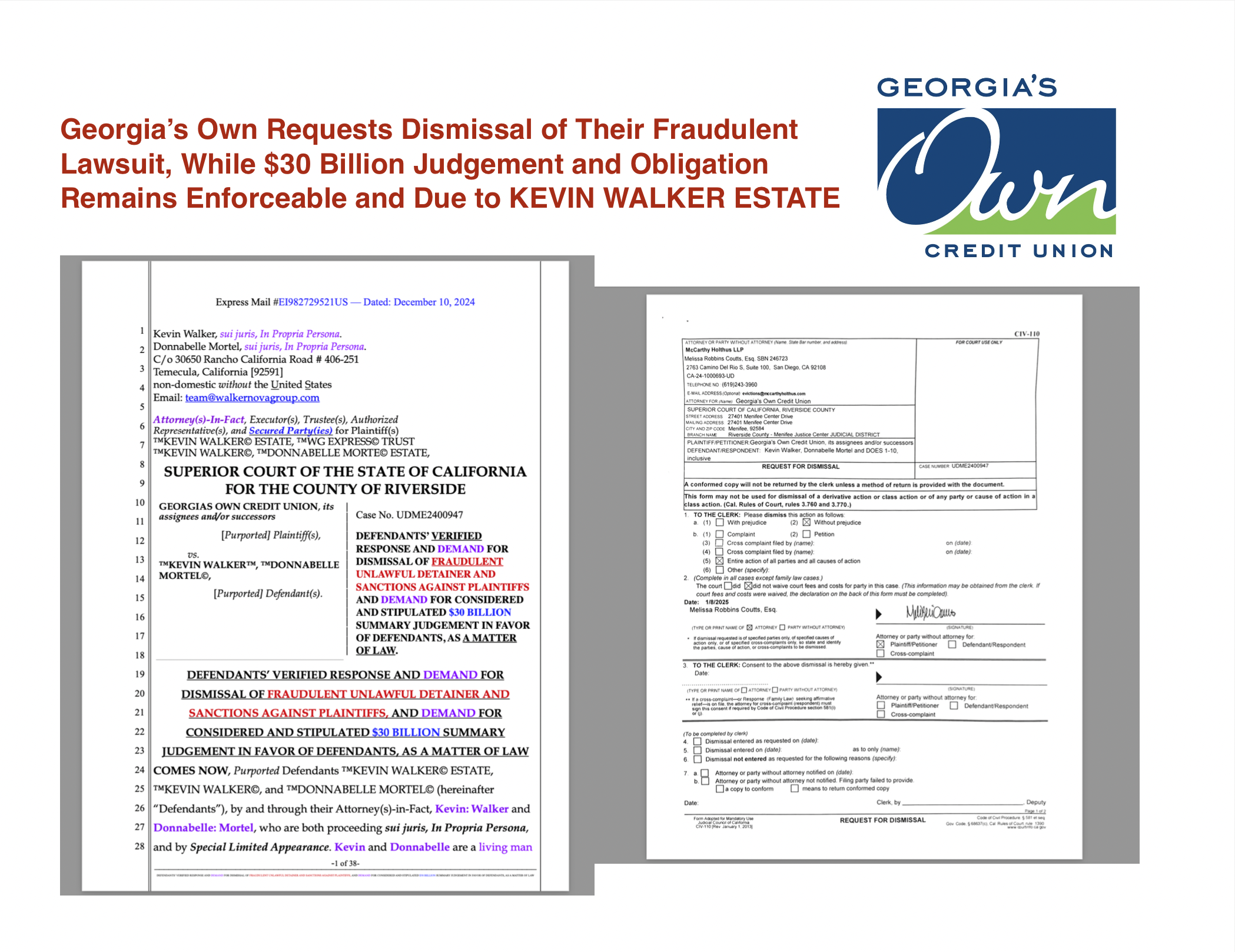

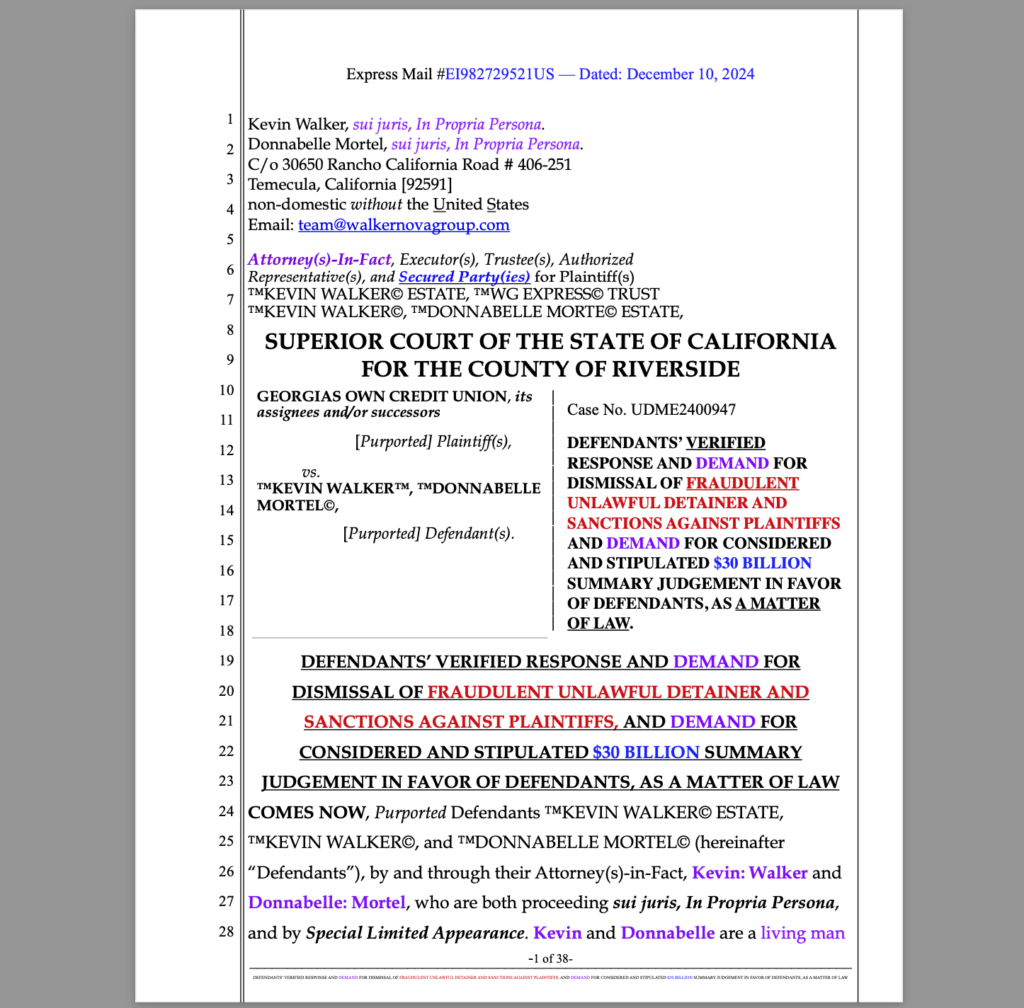

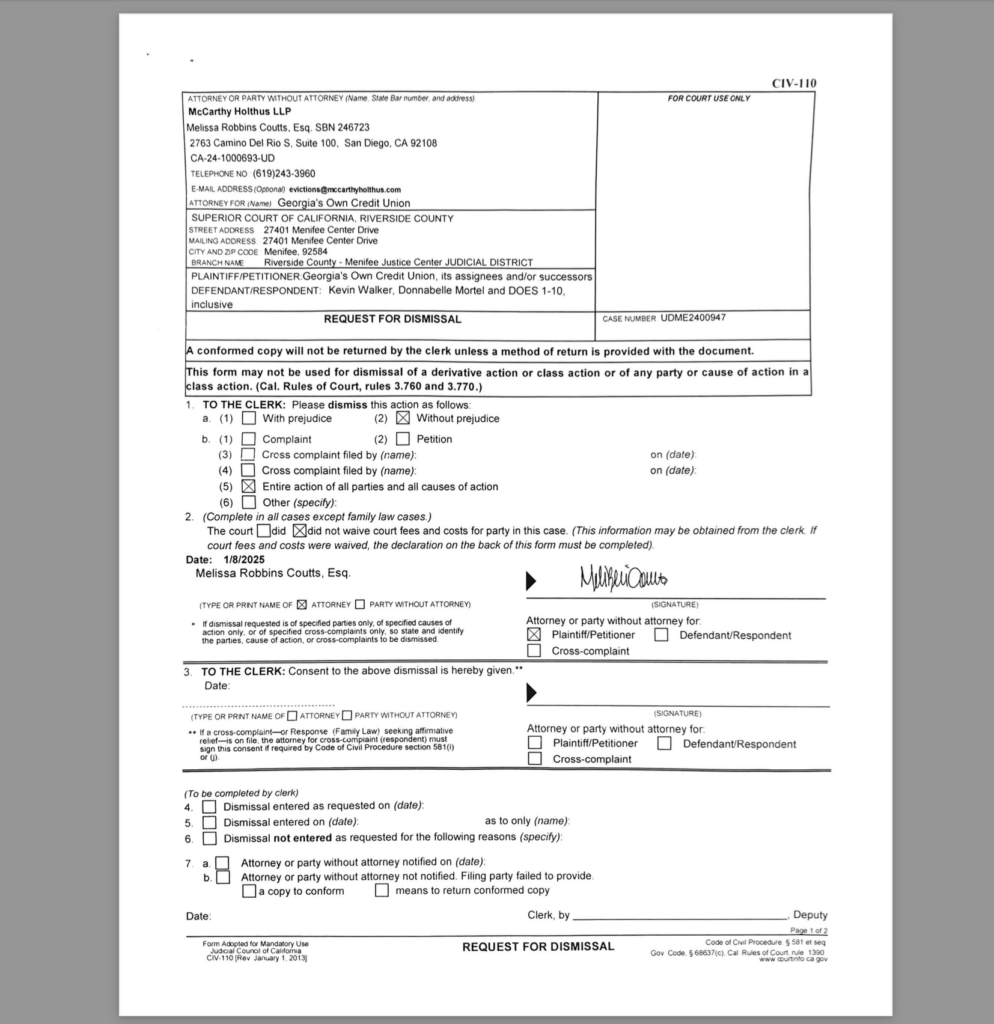

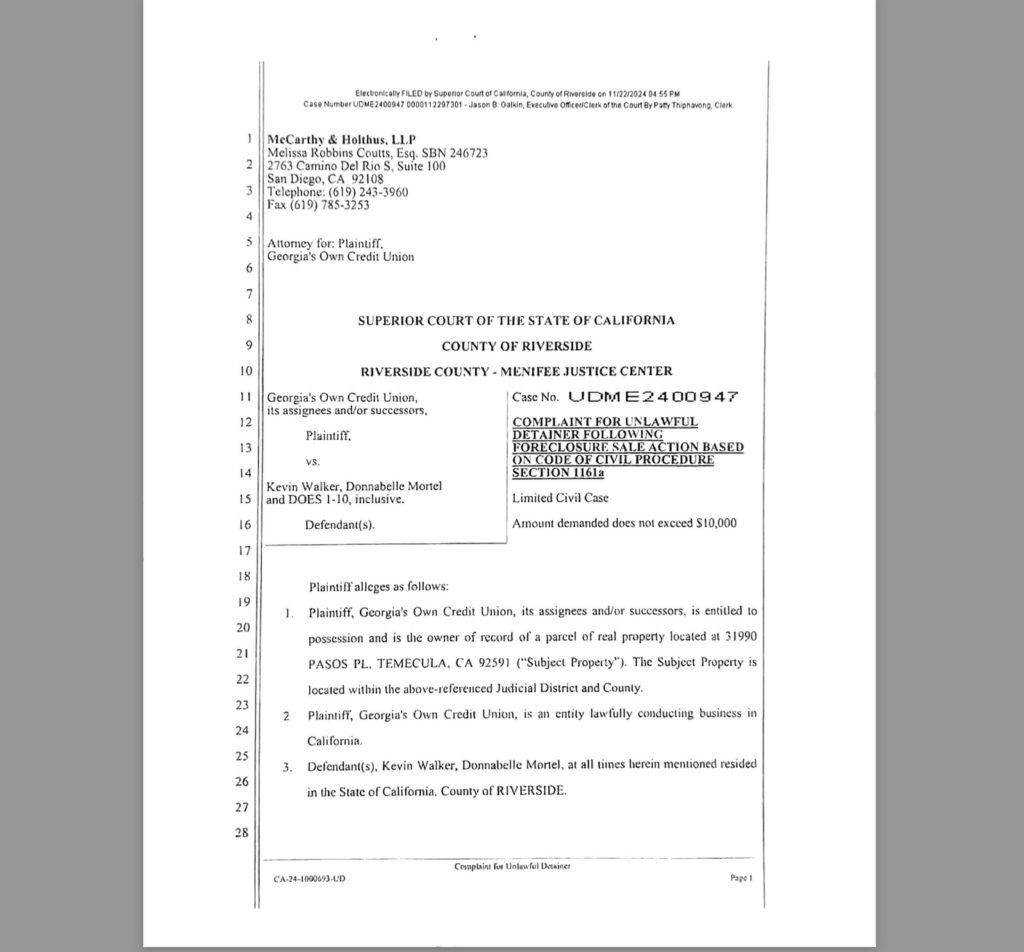

The lawsuit filed by Georgia’s Own Credit Union, Case No. UDME2400947, has reached a groundbreaking resolution. Following the receipt of the KEVIN WALKER ESTATE’s (purported “Defendants’) VERIFIED Response and Demand for Dismissal of Fraudulent Unlawful Detainer AND SANCTIONS AGAINST PLAINTIFFS and Demand FOR CONSIDERED AND STIPULATED $30 BILLION Summary JudgEment in Favor of Defendants, as a matter of law,” Georgia’s Own Credit Union has now formally requested the dismissal of their own lawsuit.

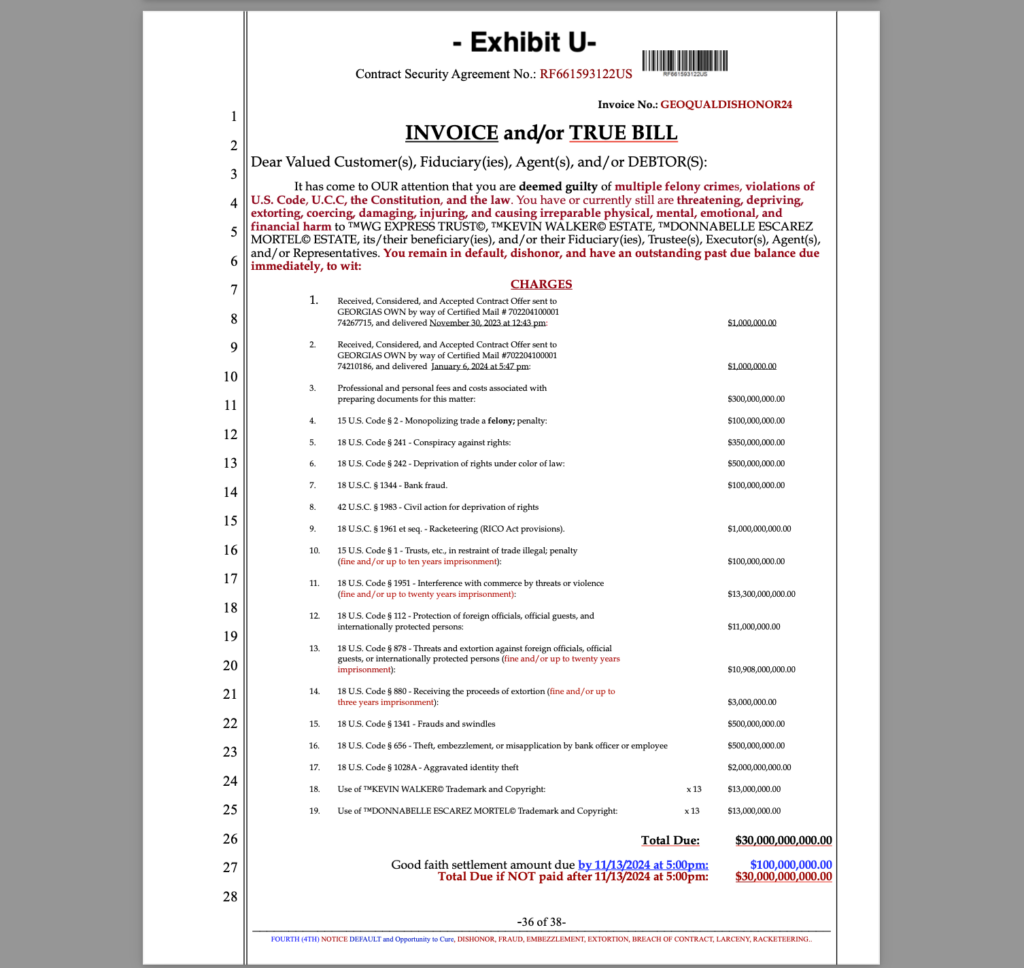

This response from the KEVIN WALKER ESTATE and WALKERNOVA GROUP exposed fraudulent actions, procedural dishonor, and violations of commercial law, resulting in the stipulated amount of $30,000,000,000.00 now being due “as a matter of law.”

DOWNLOAD 95 PAGE DOCUMENT

$30 Billion: Due as a Matter of Law

The KEVIN WALKER ESTATE’s demand for $30 billion stems from verified and unrebutted evidence of fraud, breach of contract, and the Plaintiffs’ blatant violations of the Uniform Commercial Code (UCC). Under the framework of UCC §§ 1-103, 2-204, and 2-206, the Defendants have shown that:

- The Plaintiffs acted in bad faith and engaged in procedural dishonor.

- The Plaintiffs failed to lawfully establish any standing or claim to the property.

- The Defendants fulfilled their obligations under the law by accepting and discharging all alleged debts using the principle of “Accepted for Value.”

This legally binding response has rendered all claims by the Plaintiffs invalid, and the $30 billion judgment is now enforceable as a matter of law.

Fraud and Lack of Standing: Verified Facts

The Plaintiffs, including Georgia’s Own Credit Union, have been exposed for their lack of standing and fraudulent claims on the property. Verified affidavits and unrebutted evidence confirm that the Plaintiffs attempted to unlawfully seize property already lawfully secured by allodial title in the names of Kevin Walker and Donnabelle Mortel, recorded in Riverside County.

Additionally, the Defendants’ UCC filings and the lawful use of “Accepted for Value” demonstrate the discharge of all alleged debts. These filings, which the Plaintiffs failed to rebut, now stand as binding evidence of their bad faith conduct.

UCC §§ 1-103, 2-204, and 2-206: Legal Principles Supporting the Judgment

The KEVIN WALKER ESTATE invoked key provisions of the Uniform Commercial Code (UCC) to demonstrate the illegality of the Plaintiffs’ actions:

- UCC § 1-103: Upholds the use of equitable principles and legal maxims in commercial law, ensuring fairness and justice in all transactions. The Defendants’ reliance on these principles affirmed their rights against the Plaintiffs’ dishonorable conduct.

- UCC § 2-204: Confirms that a valid contract can be formed even if terms are not fully detailed, provided mutual agreement exists. The Plaintiffs’ failure to honor the terms of their own agreements and their refusal to acknowledge the debt discharge constitutes a breach of this principle.

- UCC § 2-206: Specifies that acceptance of an offer can be made in any reasonable manner. The Defendants’ lawful “Accepted for Value” response settled all alleged obligations, rendering any further claims by the Plaintiffs procedurally dishonorable.

These provisions firmly support the Defendants’ case and underscore the legal foundation for the $30 billion judgment, which is now enforceable as a matter of law.

Legal Maxims and Unrebutted Affidavits: Binding Evidence of Fraud

The Defendants presented multiple unrebutted affidavits, which stand as conclusive evidence under commercial law. The Plaintiffs’ failure to rebut these affidavits within the prescribed timeframe constitutes tacit admission of the facts presented.

Key legal maxims support the Defendants’ actions:

- “Equity regards as done that which ought to be done.” By accepting the debt instrument for value, the Defendants lawfully discharged the alleged obligation.

- “He who comes to equity must come with clean hands.” The Plaintiffs’ fraudulent actions and procedural dishonor disqualify them from equitable relief.

House Joint Resolution 192 of 1933: Debt Discharge Obligations

This case highlights ongoing violations of House Joint Resolution 192, which mandated the discharge of debts after the U.S. abandoned the gold standard. By accepting the Deed of Trust for value, Walker and Mortel lawfully nullified all claims against them, as required by law.

Under HJR 192, the government is obligated to discharge all debts, public and private. The Plaintiffs’ refusal to honor this principle further demonstrates their bad faith conduct.

Defendants as True Creditors: Violations of UCC and GAAP

The KEVIN WALKER ESTATE stands as the true creditor in this matter. The Plaintiffs monetized the promissory note issued by Walker and Mortel but failed to account for the discharge of debt.

- UCC §§ 9-102 and 9-509: Confirm the Defendants’ position as secured parties with exclusive rights to the collateral.

- Violation of GAAP: The Plaintiffs failed to properly account for the transaction, concealing material facts and acting in bad faith.

$30 Billion Judgment: Accountability and Enforcement

The $30,000,000,000.00 judgment now stands as a legally enforceable obligation. The Plaintiffs’ fraudulent actions, procedural misconduct, and violations of commercial law have resulted in this monumental judgment, which holds them accountable for their egregious violations.

A Landmark Victory for Justice

Case No. UDME2400947 is a powerful example of justice prevailing against fraudulent and unlawful actions. The KEVIN WALKER ESTATE’s unwavering adherence to commercial law, contract principles, and legal maxims has resulted in a decisive victory, exposing the Plaintiffs’ bad faith conduct and securing the dismissal of their claims.

The $30 billion judgment due “as a matter of law” reflects the Defendants’ rightful claims and the enforcement of justice under the Uniform Commercial Code and established legal principles.

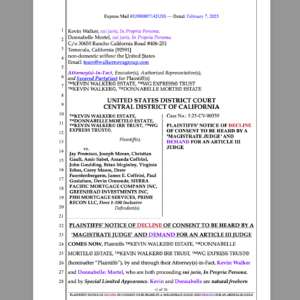

See: $30 Billion Lawsuit: Georgia’s Own Credit Union and Conspirators Caught in UCC Violations and Undeniable and Proven Fraud

See: ™KEVIN WALKER© Estate Files $30 Billion Lawsuit Against Georgia’s Own and McCarthy Holthus, Affirming Fraud, Racketeering, and Other Federal Crime