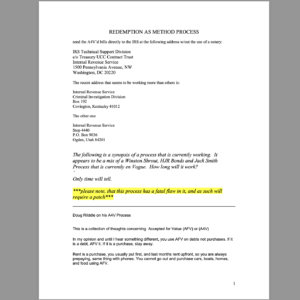

Intangible assets, though lacking physical form, are the bedrock of contemporary finance. They range from Federal Reserve Notes—our cash in hand, backed by the government’s promise—to promissory notes, which are commitments to repay a certain amount in the future. These assets, along with credit agreements, represent value based on Trust and contractual obligations.

Unlike cryptocurrencies, which are inherently fractionable, traditional intangibles like promissory notes and credit agreements are often fractionally divided and securitized beneath the surface of loans. This process transforms them into marketable securities, allowing for diversification of investment portfolios. The practice of securitizing debt amplifies the liquidity of these intangibles, enabling their trade on secondary markets. As such, they contribute to the complex web of financial instruments that underpin the global economy.

The fractionalization and securitization of these traditional intangible assets introduce layers of complexity to our financial systems, mirroring in some ways the divisible nature of cryptocurrency but within a more regulated framework. Understanding these processes is crucial, as they impact everything from interest rates to the stability of financial institutions.