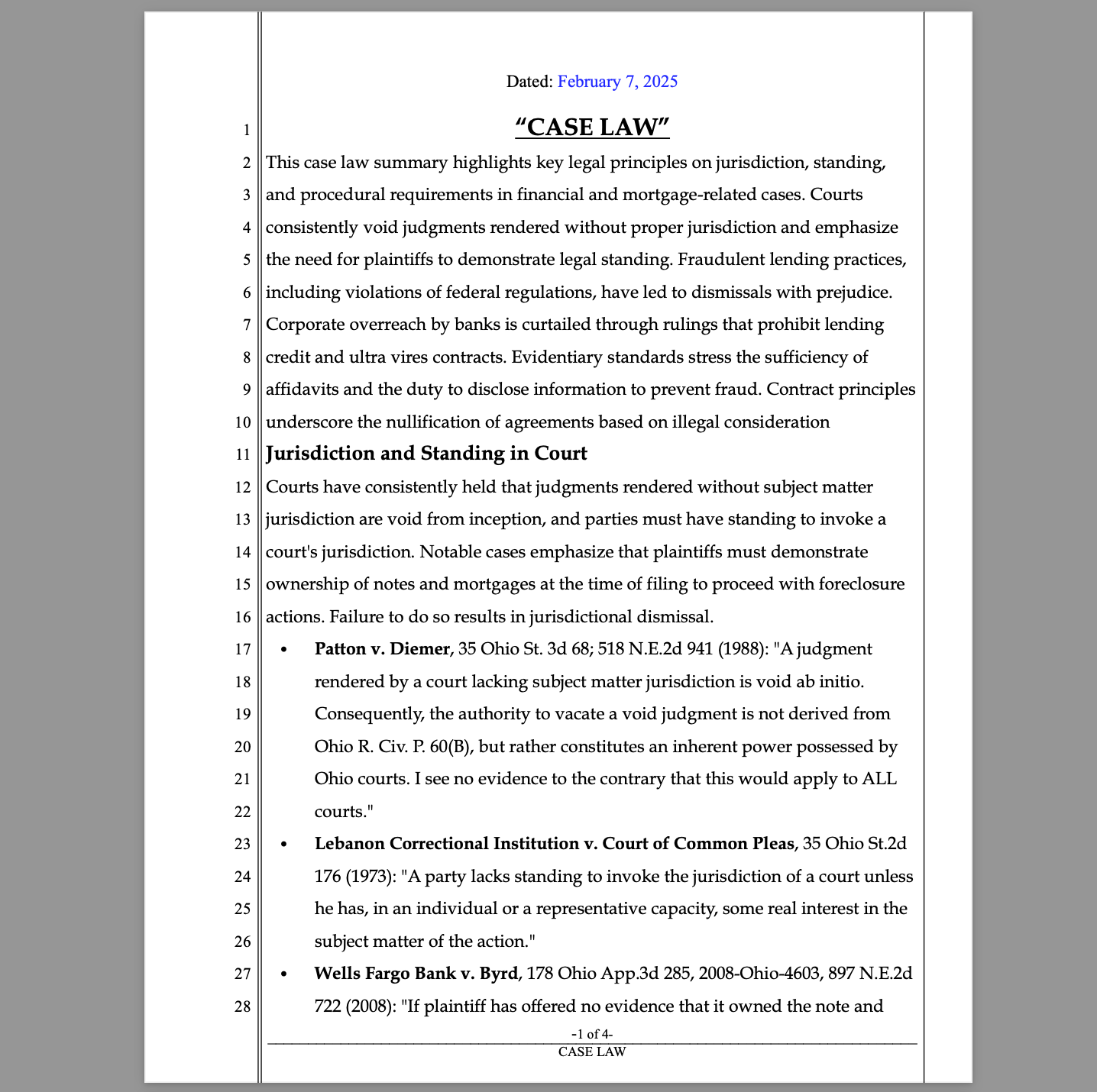

Jurisdiction and Standing in Court

Courts have consistently held that judgments rendered without subject matter jurisdiction are void from inception, and parties must have standing to invoke a court’s jurisdiction. Notable cases emphasize that plaintiffs must demonstrate ownership of notes and mortgages at the time of filing to proceed with foreclosure actions. Failure to do so results in jurisdictional dismissal.

- Patton v. Diemer, 35 Ohio St. 3d 68; 518 N.E.2d 941 (1988): “A judgment rendered by a court lacking subject matter jurisdiction is void ab initio. Consequently, the authority to vacate a void judgment is not derived from Ohio R. Civ. P. 60(B), but rather constitutes an inherent power possessed by Ohio courts. I see no evidence to the contrary that this would apply to ALL courts.”

- Lebanon Correctional Institution v. Court of Common Pleas, 35 Ohio St.2d 176 (1973): “A party lacks standing to invoke the jurisdiction of a court unless he has, in an individual or a representative capacity, some real interest in the subject matter of the action.”

- Wells Fargo Bank v. Byrd, 178 Ohio App.3d 285, 2008-Ohio-4603, 897 N.E.2d 722 (2008): “If plaintiff has offered no evidence that it owned the note and mortgage when the complaint was filed, it would not be entitled to judgment as a matter of law.”

- Indymac Bank v. Boyd, 880 N.Y.S.2d 224 (2009): “To establish a prima facie case in an action to foreclose a mortgage, the plaintiff must establish the existence of the mortgage and the mortgage note. It is the law’s policy to allow only an aggrieved person to bring a lawsuit . . . A want of ‘standing to sue,’ in other words, is just another way of saying that this particular plaintiff is not involved in a genuine controversy, and a simple syllogism takes us from there to a ‘jurisdictional’ dismissal.”

- Indymac Bank v. Bethley, 880 N.Y.S.2d 873 (2009): “The Court is concerned that there may be fraud on the part of plaintiff or at least malfeasance. Plaintiff INDYMAC (Deutsche) must have ‘standing’ to bring this action.”

Fraud and Misrepresentation in Mortgage Cases

Several cases illustrate fraudulent practices by lenders, including violations of the Federal Truth in Lending Act and withholding vital loan information. Courts have dismissed cases with prejudice where fraud on the court was evident.

- Wells Fargo, Litton Loan v. Farmer, 867 N.Y.S.2d 21 (2008): “Wells Fargo does not own the mortgage loan… Therefore, the matter is dismissed with prejudice.”

- Wells Fargo v. Reyes, 867 N.Y.S.2d 21 (2008): “Dismissed with prejudice, Fraud on Court & Sanctions. Wells Fargo never owned the Mortgage.”

- Deutsche Bank v. Peabody, 866 N.Y.S.2d 91 (2008): “EquiFirst, when making the loan, violated Regulation Z of the Federal Truth in Lending Act 15 USC §1601 and the Fair Debt Collections Practices Act 15 USC §1692; ‘intentionally created fraud in the factum’ and withheld from plaintiff ‘vital information concerning said debt and all of the matrix involved in making the loan.'”

Corporate and Banking Overreach

Decisions highlight that banks cannot lend their credit or guarantee debts, as these actions are ultra vires and not legally binding. These rulings reinforce the limitations on corporate and banking activities.

- Zinc Carbonate Co. v. First National Bank, 103 Wis. 125, 79 NW 229 (1899): “The doctrine of ultra vires is a most powerful weapon to private corporations within their legitimate spheres and punish them for violations of their corporate charters, and it probably is not invoked too often.”

- Howard & Foster Co. vs. Citizens National Bank, 133 S.C. 202, 130 S.E. 758 (1926): “It has been settled beyond controversy that a national bank, under Federal law, being limited in its power and capacity, cannot lend its credit by nor guarantee the debt of another. All such contracts being entered into by its officers are ultra vires and not binding upon the corporation.”

- American Express Co. v. Citizens State Bank, 181 Wis. 172, 194 NW 427 (1923): “Neither, as included in its powers not incidental to them, is it a part of a bank’s business to lend its credit.”

Procedural Requirements and Evidentiary Standards

The requirement for real party-in-interest prosecution is emphasized, along with rulings that affidavits alone can establish a prima facie case. Courts have ruled that silence in the face of a legal duty to respond can constitute fraud.

- Federal Rule of Civil Procedure 17(a)(1): “[A]n action must be prosecuted in the name of the real party in interest.”

- In re Jacobson, 402 B.R. 359, 365-66 (Bankr. W.D. Wash. 2009): Emphasizes that actions must be filed by the real party in interest.

- United States v. Kis, 658 F.2d 526 (7th Cir. 1981): “Indeed, no more than (affidavits) is necessary to make the prima facie case.” Cert. denied, S. Ct. (1982).

- U.S. v. Tweel, 550 F.2d 297 (1977): “Silence can only be equated with fraud where there is a legal or moral duty to speak or when an inquiry left unanswered would be intentionally misleading.”

Contract and Consideration Principles

If any part of a contract’s consideration is illegal, the entire promise becomes void. Courts have also recognized the right to rescind contracts induced by false representations, even if made innocently.

- Menominee River Co. v. Augustus Spies L & C Co., 147 Wis. 559 at p. 572; 132 NW 1118 (1912): “If any part of the consideration for a promise be illegal, or if there are several considerations for an un-severable promise one of which is illegal, the promise, whether written or oral, is wholly void, as it is impossible to say what part or which one of the considerations induced the promise.”