The intersection of law, contracts, and public administration reveals a vast framework where the government can exercise control over individuals, often under the guise of legality. By leveraging tools like propaganda, social security numbers (SSNs), and implied agreements, the government establishes a framework of public compliance while presenting an illusion of choice. This system is designed to manage public obligations, regulate access to benefits, and ensure participation in federal programs. To understand how this operates, one must examine the roles of propaganda, coercive tactics, contracts, and the critical significance of the SSN.

1. Propaganda: Government’s Tool for Shaping Public Opinion

Propaganda is one of the most overt yet legally shielded mechanisms of government influence. The Smith-Mundt Modernization Act of 2012 allows government-created content to be disseminated domestically. This marks a significant shift, as prior to this act, propaganda directed at U.S. citizens was strictly prohibited.

How Propaganda Functions

- Perception Management: By framing laws, policies, or mandates as beneficial or necessary for public safety, propaganda conditions individuals to accept government actions without question.

- Crisis Exploitation: In times of economic instability, pandemics, or wars, the government can manipulate narratives to justify actions that might otherwise face resistance.

- Media Collaboration: Partnerships with news outlets further amplify government messaging, presenting it as impartial or factual.

While not illegal, such activities blur the lines between informed governance and psychological manipulation.

2. Coercion and Deception Under the Color of Law

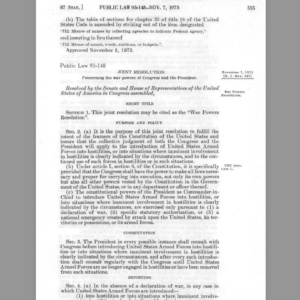

“Under the color of law” refers to actions that seem lawful but infringe on rights or exceed lawful authority. Coercion under this principle takes many forms, often leveraging administrative processes to ensure compliance.

Key Coercion Tactics

- Mandatory Compliance Posed as Voluntary: Many federal programs and tax filings are labeled “voluntary,” but failing to comply can result in penalties, audits, or legal repercussions.

- Administrative Threats: Agencies such as the IRS or DMV often use warnings of fines, license suspensions, or asset seizures to enforce compliance.

- Compelled Disclosures: Despite protections under laws like 42 U.S.C. § 408, individuals are routinely forced to disclose SSNs for employment, banking, and other essential services, with little recourse.

These measures often rely on public ignorance, banking on the idea that most people will not question their legitimacy.

3. Contracts: Implied, Expressed, Constructive, and Adhesion

A significant part of the government’s ability to regulate behavior lies in its use of contracts. Whether explicitly agreed to or implied through conduct, these contracts bind individuals to specific obligations.

Implied Contracts

- Using an SSN: When individuals use their SSN for employment, taxes, or public benefits, they implicitly agree to operate as a “citizen of the United States.” This signifies participation in federal jurisdiction and acceptance of government-provided privileges.

Expressed Contracts

- Employment Applications: Signing documents to provide an SSN expressly ties an individual to the public system, subjecting them to federal laws and tax obligations.

Constructive Contracts

- Government Benefits: Accepting unemployment, Social Security, or Medicare benefits creates an unspoken agreement to adhere to accompanying terms.

Adhesion Contracts

- Mandatory Agreements: Many contracts, such as those involving SSNs, do not allow for negotiation, leaving individuals no choice but to comply. For example, a birth certificate is automatically issued, linking the individual to the public system from birth.

4. Social Security Numbers: Key to Public Participation

The SSN is far more than a mere identification number—it represents an account tied to the legal person, often referred to as the ens legis, created at birth. This account connects the individual to public financial systems and signifies their status as a U.S. citizen operating in the public jurisdiction.

Key Implications of SSN Use

- U.S. Citizenship Designation: By using an SSN, individuals effectively declare themselves “citizens of the United States,” as defined in federal terms.

- Setoff and Exemption Account: The SSN is tied to Treasury accounts that can theoretically offset public debts. However, public disclosure of this use is avoided, keeping most individuals unaware of its potential financial significance.

- Access to Privileges and Benefits: An SSN is required for public benefits, reinforcing the individual’s role in the system as a beneficiary of government programs.

Legal Protections Against SSN Coercion

Under 42 U.S.C. § 408, compelling the use or disclosure of an SSN without proper legal justification is a felony:

“(8) Discloses, uses, or compels the disclosure of the social security number of any person in violation of the laws of the United States… shall be guilty of a felony and upon conviction thereof shall be fined under title 18 or imprisoned for not more than five years, or both.”

Despite this, SSN use is nearly unavoidable in public transactions, creating a contradiction between legal protections and societal norms.

5. Birth Certificates as Bank Notes

Prima facie evidence indicates that birth certificates are treated as bank notes in the financial system. Issued as securities, they represent the legal person’s role in the economy, acting as collateral for national debt. This ties individuals to the financial obligations of the U.S. government, further blurring the lines between public and private law.

6. Sovereignty and Government Benefits

Sovereignty in legal terms means operating outside the public jurisdiction. However, using an SSN or accepting government benefits signifies participation in the public system, making claims of sovereignty contradictory.

Sovereign Citizen Label

A person who uses public resources, such as unemployment benefits, while claiming to operate as a sovereign is often labeled a “sovereign citizen.” This term is widely misunderstood and carries legal and societal implications.

7. Enforceable Lies: Perjury as the Exception

While the government can legally deceive in many contexts, the one area where lying is punishable is perjury—deliberately providing false testimony under oath.

Requirements for Perjury

- The statement must be made under oath or in a sworn affidavit.

- The lie must be material, meaning it impacts the outcome of a legal proceeding.

- The individual must knowingly and intentionally provide false information.

Perjury laws ensure accountability in judicial processes but have limited applicability outside courtrooms.

8. Rebutting Legal Presumptions

The government’s framework operates on presumptions of consent unless explicitly rebutted. These include:

- SSN Use: Assumed consent to public obligations and U.S. citizenship.

- Birth Registration: Presumed compliance with legal and financial systems.

Rebuttal Methods

- UCC § 1-308: Reserving rights to prevent unintended contractual obligations.

- Explicit Declarations: Filing notices to clarify legal status or intent.

Conclusion

The government’s ability to influence and control through propaganda, contracts, and administrative systems demonstrates the importance of understanding legal frameworks. SSNs and birth certificates are pivotal tools for managing public obligations, often binding individuals to systems they may not fully understand. Recognizing these mechanisms, asserting rights, and challenging improper coercion are essential steps for individuals seeking greater autonomy within the legal and financial landscape.