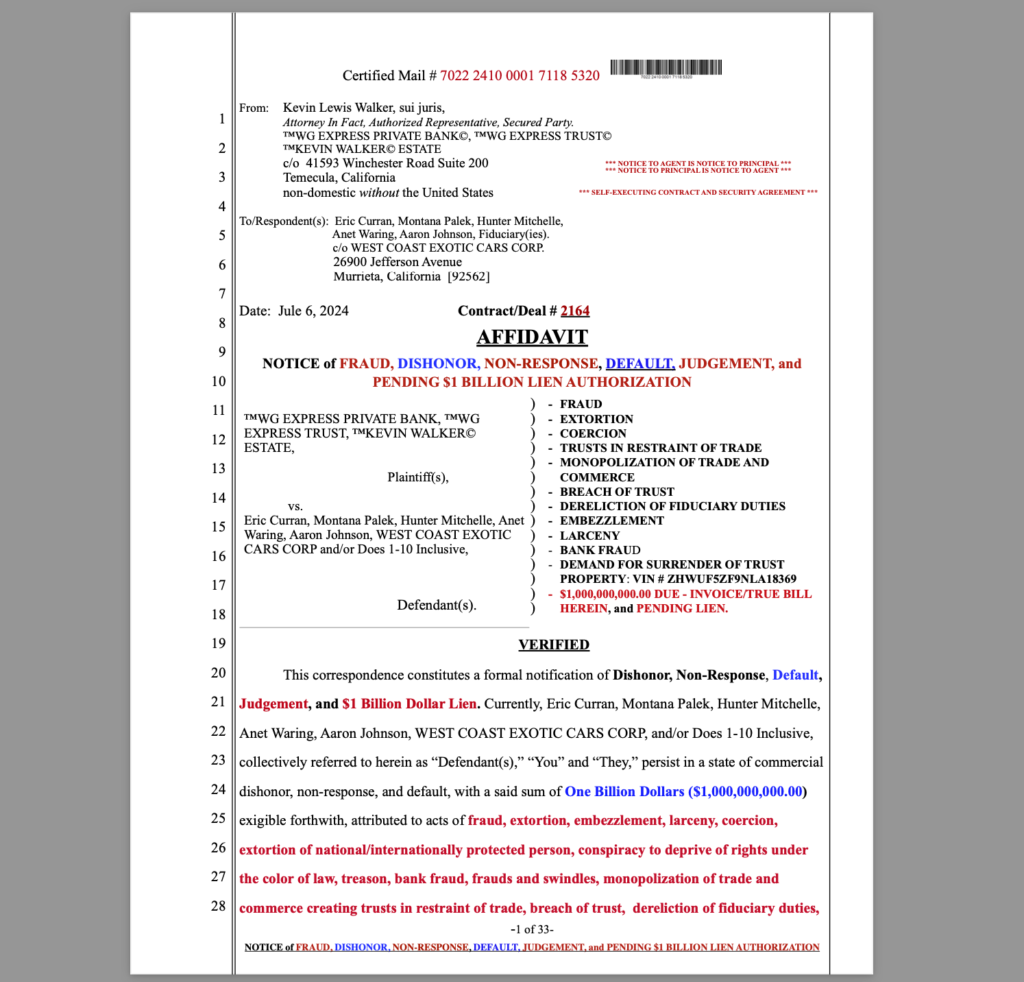

West Coast Exotic Cars, along with Eric Curran, Aaron Johnson, Hunter, and additional staff, are embroiled in a $1 billion lawsuit involving fraud, extortion, coercion, theft, and other federal felony offenses. These claims underline significant violations of consumer rights and federal finance laws, which suggest the dealership may be systematically defrauding and financially exploiting clients.

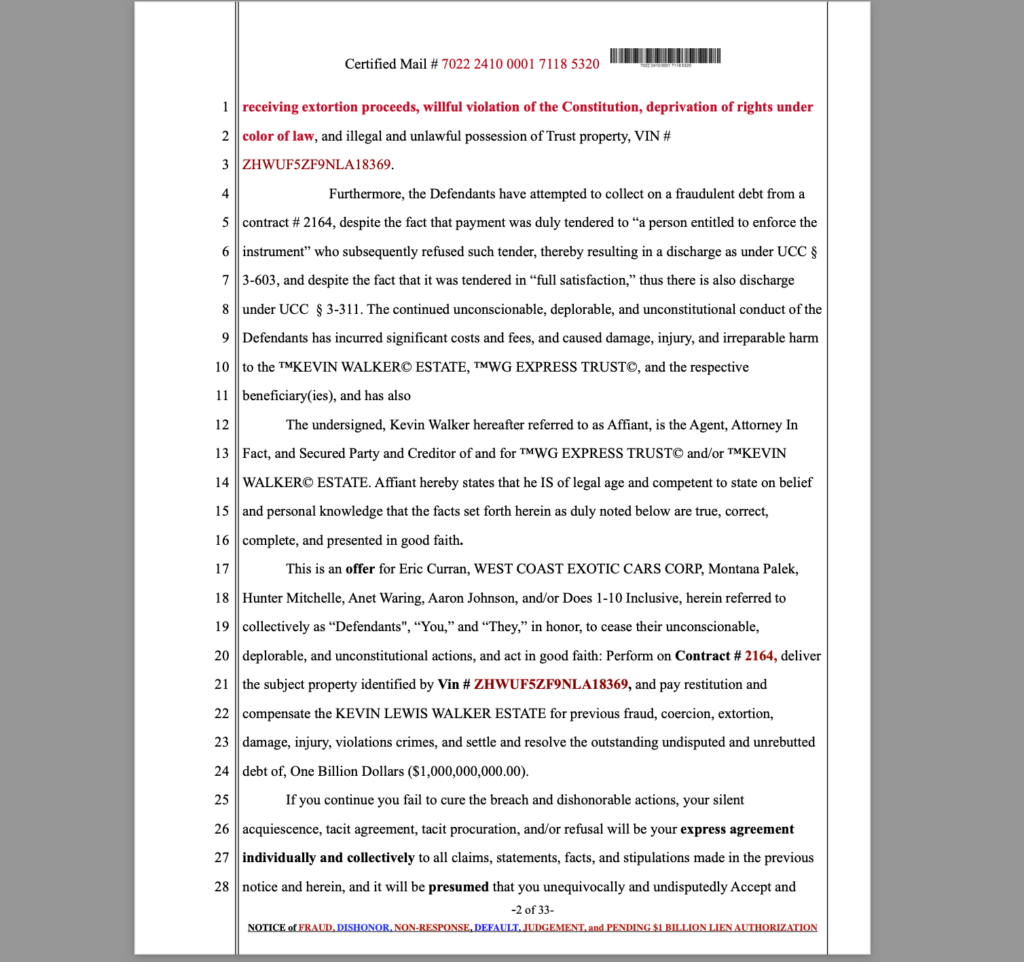

Under U.C.C. § 3-104, a signed “application” or “promissory note” qualifies as a negotiable instrument—legally equivalent to cash. When a customer signs this agreement or application, they effectively complete the payment for the vehicle. U.S. law positions the signed document as full discharge of any financial obligation, making every additional dollar collected beyond this point unauthorized and a potential federal offense. This double-dipping tactic of charging further is, therefore, a serious infraction.

Per 18 U.S.C. § 8, any debt instrument or negotiable financial document (such as a promissory note) is recognized as an “obligation of the United States.” Once a signed credit application is submitted, the federal government stands as the backing entity, discharging the consumer’s obligation to the dealership. Demanding additional funds—through down payments, inflated finance charges, or other tactics—constitutes a direct violation of federal law, potentially amounting to fraudulent behavior.

The practice is further complicated by fraud in the factum—an instance where a party is misled as to the nature or terms of a transaction. If the dealership is not transparent about the fact that a signed application or note equates to full payment, then the contract is founded on deceit, making it void ab initio (void from the outset). Fraud in the factum, by definition, nullifies any obligation of the defrauded party, reinforcing that West Coast Exotic Cars’ practices, if found fraudulent, are legally invalid from the beginning.

In addition, per 15 U.S.C. § 1691 (Equal Credit Opportunity Act), discriminatory practices in any credit transaction are illegal, and 15 U.S.C. § 1605 defines the “finance charge” as the total cost of credit imposed on a consumer, including all charges paid directly or indirectly. By requiring a down payment and then extending credit for the remaining balance, the dealership inflates the finance charge—a violation of the Truth in Lending Act’s requirements for transparency. This practice masks the true cost of the credit, potentially burdening clients under terms that would otherwise be unlawful.

Furthermore, dealerships like West Coast Exotic Cars commonly file Forms 1099-A, 1099-OID, and 1099-B, documenting transactions related to the transfer and value of credit extended. In this case, the dealership or “exchanger”/“lender” often files these forms as proof of advancing credit against the promissory note, which is treated as having intrinsic monetary value equivalent to at least its face amount. This filing underscores that the dealership benefits from the customer’s promissory note as a form of payment with recognized value. Consequently, any additional charges or demands after this transaction are both deceptive and unlawful.

Since 1933, after the abandonment of the gold standard, U.S. currency has been based on contract obligations rather than gold-backed assets. Therefore, a promissory note—backed by the federal government—is sufficient to cover the full purchase cost of the vehicle. By failing to disclose clients’ rights and charging beyond what is legally permissible, West Coast Exotic Cars appears to double-dip, treating clients’ signed documents as cash while also demanding further payments. This form of extortion disregards clients’ rights and, exploits their lack of awareness. Such conduct is a breach of both state and federal protections, rendering any contracts formed under these conditions fraudulent and void ab initio.

West Coast Exotic Cars is embroiled in serious legal issues that stem from fraudulent and unethical business practices, as evidenced by unrebutted affidavits that establish a prima facie case against the dealership. The following points summarize the key violations and the corresponding legal statutes that highlight the gravity of the situation:

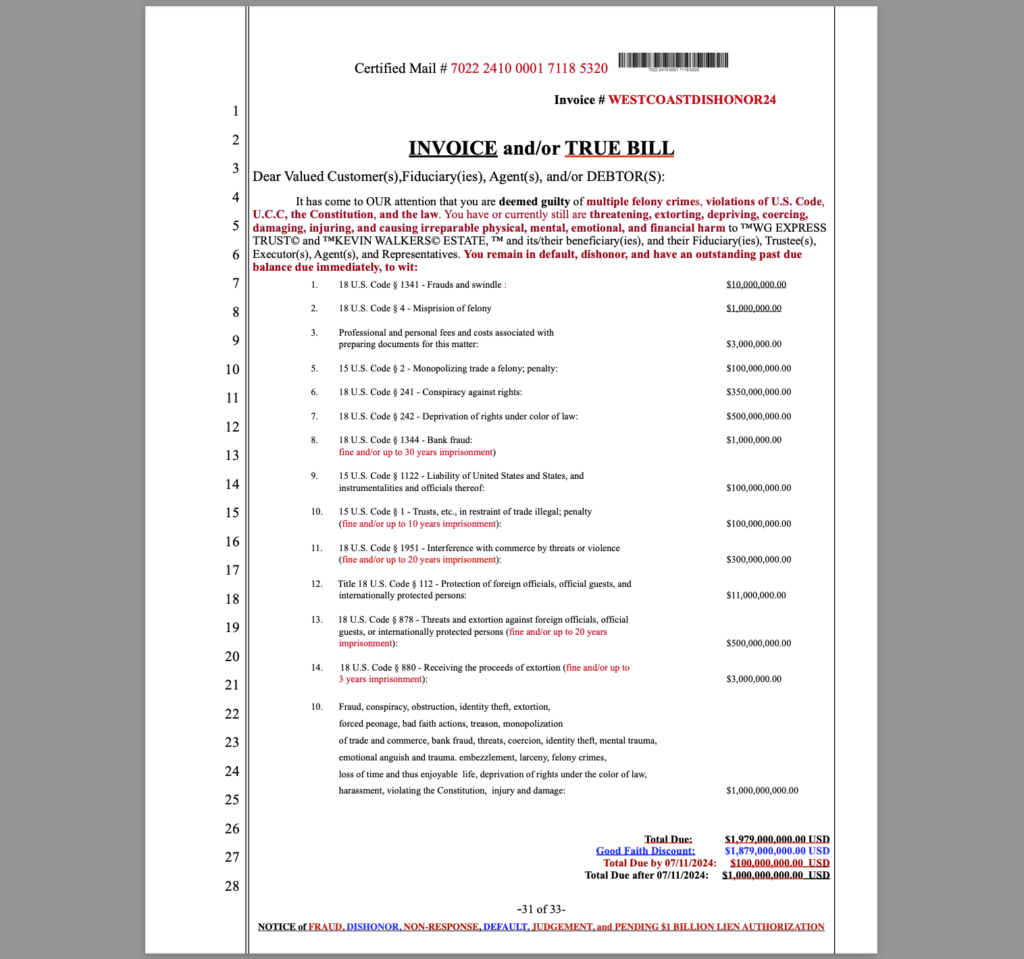

- Fraudulent Misrepresentation: The dealership has engaged in deceptive practices, including creating false claims of debt, in violation of 18 U.S. Code § 1341 (Frauds and Swindles). The presence of unrebutted affidavits confirms the intent behind these fraudulent activities.

- Extortion and Coercion: West Coast Exotic Cars has employed coercive tactics to extort funds from clients, violating 18 U.S. Code § 880. These actions demonstrate a blatant disregard for legal and ethical standards.

- Deprivation of Rights: The unlawful practices of the dealership have resulted in the infringement of clients’ constitutional rights, supported by 42 U.S.C. § 1983 and 18 U.S.C. § 241, which address conspiracies against individual rights.

- Monopolistic Practices: The dealership’s activities reflect a violation of antitrust laws, particularly 15 U.S. Code § 2 (Monopolizing Trade), indicating a pattern of anti-competitive behavior that harms consumers.

- Bank Fraud: The systematic defrauding of financial institutions falls under 18 U.S. Code § 1344, addressing fraudulent schemes aimed at banks, which further underscores the dealership’s unlawful actions.

- Racketeering Activities: The establishment of a pattern of racketeering, including fraud and extortion, is a clear violation of 18 U.S. Code § 1961 et seq., the RICO statute that targets organized crime.

- Transportation of Stolen Assets: Facts surrounding the unlawful handling and transfer of misappropriated funds point to violations of 18 U.S. Code § 2314, which addresses the transportation of stolen property.

- Financial Instruments Regulation: The dealership’s conduct is further scrutinized under 12 U.S. Code § 411, which regulates the issuance and transfer of monetary instruments, and 12 U.S. Code § 412, which outlines additional requirements for monetary transactions. These statutes emphasize the illegitimacy of the dealership’s financial practices and their failure to adhere to proper protocols.

The Racketeering situation

The unfolding saga at West Coast Exotic Cars serves as a cautionary tale about consumer exploitation and systemic fraud within the automotive industry. With compelling evidence provided by unrebutted affidavits, the case raises critical questions about corporate accountability and ethical standards in business. As legal proceedings progress, the implications for those involved could be profound, highlighting the urgent need for transparency and justice in a marketplace often clouded by deceit. Dive deeper into this case to uncover the mechanisms of fraud and the potential consequences for those who think they can operate outside the law

United States Code and Uniform Commercial Code violations:

-

- 18 U.S. Code § 1341 – Frauds and Swindles

The fraudulent misrepresentations and creation of false claims of debt by West Coast Exotic Cars, as evidenced by unrebutted commercial affidavits and the Contract Security Agreement, demonstrate a clear violation of this statute. These documents provide direct evidence of the dealership’s intent to deceive clients, constituting fraud under federal law. - 18 U.S. Code § 880 – Receiving Proceeds of Extortion

The dealership’s actions resulted in its receipt of funds obtained through extortionate practices, including coercive demands for payments beyond what was agreed upon. The existence of unrebutted affidavits confirms that West Coast Exotic Cars knowingly benefited from financial gains derived from unlawful pressure exerted on clients. - 42 U.S.C. § 1983 – Civil Action for Deprivation of Rights

West Coast Exotic Cars’ conduct involved a deprivation of clients’ constitutional rights through unfair financial practices and unauthorized charges. The unrebutted affidavits serve as prima facie evidence that the dealership’s actions directly interfered with the plaintiffs’ rights to equitable treatment in financial transactions, as protected under federal law. - 18 U.S. Code § 241 – Conspiracy Against Rights

The actions of West Coast Exotic Cars, as detailed in the affidavits, reflect a coordinated effort among its employees to deprive clients of their federally protected rights. This behavior constitutes a conspiracy under § 241, as the dealership’s practices were designed to mislead and coerce clients, violating their rights in the process. - 18 U.S. Code § 242 – Deprivation of Rights Under Color of Law

The dealership’s imposition of unauthorized financial terms deprived clients of their rights guaranteed by law. The unrebutted affidavits substantiate that West Coast Exotic Cars acted under the color of law, manipulating its authority to impose unfair terms, thereby violating § 242. - 15 U.S. Code § 2 – Monopolizing Trade; Felony

The dealership engaged in unlawful restraint of trade and monopolistic practices, as evidenced by the affidavits. West Coast Exotic Cars’ actions limited clients’ options and manipulated financial terms to its advantage, violating federal antitrust laws. - 18 U.S. Code § 878 – Extortion and Threats

The coercive tactics employed by West Coast Exotic Cars to secure compliance from clients through threats and unlawful demands constitute extortion under § 878. The affidavits provide clear evidence of the dealership’s intent to compel clients into unfavorable financial agreements. - 18 U.S. Code § 1961 et seq. – Racketeer Influenced and Corrupt Organizations Act (RICO)

The systematic practices of West Coast Exotic Cars, including fraud and extortion as outlined in the affidavits, establish a pattern of racketeering activity. This conduct, which involved multiple unlawful acts against clients, may fall under the purview of RICO. - 18 U.S. Code § 1344 – Bank Fraud

The fraudulent schemes executed by West Coast Exotic Cars aimed at deceiving financial institutions and clients about the nature of payments indicate a violation of § 1344. The affidavits corroborate the dealership’s intent to defraud, further supporting claims of bank fraud. - 18 U.S. Code § 2314 – Transportation of Stolen Property, Money, & Securities

The unlawful transportation of funds and assets gained through deceptive means, as stated in the affidavits, constitutes a violation of this statute. West Coast Exotic Cars is implicated in the transfer of misappropriated funds, which is prohibited under federal law. - 15 U.S. Code § 1691 – Equal Credit Opportunity Act (ECOA)

The dealership’s discriminatory practices in imposing unfair financial obligations without full disclosure violate the ECOA. The affidavits provide evidence that clients were denied equal access to fair credit terms, contravening the principles established by this statute. - UCC 3-104 – Negotiable Instruments

The Contract Security Agreement, which constitutes a negotiable instrument, was improperly managed by West Coast Exotic Cars. The dealership’s demands for additional payments after receiving the note indicate a failure to honor the agreement, constituting a violation of UCC 3-104, as it should have served as full payment. - 18 U.S.C. § 8 – Obligation of the United States

Under this statute, promissory notes and negotiable instruments are recognized as legal tender. West Coast Exotic Cars’ insistence on further payments after accepting such instruments violates this provision, as these notes settle debts fully under federal law.

The presence of unrebutted affidavits serves as prima facie evidence that the actions of West Coast Exotic Cars not only violated statutory and contractual obligations but also established a clear pattern of illegal conduct that undermined consumer rights and protections. These statutes collectively reinforce the claims against the dealership and affirm the validity of the grievances outlined in the documentation.

- 18 U.S. Code § 1341 – Frauds and Swindles