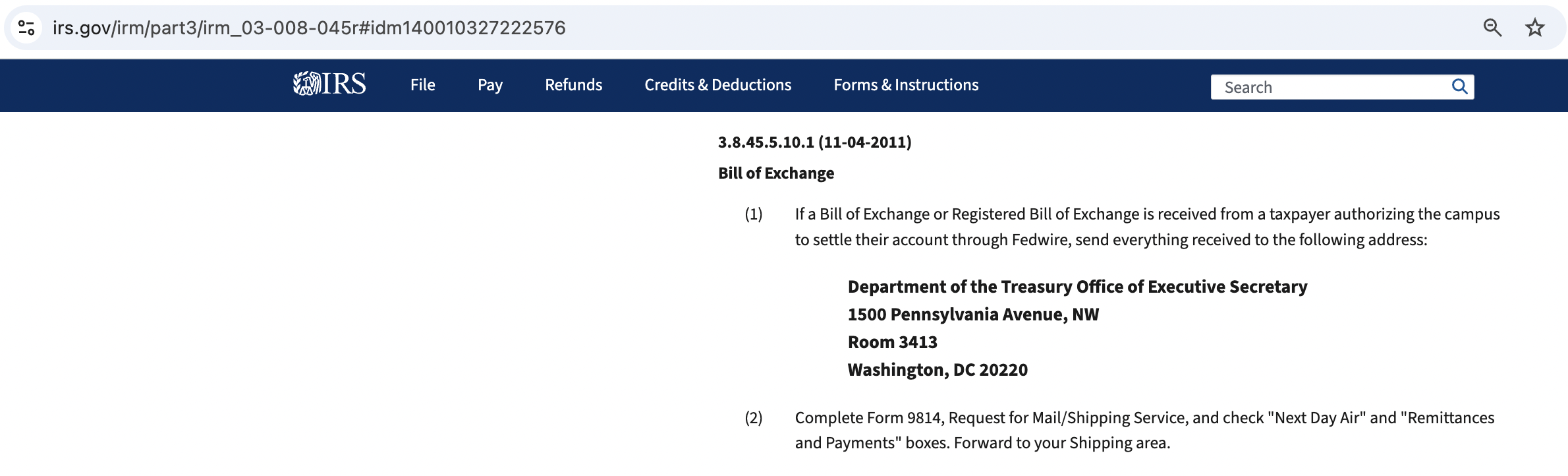

What Is a Bill of Exchange?

A Bill of Exchange is a negotiable instrument defined under UCC § 3-104 as a written, unconditional order by one party (the drawer) directing another party (the drawee) to pay a specified sum to a third party (the payee). It serves as a lawful substitute for money when executed properly and is recognized as a monetary instrument under U.S. law.

Connection to the Emergency Banking Act, HJR 192 of 1933 Public law 73-10, and 31 U.S.C. § 5118

The Emergency Banking Act of 1933 and 31 U.S.C. § 5118 reinforce the use of alternative forms of legal tender, including negotiable instruments such as Bills of Exchange:

- 31 U.S.C. § 5118: Prohibits any contractual obligation requiring payment in gold, ensuring that alternative forms of tender—including Bills of Exchange—are legally sufficient for settling debts. 31 USC 5118 Confirms that gold clauses in contracts are void, and all payments must be made using Federal Reserve Notes or debt instruments.

- HJR 192 (public law 73-10): Established the federal government’s obligation to discharge debts using lawful instruments other than gold or silver, making negotiable instruments critical in a system no longer tied to precious metals.

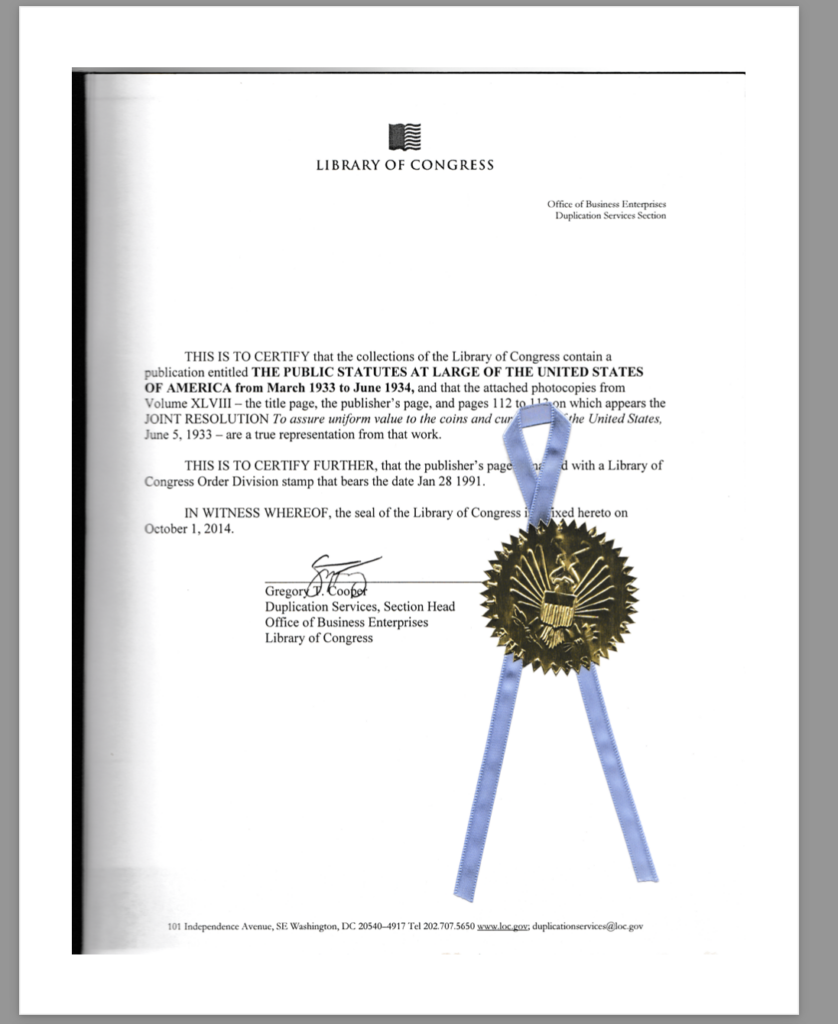

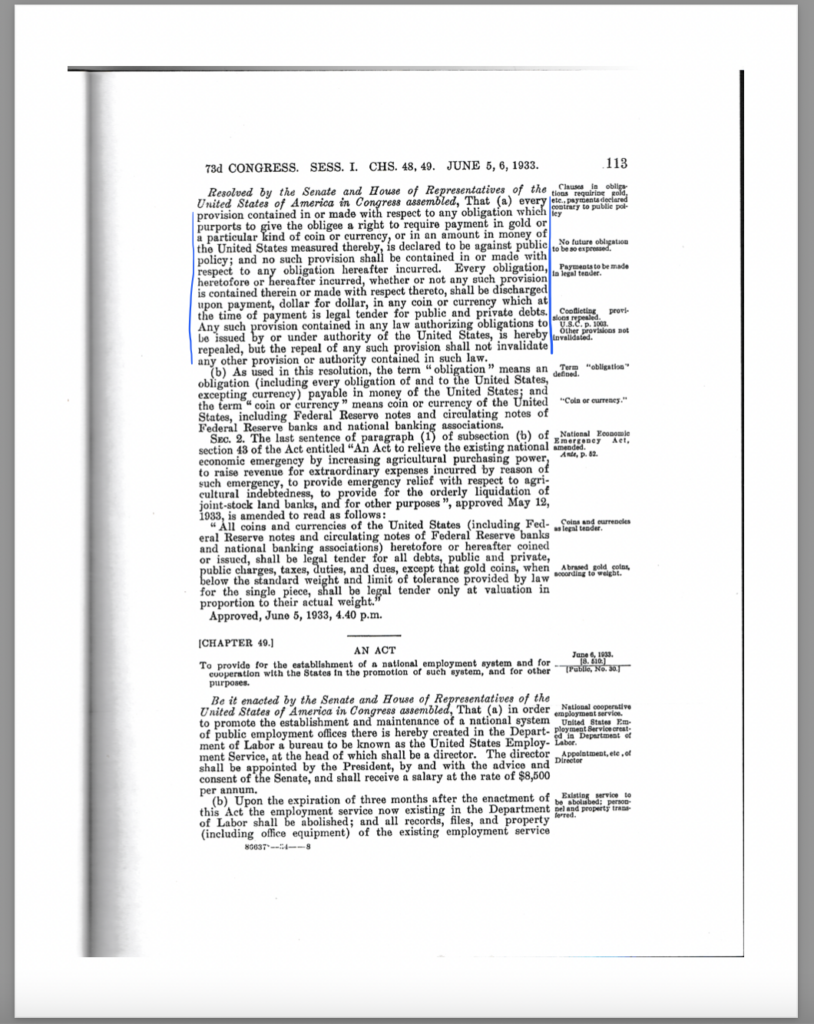

The Public Statutes at Large of the United States of America from March 1933 to June 1934: House Joint Resolution 192 of June 5, 1933, Public Law 73-10:

“every provision contained in or made with respect to any obligation which purports to give the obligee a right to require payment in gold or a particular kind of coin or currency, or in an amount in money of the United States measured thereby, is declared to be against public policy; and no such provision shall be contained in or made with respect to any obligation hereafter incurred. Every obligation, heretofore of hereafter incurred, whether or not any such provision is contained therein or made with respect thereto, shall be discharged upon payment, dollar for dollar, in any coin or currency which at the time of payment is legal tender for public and private debts.”

12 U.S.C. § 412 – Application for notes; collateral required

- 12 USC 412:

States that Federal Reserve Notes are backed by debt instruments, including promissory notes and bills of exchange, legally making them currency.

Any Federal Reserve bank may make application to the local Federal Reserve agent for such amount of the Federal Reserve notes hereinbefore provided for as it may require. Such application shall be accompanied with a tender to the local Federal Reserve agent of collateral in amount equal to the sum of the Federal Reserve notes thus applied for and issued pursuant to such application. The collateral security thus offered shall be notes, drafts, bills of exchange, or acceptances acquired under section 92, 342 to 348, 349 to 352, 361, 372, or 373 of this title, or bills of exchange endorsed by a member bank of any Federal Reserve district and purchased under the provisions of sections 348a and 353 to 359 of this title, or bankers’ acceptances purchased under the provisions of said sections 348a and 353 to 359 of this title, or gold certificates, or Special Drawing Right certificates, or any obligations which are direct obligations of, or are fully guaranteed as to principal and interest by, the United States or any agency thereof, or assets that Federal Reserve banks may purchase or hold under sections 348a and 353 to 359 of this title or any other asset of a Federal Reserve bank. In no event shall such collateral security be less than the amount of Federal Reserve notes applied for. The Federal Reserve agent shall each day notify the Board of Governors of the Federal Reserve System of all issues and withdrawals of Federal Reserve notes to and by the Federal Reserve bank to which he is accredited. The said Board of Governors of the Federal Reserve System may at any time call upon a Federal Reserve bank for additional security to protect the Federal Reserve notes issued to it. Collateral shall not be required for Federal Reserve notes which are held in the vaults of, or are otherwise held by or on behalf of, Federal Reserve banks.

UCC Provisions That Prove Bills of Exchange Act as Payment

The Uniform Commercial Code (UCC) supports the idea that bills of exchange discharge debt obligations—just like cash:

- UCC 3-603 (Tender of Payment):

“(b) If tender of payment of an obligation to pay an instrument is made and refused, there is discharge, to the extent of the amount of the tender.”

Meaning: If you present a bill of exchange as payment and the other party refuses it, the debt is discharged as if it were paid in full.

- UCC 3-311 (Accord and Satisfaction):

“If a person against whom a claim is asserted proves that (i) that person in good faith tendered an instrument to the claimant as full satisfaction of the claim, and (ii) the claimant obtained payment of the instrument…the claim is discharged.”

Meaning: Offering a bill of exchange in good faith to settle a debt discharges the debt, regardless of whether it was accepted.

- UCC 3-601 (Discharge of Obligation):

“The obligation of a party to pay the instrument is discharged as stated in this Article or by an act or agreement with the party which would discharge an obligation to pay money under a simple contract.”

Meaning: Providing a bill of exchange or other negotiable instrument fulfills the legal obligation to pay.

Unequivocal Conclusion

A bill of exchange is currency because:

- It satisfies debt obligations in commerce.

- Federal statutes (31 USC 5118, 12 USC 412) equate debt instruments with currency.

- HJR 192 (public law 73-10) confirms that gold-backed payments were eliminated and replaced with debt-based instruments.

- UCC Articles 3-603, 3-311, and 3-601 explicitly state that offering a bill of exchange discharges debt, even if refused.

Based on proper interpretation and in accordance with statues, public policy, and codes, refusal of a bill of exchange legally equals payment in full, cementing it as a valid form of currency.