When a purported borrower takes out a loan from a bank, it may seem as if the bank is lending its own money. However, under 12 U.S.C. § 83, banks are prohibited from lending their own funds. Instead, the bank uses the purported borrower’s promissory note—created through the borrower’s signature—as the source of credit. This note, becomes an asset on the bank’s books, allowing it to generate credit entries for a private monetary system without using its own capital. Importantly, no money leaves a bank account; all the credit generated is based on accounting entries. Original article on WALKERNOVAGROUP.COM.

Additionally, 12 U.S.C. § 411 states that Federal Reserve notes are obligations of the United States and must be redeemed in lawful money on demand. Meanwhile, 12 U.S.C. § 412 details that collateral (such as promissory notes) is used to secure the issuance of Federal Reserve notes. This supports the notion that the purported borrower’s note is an asset that the bank uses to generate credit, rather than any actual funds being loaned.

The lack of transparency and disclosure of this process, including the fact that the purported borrower’s note is the true source of the funds, constitutes fraud and can render such agreements void ab initio (invalid from the outset). The borrower is misled into believing they owe the bank money when, in reality, they are simply exchanging their own credit for ledger entries.

How the Scheme Works

Banks like Sierra Pacific Mortgage, Sofi, JP Morgan Chase, Wells Fargo, and others do not provide actual loans. Instead, they monetize the borrower’s promissory note, using it to create credit in a ledger entry—essentially a currency exchange. This process is often hidden from the borrower, leading them to believe they are receiving funds from the bank, resulting in coercion and extortion.

The credit generated is entirely based on the borrower’s own financial signature. By not disclosing this, banks fail to provide full transparency, violating legal obligations and committing fraud.

What Is the “Color of Law”?

The term “color of law” refers to actions that appear legally valid but are used to infringe upon or violate legal rights. In this case, banks mislead purported borrowers by pretending to loan their money when they are actually using the borrower’s promissory note to create credit. This misrepresentation is a violation of legal rights, and banks operate under the color of law by disguising the true nature of the transaction.

The Loan Process and the Lack of Full Disclosure

When a purported borrower signs a loan agreement, the bank deposits the promissory note as an asset and credits the borrower’s account based on this note. No actual bank funds are used—only credit entries for a private monetary system. This lack of full disclosure and transparency constitutes fraud, as the borrower is misled into thinking they owe money. This deceit may render the agreement void ab initio.

Legal Remedies for Purported Borrowers

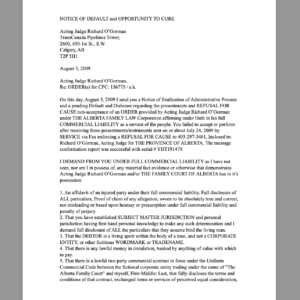

- Demand Full Disclosure: Purported borrowers can request all loan details under consumer protection laws. If the bank fails to disclose the borrower’s note as the source of the loan, the contract may be challenged.

- Invoke UCC and Common Law Protections: The Uniform Commercial Code (UCC) governs negotiable instruments like promissory notes. If the bank’s conduct violates these provisions, the purported borrower may seek to void the contract or obtain relief under the UCC.

- Cite the Agreement’s Void Status: An agreement lacking full disclosure may be void ab initio. Courts may side with borrowers who prove they were misled or that key facts were withheld.

- Legally Claim Assets and Act as Executor: The purported borrower can take control of their assets and act as the executor of their estate, asserting their rights.

- File a Lawsuit: If fraud or misrepresentation is evident, the borrower can sue the bank for damages and seek remedies under state and federal laws.

Conclusion

Banks cannot legally lend their own money as stipulated by 12 U.S.C. § 83. By using the borrower’s promissory note to generate credit and failing to disclose this, banks like Sierra Pacific Mortgage, Sofi, JP Morgan Chase, and Wells Fargo operate under the color of law. They mislead purported borrowers into thinking they receive bank funds when, in fact, the credit comes from the borrower’s own asset. This lack of full disclosure is fraudulent, making these agreements potentially void from the outset. Understanding your rights, including reclaiming assets, filing lawsuits, and invoking UCC provisions, is crucial to protect yourself from these deceptive practices.