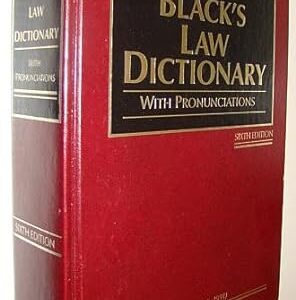

Black’s Law Dictionary 1st Edition, pages 704-:

LETTER. 1. One of the arbitrary marks or char- acters constituting the alphabet, and used in writ- ten language as the representatives of sounds or articulations of the human organs of speech.

2. A dispatch or epistle; a written or printed mes- sage; a communication in writing from one per- son to another at a distance. Buchwald v. Buch- wald, 199 A. 795, 799, 175 Md. 103.

3. In the imperial law of Rome, “letter” or “epistle” was the name of the answer returned by the emperor to a question of law submitted to him by the magistrates.

A communication inclosed, sealed, and stamped’ and being carried as first-class mail. Hyney v. U. S., C.C.A.Mich., 44 F.2d 134, 136; Wolpa v. U. S., C.C.A.Neb., 86 F.2d 35, 39.

4. A commission, patent, or written instrument containing or attesting the grant of some power, authority, or right.

The word appears in this generic sense in many com- pound phrases known to commercial law and jurispru- dence; e. g., letter of attorney, letter missive, letter of credit, letters patent. The plural is frequently used.

5. Metaphorically, the verbal expression; the strict literal meaning.

The letter of a statute, as distinguished from its spirit, means the strict and exact force of the language employed, as distinguished from the general purpose and policy of the law.

6. He who, being the owner of a thing, lets it out to another for hire or compensation. Story, Bailm. § 369.

LETTER-BOOK. A book in which a merchant or trader keeps copies of letters sent by him to his correspondents.

LETTER-CARRIER. An employe of the post-of- fice, whose duty it is to carry letters from the post-office to the persons to whom they are ad- dressed.

LETTER MISSIVE. In English law. A letter from the king or queen to a dean and chapter, con- taining the name of the person whom he would have them elect as bishop. 1 Steph.Comm. 666. A request addressed to a peer, peeress, or lord of parliament against whom a bill has been filed de- siring the defendant to appear and answer to the bill. In civil-law practice. The phrase “letters missive,” or “letters dimissory,” is sometimes used to denote the papers sent up on an appeal by the judge or court below to the superior tribunal, otherwise called the “apostles,” (q. v.).

Black’s Law Dictionary 4th Edition, pages 1048-1050:

LETTER. One of the arbitrary marks or char- acters constituting the alphabet, and used in writ- ten language as the representatives of sounds or articulations of the human organs of speech.

A dispatch or epistle; a written or printed mes- sage; a communication in writing from one per- son to another at a distance. Buchwald v. Buch- wald, 199 A. 795, 799, 175 Md. 103.

In the imperial law of Rome, “letter” or “epistle” was the name of the answer returned by the emperor to a question of law submitted to him by the magistrates.

A communication inclosed, sealed, and stamped’ and being carried as first-class mail. Hyney v. U. S., C.C.A.Mich., 44 F.2d 134, 136; Wolpa v. U. S., C.C.A.Neb., 86 F.2d 35, 39.

A commission, patent, or written instrument containing or attesting the grant of some power, authority, or right.

The word appears in this generic sense in many com- pound phrases known to commercial law and jurispru- dence; e. g., letter of attorney, letter missive, letter of credit, letters patent. The plural is frequently used.

Metaphorically, the verbal expression; the strict literal meaning.

The letter of a statute, as distinguished from its spirit, means the strict and exact force of the language employed, as distinguished from the general purpose and policy of the law.

He who, being the owner of a thing, lets it out to another for hire or compensation. Story, Bailm. § 369.

As to letters of “Administration,” “Advice,” “At- torney,” “Credit,” “Horning,” “Recommendation,” see those titles. As to “Letters Patent,” see Pat- ent.

LETTER-BOOK. A book in which a merchant or trader keeps copies of letters sent by him to his correspondents.

LETTER-CARRIER. An employe of the post-of- fice, whose duty it is to carry letters from the post-office to the persons to whom they are ad- dressed.

LETTER MISSIVE. In English law. A letter from the king or queen to a dean and chapter, con- taining the name of the person whom he would have them elect as bishop. 1 Steph.Comm. 666. A request addressed to a peer, peeress, or lord of parliament against whom a bill has been filed de- siring the defendant to appear and answer to the bill. In civil-law practice. The phrase “letters missive,” or “letters dimissory,” is sometimes used to denote the papers sent up on an appeal by the judge or court below to the superior tribunal, otherwise called the “apostles,” (q. v.).

LETTER OF ADVOCATION. In Scotch law. The process or warrant by which, on appeal to the supreme court or court of session, that tribunal assumes to itself jurisdiction of the cause, and discharges the lower court from all further pro- ceedings in the action. Ersk. Inst. 732.

LETTER OF CREDENCE. In international law. The document which accredits an ambassador, minister, or envoy to the court or government to which he is sent; e., certifies to his appointment and qualification, and bespeaks credit for his of- ficial actions and representations.

LETTER OF EXCHANGE. A bill of exchange (q. v.).

LETTER OF LICENSE. In English law, a writ- ten instrument in the nature of an agreement, signed by all the creditors of a failing or embar- rassed debtor in trade, granting him an extension of time for the payment of the debts, allowing him in the meantime to carry on the business in the hope of recuperation, and protecting him from arrest, suit, or other interference pending the agreement.

This form is not usual in America; but something sim- ilar to it is found in the “composition” or “extension agreement,” by which all the creditors agree to fund their claims in the form of promissory notes, concurrent as to date and maturity, sometimes payable serially and some- times extending over a term of years. Provision is often made for the supervision or partial control of the business, in the meantime, by a trustee or a committee of the cred- itors, in which case the agreement is sometimes called a “deed of inspectorship,” though this term is more com- monly used in England than in the United States.

LETTER OF MARQUE. A commission given to a private ship by a government to make reprisals on the ships of another state; hence, also, the ship thus commissioned. U. S. v. The Ambrose Light, D.C.N.Y., 25 F. 408; Gibbons v. Livingston, 6 N.J.Law, 255.

LETTER OF RECALL. A document addressed by the executive of one nation to that of another, in- forming the latter that a minister sent by the for- mer has been recalled.

LETTER OF RECREDENTIALS. A document embodying the formal action of a government up- on a letter of recall of a foreign minister. It, in effect, accredits him back to his own government. It is addressed to the latter government, and is de- livered to the minister by the diplomatic secretary of the state from which he is recalled.

LETTERS AD COLLIGENDUM BONA DEFUNC-

TI. In Practice. In default of the representatives and creditors to administer to the estate of an in- testate, the officer entitled to grant letters of ad- ministration may grant to such person as he ap- proves, letters to collect the goods of the deceased, which neither make him executor nor administra- tor; his only business being to collect the goods and keep them in his safe custody. 2 Bla.Com. 505.

LETTERS CLOSE. In English law. Close letters are grants of the king, and, being of private con- cern, they are thus distinguished from letters pat- ent.

LETTERS OF ABSOLUTION. Absolvatory let- ters, used in former times, when an abbot released any of his brethren ab omnia sub jectione et obedi- entia, etc., and made them capable of entering into some other order of religion. Jacob.

LETTERS OF CORRESPONDENCE. In Scotch law. Letters are admissible in evidence against the panel, i. e., the prisoner at the bar, in criminal trials. A letter written by the panel is evidence against him; not so one from a third party found in his possession. Bell.

LETTERS OF FIRE AND SWORD. See Fire and Sword.

LETTERS OF GUARDIANSHIP. A commission placing ward’s property in the care of officer of court as custodian. Walker v. Graves, 174 Tenn. 336, 125 S.W.2d 154, 157.

LETTERS OF REQUEST. A formal instrument by which an inferior judge of ecclesiastical juris- diction requests the judge of a superior court to take and determine any matter which has come before him, thereby waiving or remitting his own jurisdiction. This is a mode of beginning a suit originally in the court of arches, instead of the con- sistory court.

LETTERS OF SAFE CONDUCT. No subject of a nation at war with England can, by the law of na- tions, come into the realm, nor can travel himself upon the high seas, or send his goods and mer- chandise from one place to another, without dan- ger of being seized, unless he has letters of safe conduct.

By divers old statutes these must be granted under the great seal, and enrolled in chancery, or else are of no effect; the sovereign being the best judge of such emer- gencies as may deserve exemption from the general law of arms. But passports or licenses from the ambassadors abroad are now more usually obtained, and are allowed to be of equal validity. Wharton.

LETTERS OF SLAINS, OR SLANES. Letters subscribed by the relatives of a person who had been slain, declaring that they had received an assythment, and concurring in an application to the crown for a pardon to the offender. These or other evidences of their concurrence were neces- sary to found the application. Bell.

LETTERS ROGATORY. A request by one court of another court in an independent jurisdiction, that a witness be examined upon interrogatories sent with the request. Magdanz v. District Court in and for Woodbury County, 222 Iowa 456, 269 N.W. 498, 499, 108 A.L.R. 377. The medium where- by one country, speaking through one of its courts, requests another country, acting through its own courts and by methods of court procedure peculiar thereto and entirely within the latter’s control, to assist the administration of justice in the former country. The Signe, D.C.La., 37 F.Supp. 819, 820.

A formal communication in writing, sent by a court in which an action is pending to a court or judge of a foreign country, requesting that the testimony of a witness resident within the juris- diction of the latter court may be there formally taken under its direction and transmitted to the first court for use in the pending action.

This process was also in use, at an early period, between the several states of the Union. The request rests entirely upon the comity of courts towards each other. See Union Square Bank v. Reichmann, 41 N.Y.S. 602, 9 App.Div. 596.

LETTERS TESTAMENTARY. The formal instru- ment of authority and appointment given to an executor by the proper court, empowering him to enter upon the discharge of his office as executor. It corresponds to letters of administration granted to an administrator.

Black’s Law Dictionary 7th Edition, pages 914-:

letter. 1. A written communication that is usu. enclosed in an envelope, sealed, stamped, and delivered; esp., an official written communica tion <an opinion letter>. 2. (usu. pl.) A writ ten instrument containing or affirming a grant of some power or right <letters testamentary>. 3. Strict or literal meaning <the letter of the law>. – This sense is based on the sense of a letter of the alphabet. Cf. SPIRIT OF THE LAW.

letter-book. A merchant’s book for holding cor respondence.

letter contract. See CONTRACT.

letter missive. 1. Hist. A letter from the king (or queen) to the dean and chapter of a cathe dral, containing the name of the person whom the king wants elected as bishop. 2. Hist. After a lawsuit is filed against a peer, peeress, or lord of Parliament, a request sent to the defendant to appear and answer the suit. 3. Civil law. The appellate record sent by a lower court to a superior court. – Also termed letter dimissory.

letter of advice. A notice that a draft has been sent by the drawer to the drawee. UCC § 3-701.

letter o f attorney. See POWER O F ATTORNEY ( 1 ) .

letter of attornment. A grantor’s letter to a tenant, stating tha:t ‘the leased property has been sold and directing the tenant to pay rent to the new owner. See ATTORNMENT (1).

letter of comment. See DEFICIENCY LETTER.

letter of credence. A document that accredits a diplomat to the government of the country to which he or she is sent. – Abbr. LC; L/C. – Also termed letters ofcredence.

letter of credit. An instrument under which the issuer (usu. a bank), at a customer’s re quest, agrees to honor a draft or other demand for payment made by a third party (the benefi ciary), as long as the draft or demand complies with specified conditions, and regardless of whether any underlying agreement between the customer and the beneficiary is satisfied. • Letters of credit are governed by Article 5 of the DCC. – Abbr. LC; L/C. – Often shortened to credit. – Also termed circular letter of cred it; circular note; bill ofcredit.

“There is some confusion over the exact nature of credo its. They resemble a number of commercial devices that are not credits. Often, there is confusion between letters of credit and guaranties, and occasionally between letters of credit and lines of credit. In the credit transaction itself, it is important to distinguish the credit from other contracts and from the acceptance. Generally, the broad credit transaction consists of three separate relation ships. These include those that are ( 1 ) between the issuer and the beneficiary; (2) between the beneficiary and the account party; and (3) between the account party and the issuer. The first is the letter-of-credit engagement. The second is usually called the underlying contract, and the third is called the application agree ment.” John F. Dolan, The Law of Letters of Credit � 2.01, at 2-2 (1984).

“A credit is an original undertaking by one party (the issuer) to substitute his financial strength for that of another (the account party), with that undertaking to be triggered by the presentation of a draft or demand for payment and, often, other documents. The credit arises in a number of situations, but generally the account party seeks the strength of the issuer’s financial integri ty or reputation so that a third party (the beneficiary of the credit) will give value to the account party . ” John F . Dolan, The Law ofLetters ofCredit � 2.02, at 2-3 (1984).

“A seller hesitates to give up possession of its goods before it is paid. But a buyer wishes to have control of the goods before parting with its money. To relieve this simple tension, merchants developed the device known as the ‘letter of credit’ or simply the ‘credit’ or the ‘letter. ‘ Today, letters of credit come in two broad variet ies. The ‘commercial’ letter dates back at least 700 years. It is a mode of payment in the purchase of goods, mostly in international sales. The ‘standby’ letter of credit is a much more recent mutant. It ‘backs up’ obligations in a myriad of settings. In the most common standby a bank promises to pay a creditor upon documentary certifica tion of the applicant’s default.” 3 James J. White & Robert S. Summers, Uniform Commercial Code § 26-1, at 105 (4th ed. 1995).

clean letter of credit. A letter of credit that is payable on its presentation. • No document needs to be presented along with it. – Also termed suicide letter of credit. Cf. documenta ry letter of credit.

commercial letter of credit. A letter of credit used as a method of payment in a sale of goods (esp. in an international transac tion), with the buyer being the issuer’s cus tomer and the seller being the beneficiary, so that the seller can obtain payment directly from the issuer instead of from the buyer.

confirmed letter of credit. A letter of credit that directly obligates a financing agency (such as a bank) doing business in the seller’s financial market to a contract of sale. DCC § 2-325(3).

documentary letter of credit. A letter of credit that is payable when presented with another document, such as a certificate of title or invoice. – Abbr. DL/C. Cf. clean letter of credit.

export letter of credit. A commercial letter of credit issued by a foreign bank, at a foreign buyer’s request, in favor of a domestic export er.

general letter of credit. A letter of credit addressed to any and all persons without naming anyone in particular. Cf. special letter of credit.

guaranty letter of credit. See standby letter of credit.

import letter of credit. A commercial letter of credit issued by a domestic bank, at an importer’s request, in favor of a foreign sell er.

irrevocable letter of credit (i-rev-a-ka-bal). A letter of credit in which the issuing bank guarantees that it will not withdraw the cred it or cancel the letter before the expiration date; a letter of credit that cannot be modi fied or revoked without the customer’s con sent.

negotiation letter of credit. A letter of credit in which the issuer’s engagement runs to drawers and indorsers under a standard negotiation clause.

“Letter-of-credit law has long distinguished the straight credit from the negotiation credit. The engagement of the former runs to the beneficiary; the engagement of the latter runs to ‘drawers, endorsers, and bona fide holders . ‘ This quoted phrase is the traditional negotia tion clause. The significance of it is that it obviously extends the credit engagement to parties other than the person with whom the account party is doing business.” John F. Dolan, The Law 4/’ Letters of Credit 11 8.02[6], at 8-11 (1984).

open letter of credit. A letter of credit that can be paid on a simple draft without the need for documentary title.

revocable letter of credit (rev-a-ka-bal) . A letter of credit in which the issuing bank reserves the right to cancel and withdraw from the transaction upon appropriate notice. • The letter cannot be revoked if the credit has already been paid by a third party.

revolving letter of credit. A letter of credit that self-renews by providing for a continuing line of credit that the beneficiary periodically draws on and the customer periodically re pays. • A revolving letter of credit is used when there will be multiple drafts under a single transaction or multiple transactions under a single credit. – Abbr. RL/C.

special letter of credit. A letter of credit addressed to a particular individual, firm, or corporation. Cf. general letter of credit.

standby letter of credit. A letter of credit used to guarantee either a monetary or a nonmonetary obligation (such as the perfor mance of construction work) , whereby the issuer agrees to pay the beneficiary if the customer defaults on its obligation. – Abbr. SLiC. – Also termed guaranty letter of credit.

straight letter of credit. A letter of credit requiring that drafts drawn under it be pre sented to a specified party.

suicide letter of credit. See clean letter of credit.

time letter of credit. A letter of credit that is duly honored by the issuer accepting drafts drawn under it. – Also termed acceptance credit; usance credit.

transferable letter of credit. A letter of credit that authorizes the beneficiary to as sign the right to draw under it.

traveler’s letter of credit. 1. A letter of credit addressed to a correspondent bank, from which one can draw credit by identify ing oneself as the person in whose favor the credit is drawn. 2. A letter of credit used by a person traveling abroad, by which the issuing bank . authorizes payment of funds to the holder in the local currency by a local bank. • The holder signs a check on the issuing bank, and the local bank forwards it to the issuing bank for its credit.

letter of exchange. See DRAFT ( 1 ) .

letter of intent. A written statement detailing the preliminary understanding of parties who plan to enter into a contract or some other agreement; a noncommittal writing preliminary to a contract. • A letter of intent is not meant to be binding and does not hinder the parties from bargaining with a third party. Business people typically mean not to be bound by a letter of intent, and courts ordinarily do not enforce one; but courts occasionally find that a commitment has been made. – Abbr. LO!. – Also termed memorandum of intent. Cf. precon tract under CONTRACT.

letter of license. English law. An agreement signed by all the creditors of a financially trou bled business that does the following: (1) grants the debtor more time to pay debts, (2) permits the debtor to continue business in the hope of overcoming its financial distress, and (3) pro tects the debtor from arrest, lawsuit, or other interference while the letter is in effect. See ARRANGEMENT WITH CREDITORS.

letter of recall. 1. A document sent from one nation’s executive to that of another, stating that the former executive is summoning a min ister back to his or her own country. 2. A manufacturer’s letter to a buyer of a particular product, asking the buyer to bring the product back to the dealer for repair or replacement.

letter of recredentials. A formal letter from the diplomatic secretary of state of a host coun try to a foreign minister or ambassador who has been recalled. • The letter officially accred its the foreign minister back to his or her home country.

letter of request. A document issued by one court to a foreign court, requesting that the foreign court (1) take evidence from a specific person within the foreign jurisdiction or serve process on an individual or corporation within the foreign jurisdiction and (2) return the testi mony or proof of service for use in a pending case. See Fed. R. Civ. P. 28. PI. letters of request. – Also termed letter rogatory (rog-e-tor-ee); rogatory letter; requisitory letter (ri-kwiz-e-tor-ee) .

letter of the law. The strictly literal meaning of the law, rather than the intention or policy behind it. – Also termed litera legis. Cf. SPIRIT OF THE LAW.

letter of undertaking. An agreement by which a shipowner – to avoid having creditors seize the ship and release it on bond – agrees to post security on the ship, and to enter an appearance, acknowledge ownership, and pay any final decree entered against the vessel whether it is lost or not.

“Such informal or extra-legal agreements save court costs and the marshal’s fees, avoid the annoyance of having the vessel even temporarily arrested and may well be cheaper than the usual surety bond . . . . In Conti nental Grain Co. v. Federal Barge Lines, Inc., [268 F.2d 240 (5th Cir. 1959), aff’d, 364 U.S. 19, 80 S.Ct. 1470 (1960)], Judge Brown commented that a letter of under taking given by a shipowner would be treated ‘as though, upon the libel being filed, the vessel had actually been seized, a claim filed, a stipulation to abide decrees with sureties executed and filed by claimant, and the vessel formally released. Any other course would imperil the desirable avoidance of needless cost, time and inconvenience to litigants, counsel, ships, clerks, marshals, keep ers and court personnel through the ready acceptance of such letters of undertakings.’ [268 F.2d at 243]. If, as Judge Brown suggests, the informal agreement is treated as having the same effect as a formal release under bond or stipulation, few questions relating to their use will ever have to be litigated.” Grant Gilmore & Charles L. Black, Jr., The Law ofAdmiralty § 9-89, at 800-01 (2d ed. 1975).

Black’s Law Dictionary 8th Edition, pages 2647-2652:

letter. 1. A written communication that is usu. enclosed in an envelope, sealed, stamped, and delivered (esp., an official written communication) <an opinion letter>.2. (usu. pl.) A written instrument containing or affirming a grant of some power or right <letters testamentary>. [Cases: Executors and Administrators 27. C.J.S. Executors and Administrators § 79.] 3. Strict or literal meaning <the letter of the law>. • This sense is based on the sense of a letter of the alphabet. Cf. SPIRIT OF THE LAW.

LETTER-BOOK

letter-book. A merchant’s book for holding correspondence.

LETTER CONTRACT

letter contract.See CONTRACT.

LETTER MISSIVE

letter missive. 1.Hist. A letter from the king (or queen) to the dean and chapter of a cathedral, containing the name of the person whom the king wants elected as bishop. 2.Hist. After a lawsuit is filed against a peer, peeress, or lord of Parliament, a request sent to the defendant to appear and answer the suit. 3.Civil law.The appellate record sent by a lower court to a superior court. — Also termed letter dimissory.

LETTER OF ADVICE

letter of advice.Commercial law. A notice that a draft has been sent by the drawer to the drawee.

LETTER OF ADVOCATION

letter of advocation.Hist. Scots law. A warrant, issued by the Court of Session, discharging an inferior court from further proceedings in a matter and transferring the action to the issuing superior court. • In a criminal case, the High Court of Justiciary could issue a letter to call up a case for review from an inferior court. The letter of advocation was abolished in 1868 and replaced by appeal.

letter of attorney.1.POWER OF ATTORNEY(1); 2.ATTORNEY(1).

LETTER OF ATTORNMENT

letter of attornment.A grantor’s letter to a tenant, stating that the leased property has been sold and directing the tenant to pay rent to the new owner. See ATTORNMENT(1).

LETTER OF COMFORT

letter of comfort.See COMFORT LETTER.

LETTER OF COMMENT

letter of comment.See DEFICIENCY LETTER.

LETTER OF COMMITMENT

letter of commitment.See COMMITMENT LETTER.

LETTER OF CREDENCE

letter of credence.Int’l law. A document that accredits a diplomat to the government of the country to which he or she is sent. — Abbr. LC; L/C. — Also termed letters of credence.

letter of credit.Commercial law. An instrument under which the issuer (usu. a bank), at a customer’s request, agrees to honor a draft or other demand for payment made by a third party (the beneficiary), as long as the draft or demand complies with specified conditions, and regardless of whether any underlying agreement between the customer and the beneficiary is satisfied. • Letters of credit are governed by Article 5 of the UCC. — Abbr. LC; L/C. — Often shortened to credit. — Also termed circular letter of credit; circular note; bill of credit. [Cases: Banks and Banking 191. C.J.S. Bills and Notes; Letters of Credit §§ 341–366, 368–370, 372–376.]

“There is some confusion over the exact nature of credits. They resemble a number of commercial devices that are not credits. Often, there is confusion between letters of credit and guaranties, and occasionally between letters of credit and lines of credit. In the credit transaction itself, it is important to distinguish the credit from other contracts and from the acceptance.

Generally, the broad credit transaction consists of three separate relationships. These include those that are (1) between the issuer and the beneficiary; (2) between the beneficiary and the account party; and (3) between the account party and the issuer. The first is the letter-of-credit engagement. The second is usually called the underlying contract, and the third is called the application agreement.” John F. Dolan, The Law of Letters of Credit ¶ 2.01, at 2-2 (1984).

“A credit is an original undertaking by one party (the issuer) to substitute his financial strength for that of another (the account party), with that undertaking to be triggered by the presentation of a draft or demand for payment and, often, other documents. The credit arises in a number of situations, but generally the account party seeks the strength of the issuer’s financial integrity or reputation so that a third party (the beneficiary of the credit) will give value to the account party.” Id. ¶ 2.02, at 2-3.

“A seller hesitates to give up possession of its goods before it is paid. But a buyer wishes to have control of the goods before parting with its money. To relieve this simple tension, merchants developed the device known as the ‘letter of credit’ or simply the ‘credit’ or the ‘letter.’ Today, letters of credit come in two broad varieties. The ‘commercial’ letter dates back at least 700 years. It is a mode of payment in the purchase of goods, mostly in international sales. The ‘standby’ letter of credit is a much more recent mutant. It ‘backs up’ obligations in a myriad of settings. In the most common standby a bank promises to pay a creditor upon documentary certification of the applicant’s default.” 3 James J. White & Robert S. Summers, Uniform Commercial Code § 26-1, at 105 (4th ed. 1995).

clean letter of credit.A letter of credit that is payable on its presentation. • No document needs to be presented along with it. — Also termed suicide letter of credit. Cf. documentary letter of credit.

commercial letter of credit.A letter of credit used as a method of payment in a sale of goods (esp. in an international transaction), with the buyer being the issuer’s customer and the seller being the beneficiary, so that the seller can obtain payment directly from the issuer instead of from the buyer.

confirmed letter of credit.A letter of credit that directly obligates a financing agency (such as a bank) doing business in the seller’s financial market to a contract of sale. UCC § 2-325(3).

documentary letter of credit.A letter of credit that is payable when presented with another document, such as a certificate of title or invoice. — Abbr. DL/C. Cf. clean letter of credit.

export letter of credit.A commercial letter of credit issued by a foreign bank, at a foreign buyer’s request, in favor of a domestic exporter.

general letter of credit.A letter of credit addressed to any and all persons without naming anyone in particular. Cf. special letter of credit.

guaranty letter of credit.See standby letter of credit.

import letter of credit.A commercial letter of credit issued by a domestic bank, at an importer’s request, in favor of a foreign seller.

irrevocable letter of credit (i-rev-<<schwa>>-k<<schwa>>-b<<schwa>>l).1. A letter of credit that the issuing bank guarantees will not be withdrawn or canceled before the expiration date. 2. A letter of credit that cannot be modified or revoked without the customer’s consent. 3. A letter of credit that cannot be modified or canceled without the consent of all parties.

negotiation letter of credit.A letter of credit in which the issuer’s engagement runs to drawers and indorsers under a standard negotiation clause.

“Letter-of-credit law has long distinguished the straight credit from the negotiation credit. The engagement of the former runs to the beneficiary; the engagement of the latter runs to ‘drawers, endorsers, and bona fide holders.’ This quoted phrase is the traditional negotiation clause. The significance of it is that it obviously extends the credit engagement to parties other than the person with whom the account party is doing business.” John F. Dolan, The Law of Letters of Credit ¶ 8.02[6], at 8-11 (1984).

open letter of credit.A letter of credit that can be paid on a simple draft without the need for documentary title.

revocable letter of credit (rev-<<schwa>>-k<<schwa>>-b<<schwa>>l). A letter of credit in which the issuing bank reserves the right to cancel and withdraw from the transaction upon appropriate notice. • The letter cannot be revoked if the credit has already been paid by a third party. [Cases: Banks and Banking 191.10. C.J.S. Bills and Notes; Letters of Credit §§ 341–366, 368–370, 372–376.]

revolving letter of credit.A letter of credit that self-renews by providing for a continuing line of credit that the beneficiary periodically draws on and the bank customer periodically repays. • A revolving letter of credit is used when there will be multiple drafts under a single transaction or multiple transactions under a single credit. — Abbr. RL/C.

special letter of credit.A letter of credit addressed to a particular individual, firm, or corporation. Cf. general letter of credit.

standby letter of credit.A letter of credit used to guarantee either a monetary or a nonmonetary obligation (such as the performance of construction work), whereby the issuing bank agrees to pay the beneficiary if the bank customer defaults on its obligation. — Abbr. SL/C. — Also termed guaranty letter of credit. [Cases: Banks and Banking 191.10. C.J.S. Bills and Notes; Letters of Credit §§ 341–366, 368–370, 372–376.]

straight letter of credit.A letter of credit requiring that drafts drawn under it be presented to a specified party.

suicide letter of credit.See clean letter of credit.

time letter of credit.A letter of credit that is duly honored by the issuer accepting drafts drawn under it. — Also termed acceptance credit; usance credit.

transferable letter of credit.A letter of credit that authorizes the beneficiary to assign the right to draw under it. [Cases: Banks and Banking 191.10. C.J.S. Bills and Notes; Letters of Credit §§

traveler’s letter of credit. 1. A letter of credit addressed to a correspondent bank, from which one can draw credit by identifying oneself as the person in whose favor the credit is drawn. 2. A letter of credit used by a person traveling abroad, by which the issuing bank authorizes payment of funds to the holder in the local currency by a local bank. • The holder signs a check on the issuing bank, and the local bank forwards it to the issuing bank for its credit.

LETTER OF EXCHANGE

letter of exchange.See DRAFT(1).

LETTER OF INTENT

letter of intent.A written statement detailing the preliminary understanding of parties who plan to enter into a contract or some other agreement; a noncommittal writing preliminary to a contract. • A letter of intent is not meant to be binding and does not hinder the parties from bargaining with a third party. Businesspeople typically mean not to be bound by a letter of intent, and courts ordinarily do not enforce one; but courts occasionally find that a commitment has been made. — Abbr. LOI. — Also termed memorandum of intent; memorandum of understanding; term sheet; commitment letter. Cf. precontract under CONTRACT. [Cases: Contracts 25. C.J.S. Contracts § 60.]

LETTER OF LICENSE

letter of license.English law. An agreement signed by all the creditors of a financially troubled business that does the following: (1) grants the debtor more time to pay debts, (2) permits the debtor to continue business in the hope of overcoming its financial distress, and (3) protects the debtor from arrest, lawsuit, or other interference while the letter is in effect. See ARRANGEMENT WITH CREDITORS.

LETTER OF RECALL

letter of recall. 1. A document sent from one nation’s executive to that of another, summoning a minister back to his or her own country. 2. A manufacturer’s letter to a buyer of a particular product, asking the buyer to bring the product back to the dealer for repair or replacement. — Also termed recall letter.

LETTER OF RECREDENTIALS

letter of recredentials (ree-kr<<schwa>>-den-sh<<schwa>>lz). A formal letter from a host country’s diplomatic secretary of state to a minister or ambassador who has been recalled by his or her own country. • The letter officially accredits the foreign minister back to his or her home country.

LETTER OF REQUEST

letter of request. 1. A document issued by one court to a foreign court, requesting that the foreign court (1) take evidence from a specific person within the foreign jurisdiction or serve process on an individual or corporation within the foreign jurisdiction and (2) return the testimony or proof of service for use in a pending case. See Fed. R. Civ. P. 28. — Also termed letter rogatory (rog-<<schwa>>-tor-ee); rogatory letter; requisitory letter (ri-kwiz-<<schwa>>-tor-ee). [Cases: Federal Civil Procedure 1312.] 2. An instrument by which an inferior court withdraws or waives jurisdiction so that a matter can be heard in the court immediately above. Pl. letters of request.

LETTER OF THE LAW

letter of the law.The strictly literal meaning of the law, rather than the intention or policy behind it. — Also termed litera legis. Cf. SPIRIT OF THE LAW . [Cases: Statutes 183. C.J.S. Statutes § 317.]

LETTER OF UNDERTAKING

letter of undertaking.An agreement by which a shipowner — to avoid having creditors seize the ship and release it on bond — agrees to post security on the ship, and to enter an appearance, acknowledge ownership, and pay any final decree entered against the vessel whether it is lost or not. • A letter of undertaking is often issued by the shipowner’s liability insurer. [Cases: Admiralty 57. C.J.S. Admiralty §§ 162–168.]

“Such informal or extra-legal agreements save court costs and the marshal’s fees, avoid the annoyance of having the vessel even temporarily arrested and may well be cheaper than the usual surety bond …. In Continental Grain Co. v. Federal Barge Lines, Inc., [268 F.2d 240 (5th Cir. 1959), aff’d, 364 U.S. 19, 80 S.Ct. 1470 (1960)], Judge Brown commented that a letter of undertaking given by a shipowner would be treated ‘as though, upon the libel being filed, the vessel had actually been seized, a claim filed, a stipulation to abide decrees with sureties executed and filed by claimant, and the vessel formally released. Any other course would imperil the desirable avoidance of needless cost, time and inconvenience to litigants, counsel, ships, clerks, marshals, keepers and court personnel through the ready acceptance of such letters of undertakings.’ [268 F.2d at 243.] If, as Judge Brown suggests, the informal agreement is treated as having the same effect as a formal release under bond or stipulation, few questions relating to their use will ever have to be litigated.” Grant Gilmore & Charles L. Black Jr., The Law of Admiralty § 9-89, at 800–01 (2d ed. 1975).

LETTER ROGATORY

letter rogatory.See LETTER OF REQUEST.

LETTER RULING

letter ruling.Tax. A written statement issued by the IRS to an inquiring taxpayer, explaining the tax implications of a particular transaction. — Also termed private letter ruling. [Cases: Internal Revenue 3049.]

Recent Comments