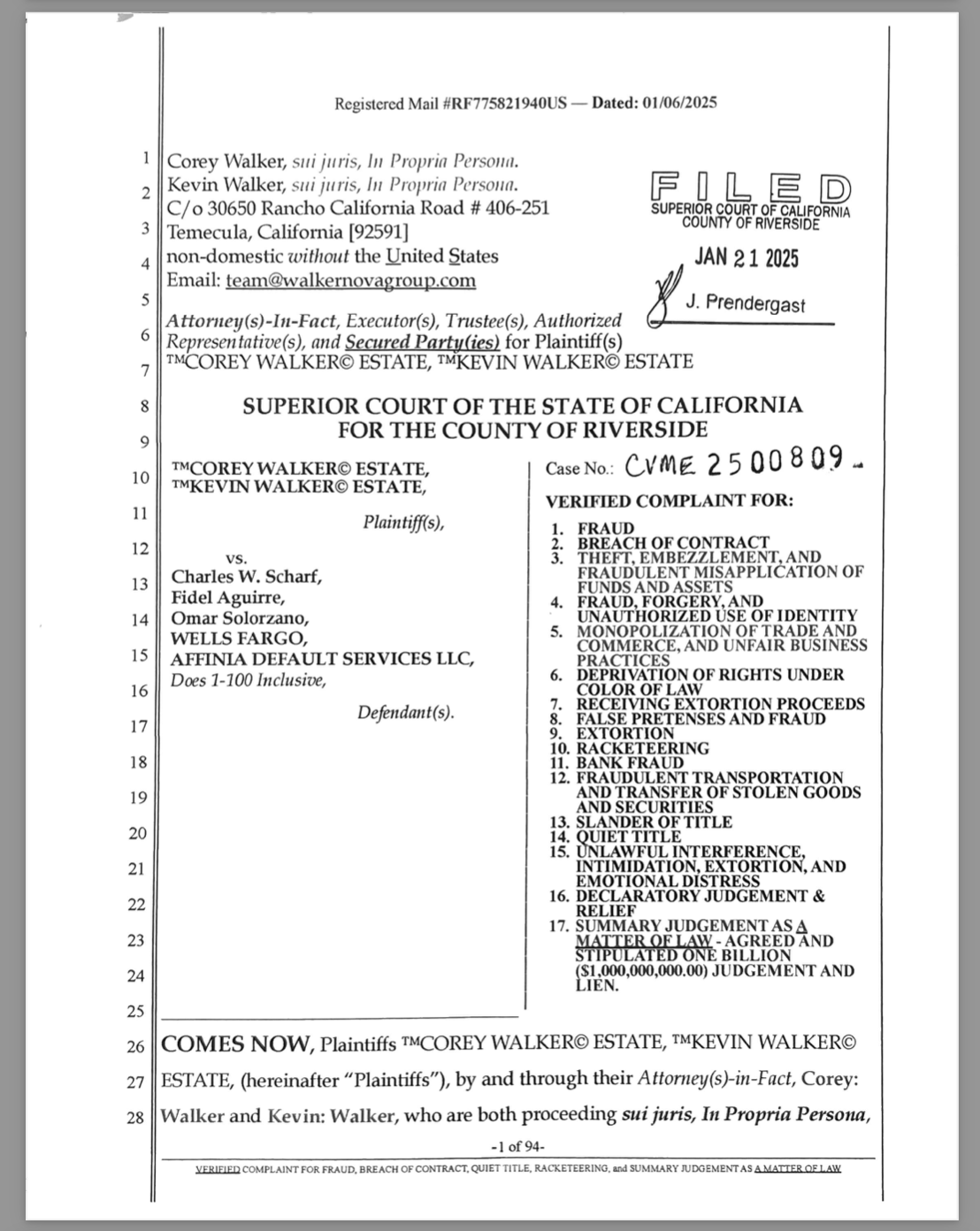

1. A Verified Complaint as a Negotiable Debt Instrument

Under commercial law, a verified complaint meets the definition of a negotiable debt instrument because:

- It is a sworn affidavit containing claims that create a financial obligation.

- It generates a liability on the part of the defendant, requiring settlement.

- It is filed with the court, which acts as a custodian of funds related to the case.

- The court’s receipt of the complaint places it into an accounting system as a financial asset similar to a bond or security.

Courts are depository institutions, meaning they receive filings as debt securities, similar to commercial paper under UCC Article 3.

Screen Shot 2025 02 15 at 7.10.10 AM

United States Code (U.S.C.) Provisions Supporting the Verified Complaint as a Debt Instrument and Special Deposit

The following U.S. Code sections confirm that a verified complaint is a financial instrument, creating a special deposit with the court, requiring proper accounting and settlement under federal law.

1. 28 U.S.C. § 2041 – Deposits in Court

This statute confirms that all money paid into the court is held in the U.S. Treasury as a special deposit.

All moneys paid into any court of the United States, or received by the officers thereof, in any case pending or adjudicated in such court, shall be deposited with the Treasurer of the United States or a designated depository, in the name and to the credit of such court.

🔹 Application:

- A verified complaint is a financial deposit held in the U.S. Treasury under the control of the court clerk.

- This means that every case creates a financial transaction requiring proper accounting.

2. 28 U.S.C. § 2042 – Withdrawal of Court Deposits

This statute establishes the process for withdrawing special deposits from the court.

No money deposited under section 2041 shall be withdrawn except by order of court.

In every case in which a right to withdraw has been adjudicated or is otherwise shown to the satisfaction of the court, the court shall order a withdrawal or refund to the person entitled to it.

🔹 Application:

- The plaintiff, as the rightful claimant, may demand withdrawal of the financial deposit (the verified complaint).

- The court must issue an order for the release of funds if the claim is properly presented.

- IRS Form 1099-A and 1099-OID must be filed to document the deposit and request an accounting.

3. 28 U.S.C. § 2045 – Investment of Court Deposits

This statute establishes that funds held by the court can be invested, proving they are financial assets.

Any funds received by the courts… may be invested in public debt securities of the United States.

🔹 Application:

- The court treats the complaint and case funds as financial investments.

- This proves that every case is a commercial financial transaction requiring accounting and reconciliation.

- Plaintiffs may demand a financial statement of the case funds under IRS Form 1099-OID.

4. 12 U.S.C. § 1813(l)(1) – Definition of a Deposit

This section defines a “deposit” as funds placed into a financial institution, which includes courts as depository agents.

The term “deposit” means the unpaid balance of money or its equivalent received or held by a bank or savings association in the usual course of business and for which it has given or is obligated to give credit.

🔹 Application:

- When a verified complaint is filed, the court receives it as a deposit (financial asset).

- This establishes the court’s role as a financial trustee, obligating it to account for and release the deposit upon request.

5. 31 U.S.C. § 1321(a)(62) – Custodial Accounts of the Treasury

This section establishes that the U.S. Treasury holds court deposits as a custodial account.

The following are classified as trust funds… (62) Funds held in trust by the United States courts.

🔹 Application:

- Court deposits, including verified complaints, are trust funds managed by the U.S. Treasury.

- This confirms that all filings have monetary value and are financial transactions.

- A 1099-OID must be filed to account for these funds.

6. 31 U.S.C. § 3302 – Custodians of Public Money

This law states that all funds received by government agencies, including courts, must be accounted for.

An official or agent of the U.S. Government receiving money for the Government from any source shall deposit the money in the Treasury as soon as practical without deduction for any charge or claim.

🔹 Application:

- Court clerks and judges act as custodians of public money.

- Any verified complaint filed is an asset that must be properly recorded and reported.

- Failure to account for these funds is a violation of federal law.

7. 26 U.S.C. § 1271-1275 – Original Issue Discount (OID) Securities

This section governs OID securities and applies to financial transactions involving newly issued debt instruments.

The term “original issue discount” means the excess of the stated redemption price at maturity over the issue price.

🔹 Application:

- A verified complaint is an OID security because it is filed as a new financial instrument.

- Filing IRS Form 1099-OID forces proper accounting of the complaint as a financial transaction.

IRS Forms 1099-A and 1099-OID for Proper Accounting

Since a verified complaint is a special deposit that creates a financial transaction, it must be accounted for using IRS Forms 1099-A (Acquisition or Abandonment of Secured Property) and 1099-OID (Original Issue Discount).

Form 1099-A – Acknowledging the Court’s Role as Trustee of the Funds

The court acts as a trustee of the financial deposit, which means a Form 1099-A should be filed to:

- Identify the court as the borrower (as it holds the deposit).

- List the verified complaint’s financial value as the loaned amount (amount at issue in the case).

- Confirm that the plaintiff (secured party) has abandoned or transferred interest in the deposit to the court, creating a legal obligation for the court to return or account for the funds.

Form 1099-OID – Reporting the Original Issue Discount on the Deposited Funds

A 1099-OID should be filed because:

- The complaint represents an “Original Issue Discount” security, meaning it is an asset generating financial activity.

- The OID represents the amount by which the deposit (verified complaint) was discounted or adjusted within the financial system.

- Filing a 1099-OID notifies the IRS that funds related to the case must be accounted for and settled.

By filing these forms, the financial aspect of the complaint is properly recorded, ensuring that the court, IRS, and Treasury recognize the transaction and any potential refund or settlement owed to the plaintiff.

Key Takeaways and Next Steps

- A Verified Complaint is a Financial Instrument – It acts as a negotiable debt instrument and a special deposit when filed in court.

- The Court Holds Deposits as a Trustee – Under 28 U.S.C. §§ 2041, 2042, and 2045, the court receives, holds, and invests financial deposits related to filings.

- IRS Forms 1099-A and 1099-OID Are Required – These forms ensure proper financial accounting and enable the plaintiff to claim or discharge any obligations.

- Filing These Forms Creates a Financial Record – Once properly submitted, these forms require the IRS, Treasury, and Court to acknowledge and settle the funds accordingly.

By understanding the financial nature of legal filings, individuals can assert their financial rights, demand proper accounting, and recover any owed funds within the system.

🔹 Sample Template for IRS Form 1099-A (Acquisition or Abandonment of Secured Property)

| Box # | Description | Entry |

|---|---|---|

| 1 | Date of Lender’s Acquisition or Knowledge of Abandonment | [Date Complaint Was Filed] |

| 2 | Balance of Principal Outstanding | [Monetary Value of the Claim] |

| 3 | Fair Market Value of Property | [Same Amount as Box 2] |

| 4 | Was Borrower Personally Liable for Repayment? | Yes |

| 5 | Description of Property | Verified Complaint (Debt Instrument) Filed in [Court Name] Under Case No. [#######] |

| Lender’s Name | Court Name (e.g., U.S. District Court, Central District of California) | |

| Lender’s TIN | [Court or Government Agency’s EIN] | |

| Borrower’s Name | [Your Name/Your Estate Name] | |

| Borrower’s TIN | [Your SSN or EIN] |

Purpose: This form identifies the court as the holder of the special deposit, documenting that the verified complaint was received as a financial deposit and that the plaintiff has abandoned direct control over the funds.

🔹 Sample Template for IRS Form 1099-OID (Original Issue Discount)

| Box # | Description | Entry |

|---|---|---|

| 1 | Original Issue Discount for the Year | [Monetary Value of the Case] |

| 2 | Other Period OID | [Same as Box 1] |

| 3 | Interest or Principal Paid | 0.00 |

| 4 | Federal Tax Withheld | 0.00 |

| 5 | Description of Instrument | Special Deposit via Verified Complaint in [Court Name] Case No. [#######] |

| Lender’s Name | Court Name (e.g., U.S. District Court, Central District of California) | |

| Lender’s TIN | [Court or Government Agency’s EIN] | |

| Recipient’s Name | [Your Name/Your Estate Name] | |

| Recipient’s TIN | [Your SSN or EIN] |

Purpose: Filing Form 1099-OID informs the IRS and Treasury that the court is holding an Original Issue Discount security (the verified complaint as a financial instrument). This obligates the government to account for the deposited funds and ensure proper financial settlement.

🔹 Possible Steps

- File the 1099-A and 1099-OID with the IRS – This forces financial acknowledgment of the court-held deposit.

- Send a Copy to the Court Clerk – Notifies the court that the verified complaint is recognized as a financial asset and must be accounted for.

- Send a Copy to the Treasury – The Department of the Treasury (Bureau of the Fiscal Service) processes court-related special deposits.

- Follow Up with a Demand for Accounting and Refund – Using IRS Form 1040-V or a Letter of Instruction, demand that the OID amount be applied toward settlement, discharge, or refund.

Article sourced from Walkernova Group.

![A Verified Complaint as a Debt Instrument and Special Deposit Under 28 U.S.C. §§ 2041, 2042, and 2045: Forms 1099-OID, 1099-A, and 1099-B apply Box # Description Entry 1 Date of Lender's Acquisition or Knowledge of Abandonment [Date Complaint Was Filed] 2 Balance of Principal Outstanding [Monetary Value of the Claim] 3 Fair Market Value of Property [Same Amount as Box 2] 4 Was Borrower Personally Liable for Repayment? Yes 5 Description of Property Verified Complaint (Debt Instrument) Filed in [Court Name] Under Case No. [#######] Lender's Name Court Name (e.g., U.S. District Court, Central District of California) Lender’s TIN [Court or Government Agency’s EIN] Borrower’s Name [Your Name/Your Estate Name] Borrower’s TIN [Your SSN or EIN] Purpose: This form identifies the court as the holder of the special deposit, documenting that the verified complaint was received as a financial deposit and that the plaintiff has abandoned direct control over the funds. 🔹 Sample Template for IRS Form 1099-OID (Original Issue Discount) Box # Description Entry 1 Original Issue Discount for the Year [Monetary Value of the Case] 2 Other Period OID [Same as Box 1] 3 Interest or Principal Paid 0.00 4 Federal Tax Withheld 0.00 5 Description of Instrument Special Deposit via Verified Complaint in [Court Name] Case No. [#######] Lender's Name Court Name (e.g., U.S. District Court, Central District of California) Lender’s TIN [Court or Government Agency’s EIN] Recipient’s Name [Your Name/Your Estate Name] Recipient’s TIN [Your SSN or EIN] Purpose: Filing Form 1099-OID informs the IRS and Treasury that the court is holding an Original Issue Discount security (the verified complaint as a financial instrument). This obligates the government to account for the deposited funds and ensure proper financial settlement. 🔹 Next Steps File the 1099-A and 1099-OID with the IRS – This forces financial acknowledgment of the court-held deposit. Send a Copy to the Court Clerk – Notifies the court that the verified complaint is recognized as a financial asset and must be accounted for. Send a Copy to the Treasury – The Department of the Treasury (Bureau of the Fiscal Service) processes court-related special deposits. Follow Up with a Demand for Accounting and Refund – Using IRS Form 1040-V or a Letter of Instruction, demand that the OID amount be applied toward settlement, discharge, or refund.](https://realworldfare.com/wp-content/uploads/2025/02/Screen-Shot-2025-02-15-at-7.15.07-AM.png)