A “Sovereign Citizen” typically makes incorrect claims like stating they are an “American State National,” or “Sovereign Citizen,” or “State National,” instead of properly and correctly referring to themselves as a “national,” “non-citizen national,” “state Citizen,” “private citizen,” and/or “Sovereign.”

A “Sovereign Citizen” typically does not fully comprehend, House Joint Resolution 192 of June 5, 1933 public law 73-10.

A “Sovereign Citizen” typically does not fully comprehend, Gold Reserve Act of 1934, Public Law 73-87, Title III, Section 3.

A “Sovereign Citizen” typically does not fully comprehend, House Joint Resolution 348 Public Resolution, Number 63.

A “Sovereign Citizen” typically does not fully comprehend, Article 1, Section 10, of the U.S. Constitution.

A “Sovereign Citizen” typically does not fully comprehend, the “1940 Buck Act” and “Federal Areas.”

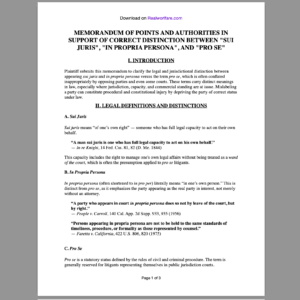

A “Sovereign Citizen” typically is dual-minded in their approach to public and private law and does not proceed sui juris, In Propria Persona, or by Special Limited Appearance.

A “Sovereign Citizen” typically could possibly be partially mentally incompetent and think they are their straw man/bank/person/individual/U.S. citizen.

A “Sovereign Citizen” typically claims to be a Sovereign, while still utilizing a “Social Security Number.”

A “Sovereign Citizen” typically claims to be a Sovereign, while receiving “benefits” and/or “privileges” from the United States.

A “Sovereign Citizen” typicallymakes incorrect statements and references to “Citizenship.”

A “Sovereign Citizen” typically is not capable of creating their own unsworn declarations “without the United States” in accordance with, 28 U.S. Code § 1746.

A “Sovereign Citizen” typically does not fully comprehend jurisdiction and how it can be obtained.

A “Sovereign Citizen” typically does not fully comprehend how to abate a matter.

A “Sovereign Citizen” typically does not reserve their rights in accordance with U.C.C. § 1-308 (formerly § 1-207).

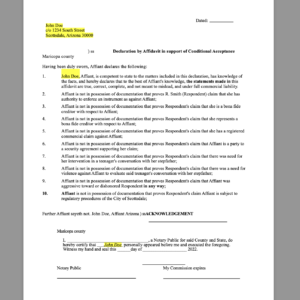

A “Sovereign Citizen” typically is not capable of creating and completing a conditional acceptance on their own.

A “Sovereign Citizen” typically is not capable of completing an administrative procedure.

A “Sovereign Citizen” typically is not capable of assessing their own taxes and requires and relies significant assistance of a “Attorney In Fact.”

A “Sovereign Citizen” typically does not fully comprehend “minimum contacts” and/or “Invisible contracts.”

A “Sovereign Citizen” typically does not fully comprehend “offer and acceptance.”

A “Sovereign Citizen” typically does not fully comprehend “mailbox rule” aka “posting rule.’

A “Sovereign Citizen” typically tries to mix public and private law and do not know how to properly assert and exercise their rights.

A “Sovereign Citizen” typically places “blank indorsements” on all of their negotiable instruments, currency, and monetary instruments.

A “Sovereign Citizen” typically does know the different between a “right to travel” and “privilege of driving.”

A “Sovereign Citizen” typically claims to be a Sovereign but does not fully comprehend the “Sovereign Statutes” known as the “United States Code.”

A “Sovereign Citizen” typically claims to be a Sovereign but does not fully comprehend the “Uniform Commercial Code”

A “Sovereign Citizen” typically claims to be a Sovereign but is not a “secured party” and/or ‘secured creditor.”

A “Sovereign Citizen” typically claims to be a Sovereign but does not have their own private U.C.C. contract trust established to handle and maintain their own private banking ledger.

A “Sovereign Citizen” typically does not fully comprehend contract law, trust law, tax law, common law, Constitutional law, commerce, and banking.

Recent Comments