We’ve all heard the various sayings about 5% of the world’s population holding 95% of the world’s wealth but not many are sure how and why this is our reality. If you are here you are seeing things for what they really are now, or are likely on your way.

Doing some online research about what is money and how is it created will inevitably lead one to discover the surprisingly fraudulent ways in which banks create money and make loans. Money of account for money of exchange. As supported by UCC §3-104(f), a promissory note or draft is the equivalent of a check and can be securitized or monetized by direct deposit in a commercial checking, time, thrift, or saving account, and under Title 12 of the United States Code §1813(l)(1), upon being deposited, it becomes the equivalent of money.

the “Law of Consideration” means essentially that a contract wasis null and void if both parties are not exchanging something of inherent value.

In this case, Jerome Daly defended himself against a lawsuit brought by a bank holding the mortgage on his house. Mr. Daly had defaulted on the mortgage and the bank was suing to foreclose and take his house.

Unfortunately for the bank, even though it was 1969 and all good little citizens were doing as they were told, never daring to question any kind of authority, Mr. Daly was well educated in the way banks create money. Mr. Daly knew that when a bank makes a loan, it instantly creates money by the stroke of a pen in a ledger, which then is transferred to the borrower’s account.

Mr. Daly argued, and somehow got the bank to admit, that they created the money with a stroke of a pen at the time of the loan (and that there was no actual official law empowering them to do so.) Since the bank did not “put up” anything of value (other than the ink from the pen) for Mr. Daly’s home mortgage, there was no consideration, therefore the mortgage agreement was null and void.

Justice Martin V. Mahoney ruled against the bank (in favor of Daly) and denied the foreclosure. Mr. Daly kept his house and paid no more mortgage. Six months later Justice Mahoney was found dead (allegedly by poison) and Mr. Daly was disbarred and never practiced law again.

Brief summary of the facts:

- Jerome Daly had a mortgage with the First National Bank of Montgomery , Minnesota .

In Spring 1967, he was $476.00 in arrears, the bank foreclosed and bought the property at a Sheriff’s sale on June 26, 1967.

The bank sued for possession. - A jury trial presided over by Martin V. Mahoney, Justice of the Peace, Credit River Township , Scott County, Minnesota, was held on December 7, 1968.

- The bank’s president, one Lawrence V. Morgan (familiar name?) appeared along with lawyer R. Melby for the plaintiff and Jerome Daly, who was a lawyer, appeared on his own behalf.

“The Credit River Decision,” which is, still “The Law of the Land” declared the following

- the Federal Reserve Act is unconstitutional and VOID

- the National Banking Act is unconstitutional and VOID

- the mortgage acquired by the First National Bank of Montgomery, Minnesota in the regular course of its business, along with the foreclosure and the sheriff’s sale, to be VOID

The decision:

1.That the Plaintiff is not entitled to recover the possession of Lot 19, Fairview Beach, Scott County, Minnesota according to the Plat thereof on file in the Register of Deeds office.

2.That because of failure of a lawful consideration the Note and Mortgage dated May 8, 1964 are null and void.

3.That the Sheriff’s sale of the above described premises held on June 26, 1967 is null and void, of no effect.

4.That the Plaintiff has no right title or interest in said premises or lien thereon as is above described.

5.That any provision in the Minnesota Constitution and any Minnesota Statute binding the jurisdiction of this Court is repugnant to the Constitution of the United States and to the Bill of Rights of the Minnesota Constitution and is null and void and that this Court has jurisdiction to render complete Justice in this Cause.

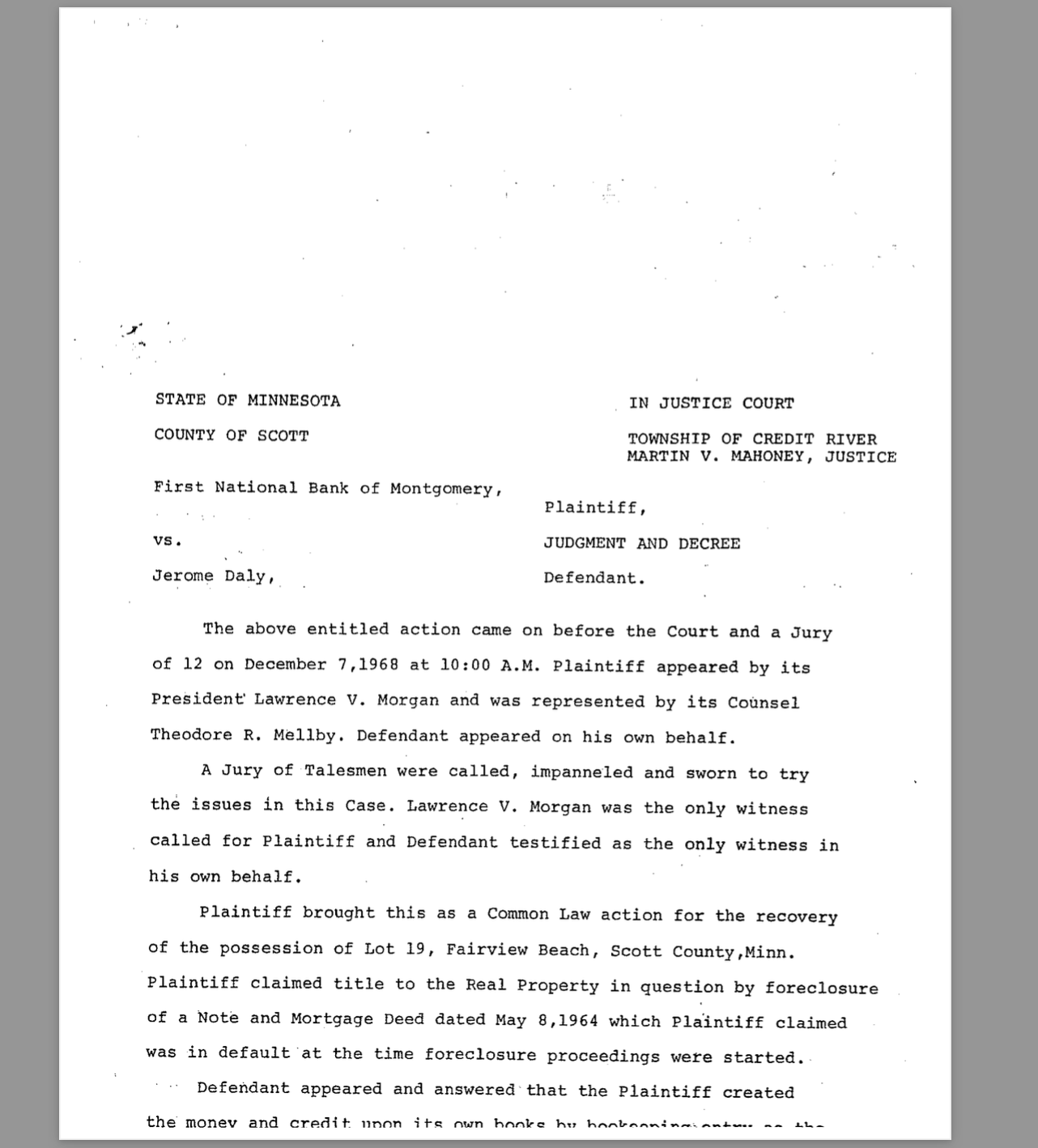

THE MAHONEY CREDIT RIVER DECISION

RE: First National Bank of Montgomery vs. Jerome Daly

IN THE JUSTICE COURT

STATE OF MINNESOTA

COUNTY OF SCOTT

TOWNSHIP OF CREDIT RIVER

JUSTICE MARTIN V. MAHONEY

First National Bank of Montgomery,

Plaintiff

vs

Jerome Daly,

Defendant

JUDGMENT AND DECREE

The above entitled action came on before the Court and a Jury of 12 on December 7, 1968 at 10:00 am. Plaintiff appeared by its President Lawrence V. Morgan and was represented by its Counsel, R. Mellby. Defendant appeared on his own behalf.

A Jury of Talesmen were called, impaneled and sworn to try the issues in the Case. Lawrence V. Morgan was the only witness called for Plaintiff and Defendant testified as the only witness in his own behalf.

Plaintiff brought this as a Common Law action for the recovery of the possession of Lot 19 Fairview Beach, Scott County, Minn. Plaintiff claimed title to the Real Property in question by foreclosure of a Note and Mortgage Deed dated May 8, 1964 which Plaintiff claimed was in default at the time foreclosure proceedings were started.

Defendant appeared and answered that the Plaintiff created the money and credit upon its own books by bookkeeping entry as the consideration for the Note and Mortgage of May 8, 1964 and alleged failure of the consideration for the Mortgage Deed and alleged that the Sheriff’s sale passed no title to plaintiff.

The issues tried to the Jury were whether there was a lawful consideration and whether Defendant had waived his rights to complain about the consideration having paid on the Note for almost 3 years.

Mr. Morgan admitted that all of the money or credit which was used as a consideration was created upon their books, that this was standard banking practice exercised by their bank in combination with the Federal Reserve Bank of Minneapolis, another private Bank, further that he knew of no United States Statute or Law that gave the Plaintiff the authority to do this. Plaintiff further claimed that Defendant by using the ledger book created credit and by paying on the Note and Mortgage waived any right to complain about the Consideration and that the Defendant was estopped from doing so.

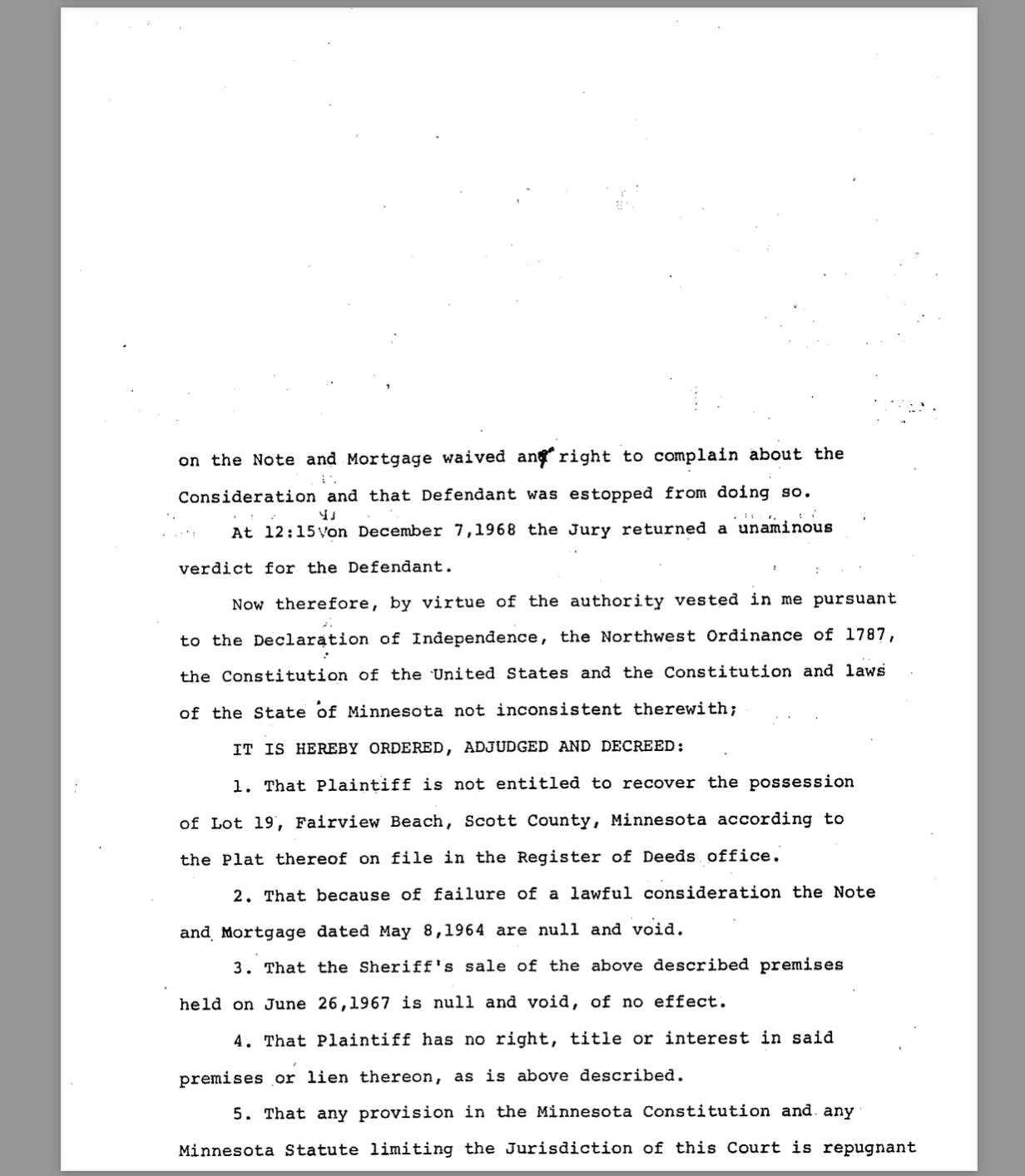

At 12:15 on December 7, 1968 the Jury returned a unanimous verdict for the Defendant.

Now therefore, by virtue of the authority vested in me pursuant to the Declaration of Independence, the Northwest Ordinance of 1787, the Constitution of United States and the Constitution and the laws of the State of Minnesota not inconsistent therewith ;

IT IS HEREBY ORDERED, ADJUDGED AND DECREED:

1.That the Plaintiff is not entitled to recover the possession of Lot 19, Fairview Beach, Scott County, Minnesota according to the Plat thereof on file in the Register of Deeds office.

2.That because of failure of a lawful consideration the Note and Mortgage dated May 8, 1964 are null and void.

3.That the Sheriff’s sale of the above described premises held on June 26, 1967 is null and void, of no effect.

4.That the Plaintiff has no right title or interest in said premises or lien thereon as is above described.

5.That any provision in the Minnesota Constitution and any Minnesota Statute binding the jurisdiction of this Court is repugnant to the Constitution of the United States and to the Bill of Rights of the Minnesota Constitution and is null and void and that this Court has jurisdiction to render complete Justice in this Cause.

The following memorandum and any supplementary memorandum made and filed by this Court in support of this Judgment is hereby made a part hereof by reference.

BY THE COURT

Dated December 9, 1968

Justice MARTIN V. MAHONEY

Credit River Township

Scott County, Minnesota

MEMORANDUM

The issues in this case were simple. There was no material dispute of the facts for the Jury to resolve.

Plaintiff admitted that it, in combination with the Federal Reserve Bank of Minneapolis, which are for all practical purposes, because of their interlocking activity and practices, and both being Banking Institutions Incorporated under the Laws of the United States, are in the Law to be treated as one and the same Bank, did create the entire $14,000.00 in money or credit upon its own books by bookkeeping entry. That this was the Consideration used to support the Note dated May 8, 1964 and the Mortgage of the same date. The money and credit first came into existence when they created it. Mr. Morgan admitted that no United States Law Statute existed which gave him the right to do this. A lawful consideration must exist and be tendered to support the Note. See Ansheuser-Busch Brewing Company v. Emma Mason, 44 Minn. 318, 46 N.W. 558. The Jury found that there was no consideration and I agree. Only God can create something of value out of nothing.

Even if Defendant could be charged with waiver or estoppel as a matter of Law this is no defense to the Plaintiff. The Law leaves wrongdoers where it finds them. See sections 50, 51 and 52 of Am Jur 2nd “Actions” on page 584 – “no action will lie to recover on a claim based upon, or in any manner depending upon, a fraudulent, illegal, or immoral transaction or contract to which Plaintiff was a party.”

Plaintiff’s act of creating credit is not authorized by the Constitution and Laws of the United States, is unconstitutional and void, and is not a lawful consideration in the eyes of the Law to support any thing or upon which any lawful right can be built.

Nothing in the Constitution of the United States limits the jurisdiction of this Court, which is one of original Jurisdiction with right of trial by Jury guaranteed. This is a Common Law action. Minnesota cannot limit or impair the power of this Court to render Complete Justice between the parties. Any provisions in the Constitution and laws of Minnesota which attempt to do so is repugnant to the Constitution of the United States and void. No question as to the Jurisdiction of this Court was raised by either party at the trial. Both parties were given complete liberty to submit any and all facts to the Jury, at least in so far as they saw fit.

No complaint was made by Plaintiff that Plaintiff did not receive a fair trial. From the admissions made by Mr. Morgan the path of duty was direct and clear for the Jury. Their Verdict could not reasonably been otherwise. Justice was rendered completely and without denial, promptly and without delay, freely and without purchase, conformable to the laws in this Court of December 7, 1968.

BY THE COURT

December 9, 1968

Justice Martin V. Mahoney

Credit River Township

Scott County, Minnesota.

Note: It has never been doubted that a Note given on a Consideration which is prohibited by law is void. It has been determined, independent of Acts of Congress, that sailing under the license of an enemy is illegal. The emission of Bills of Credit upon the books of these private Corporations for the purpose of private gain is not warranted by the Constitution of the United States and is unlawful. See Craig v. Mo. 4 Peters Reports 912. This Court can tread only that path which is marked out by duty. M.V.M