard Mullin.

The case has reached a pivotal moment following the conditional acceptance of the “Notice of Removal” and the filing of two crucial motions: the Motion for Summary Judgment and the “Demand/MOTION for Summary Judgment Without Hearing Based on THREE UNREBUTTED AFFIDAVITS, Binding Conditional Acceptance, and NO Material Dispute of Fact.”

These motions and/or demands underscore that the overwhelming evidence justifies an immediate judgment in favor of the plaintiff, eliminating the need for trial or further delay. This phase also establishes additional binding contractual obligations under commercial law, further solidifying the defendants’ accountability as they tacitly accepted and became bound by the terms presented.

Key Legal and Financial Implications of a Summary Judgment Ruling

If the court grants the Motion for Summary Judgment, SDCCU and Sheppard Mullin would face immediate and substantial financial repercussions, alongside potentially irreversible reputational damage. For both organizations, a ruling in the plaintiff’s favor would underscore the severity of their alleged misconduct, serving as a powerful precedent on the consequences of actions deemed unconstitutional, fraudulent, or extortionate in nature.

On the other hand, should the court deny the motion, the plaintiff contends this would effectively endorse a breach of constitutional duty by the judiciary. Such an outcome, they argue, would embolden future violations by suggesting that even mounds of clear, unrebutted evidence can be ignored or minimized.

Writ of Mandamus and Demand for Recusal

If summary judgment is not granted, a writ of mandamus will be filed to compel the court to issue the judgment based on the clear evidence presented. Additionally, a demand for recusal will be submitted if the judge fails to act impartially and in accordance with their legal duty.

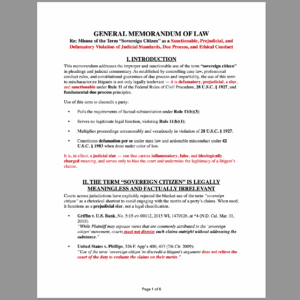

- “When enforcing mere statutes, judges of all courts do not act judicially (and thus are not protected by ‘qualified’ or ‘limited immunity’) — SEE: Owen v. City, 445 U.S. 662; Bothke v. Terry, 713 F2d 1404. Judges serve merely as extensions or agents of the involved agency, acting in a ‘ministerial’ rather than a ‘discretionary’ capacity.” — Thompson v. Smith, 154 S.E. 579, 583; Keller v. P.E., 261 US 428; F.R.C. v. G.E., 281, U.S. 464.

- “Judges not only can be sued over their official acts but may also be held liable for injunctive and declaratory relief and attorney’s fees.” — Lezama v. Justice Court, A025829.

- “Ignorance of the law does not excuse misconduct in anyone, least of all in a sworn officer of the law.” — In re McCowan (1917), 177 C. 93, 170 P. 1100.

- “All are presumed to know the law.” — San Francisco Gas Co. v. Brickwedel (1882), 62 C. 641; Dore v. Southern Pacific Co. (1912), 163 C. 182, 124 P. 817; People v. Flanagan (1924), 65 C.A. 268, 223 P. 1014; Lincoln v. Superior Court (1928), 95 C.A. 35, 271 P. 1107; San Francisco Realty Co. v. Linnard (1929), 98 C.A. 33, 276 P. 368.

- “It is one of the fundamental maxims of the common law that ignorance of the law excuses no one.” — Daniels v. Dean (1905), 2 C.A. 421, 84 P. 332.

- Furthermore, “the people, not the States, are sovereign,” as noted in Chisholm v. Georgia, 2 Dall. 419, 2 U.S. 419, 1 L.Ed. 440 (1793).

These precedents underscore that a judge’s failure to uphold their lawful duty without bias or discretion in this matter may constitute an act in conflict with constitutional principles, thereby justifying the demands for both mandamus relief and recusal.

What’s Next: The Case’s Potential Impact on National and International Law

The case’s outcome is likely to resonate beyond the courtroom. This lawsuit challenges not only the defendants but also the standards of accountability and constitutional adherence expected of financial institutions and legal firms. The judgment could have lasting implications, potentially reshaping how similar cases are approached in both national and international legal contexts, especially when Constitutional protections are disregarded.

This case as a wholr represents a watershed moment in the ongoing effort to uphold justice, Constitutional rights, and integrity in the financial and legal industries. By demanding swift and unequivocal accountability, the plaintiff calls upon the Florida court to reinforce the values embedded within the Constitution, setting a resounding precedent that fraud, racketeering, and exploitation will not be tolerated in any form or by any entity.