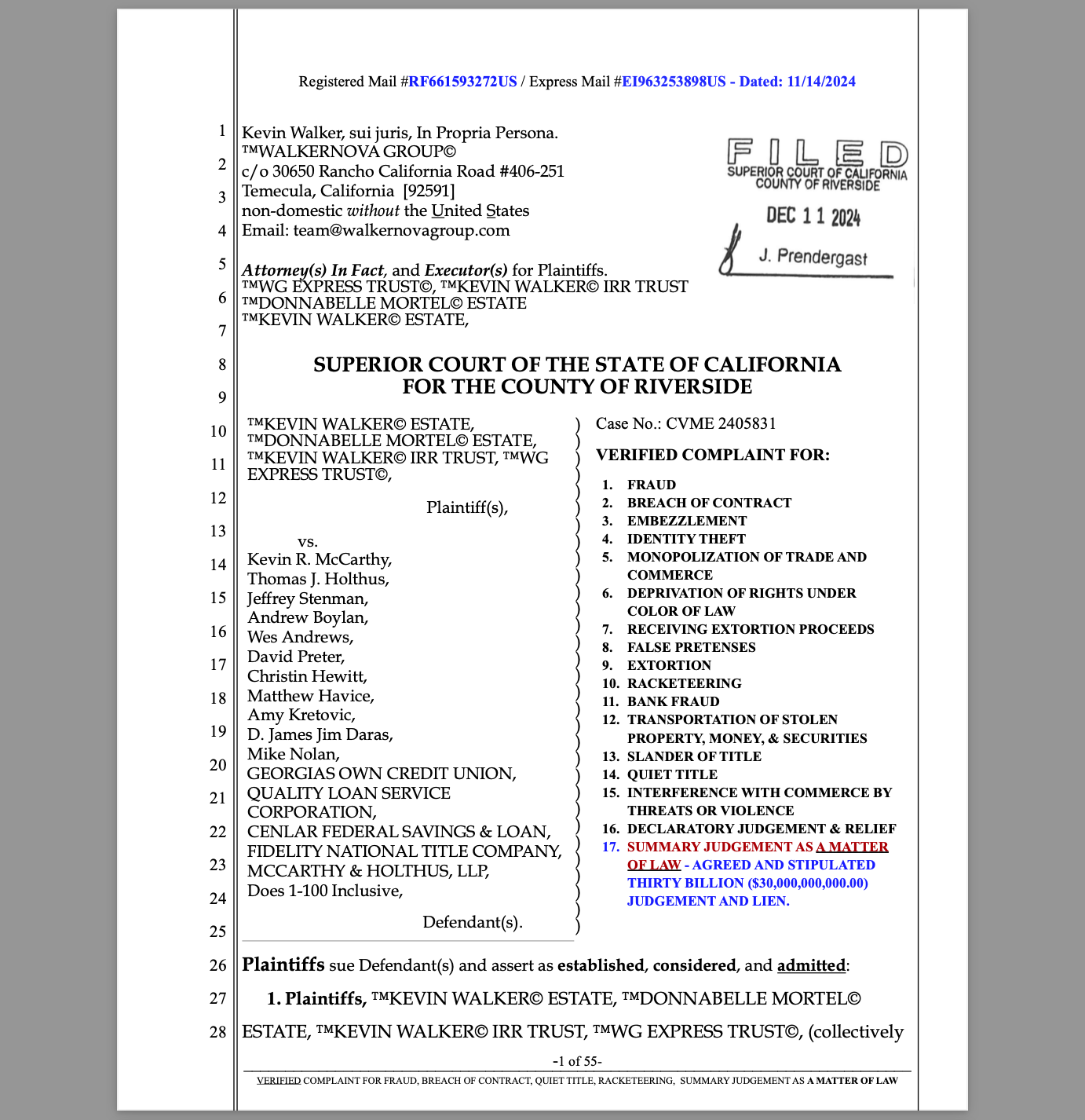

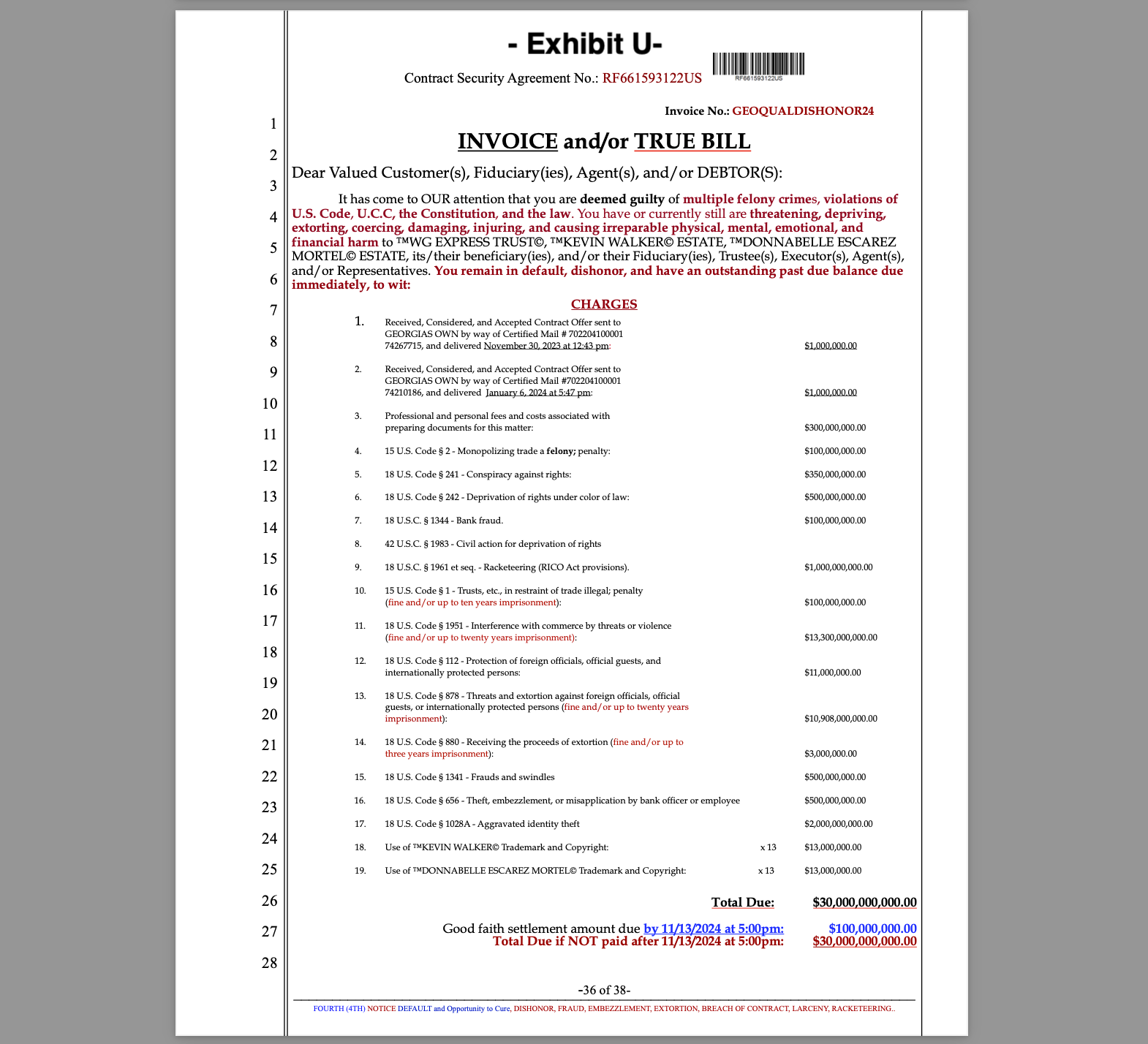

Temecula, CA – In a groundbreaking legal battle, the ™KEVIN WALKER© ESTATE, alongside affiliated trusts, has filed a verified complaint against multiple high-profile defendants, including Kevin R. McCarthy, Georgia’s Own Credit Union, and McCarthy & Holthus LLP. The suit, demanding damages totaling $30,000,000,000.00 Billion, includes a cascade of Federal and State law violations supported by prima facie evidence and over six unrebutted affidavits. The actions range from fraud, bank fraud, and racketeering to deprivation of rights under color of law, treason, and identity theft.

Claims Against Defendants

The Kevin Walker Estate, joined by related entities ™KEVIN WALKER© ESTATE, ™DONNABELLE MORTEL© ESTATE, T™KEVIN WALKER© IRR TRUST, and ™WG EXPRESS TRUST©, has outlined a comprehensive list of actions in their verified complaint, including:

- Fraud

- Breach of Contract

- Embezzlement

- Identity Theft

- Monopolization of Trade and Commerce

- Deprivation of Rights Under Color of Law

- Receiving Extortion Proceeds

- False Pretenses

- Extortion

- Racketeering

- Bank Fraud

- Transportation of Stolen Property, Money, & Securities

- Slander of Title

- Quiet Title

- Interference with Commerce by Threats or Violence

- Declaratory Judgment and Relief

- Summary Judgment as a Matter of Law

The lawsuit alleges that these actions have inflicted immense harm on the plaintiffs and resulted in the illegal seizure and manipulation of private trust property, financial instruments, and other assets

Key Evidence and Claims

The plaintiffs, represented by the Kevin Walker© Estate, affiliated trusts, and authorized representatives, assert their standing as holders in due course of all assets and properties involved in the dispute. Key evidence includes:

- Unrebutted Affidavits: Admissions of guilt by defendants through their failure to counter sworn statements.

- Admissions of Guilt: The defendants purportedly admitted to wrongdoing in certain affidavits.

- UCC Filings and Recorded Deeds: Documents establishing the plaintiffs’ lawful ownership of assets, including UCC1 and UCC3 filings in Nevada, and a Grant Deed recorded in Riverside County.

- Contractual and Fiduciary Rights: Explicit reservations of rights under UCC § 1-308 and evidence of compliance with House Joint Resolution 192, Public Law 73-10, which mandates the discharge of debts.

The plaintiffs emphasize their exclusive standing as the real parties in interest and the sole holders of all rights to the assets in question.

Affected Property and Assets

Central to the case is a private trust property situated in Riverside County, CA. Plaintiffs affirm that the defendants wrongfully claimed interest in the property despite it being secured under trust ownership, and that while the property remains properly Deeded to the private irrevocable trust, the Defendants have acquired a fraudulent Trustees Deed Upon Sale.

Claims Against Defendants

Based on the evidence submitted, Defendants, including McCarthy & Holthus LLP and Georgia’s Own Credit Union, are fraudulently acting as debtors without standing while lacking power of attorney over any of the assets in question. Plaintiffs further affirm that these defendants were complicit in extortionate practices and fraudulent financial schemes targeting the estate’s assets, and are preying on the people of the California De’Jure Republic, as guaranteed by Article 4 of the Constitution.

Legal Remedies Sought

The complaint seeks multiple forms of relief, including:

- Quiet Title: To remove any clouds on the title of the trust property.

- Declaratory Judgment and Summary Judgment: Legal recognition of the plaintiffs’ rights to the assets.

- Monetary Damages: $30 billion in compensation for fraud, deprivation of rights, and other damages.

Additionally, plaintiffs assert a summary judgment as a matter of law, claiming defendants have implicitly agreed to their claims by failing to rebut any of the affidavits and evidence presented, are required by Law.

Implications and Next Steps

This case has far-reaching implications, not only for the parties involved but also for broader legal and financial practices. By emphasizing unrebutted affidavits and foundational rights under the Uniform Commercial Code, the plaintiffs set a precedent for asserting individual rights against corporate entities.

The defendants are expected to respond within the statutory timeframe or face further judicial determinations in favor of the plaintiffs.

Conclusion

The Kevin Walker Estate’s lawsuit underscores the significance of upholding fiduciary rights, contractual obligations, and legal due process. As this landmark case unfolds, it will test the boundaries of contract law, trust law, property rights, the Uniform Commercial Code, United States Code, and corporate accountability in the modern legal landscape.