Introduction

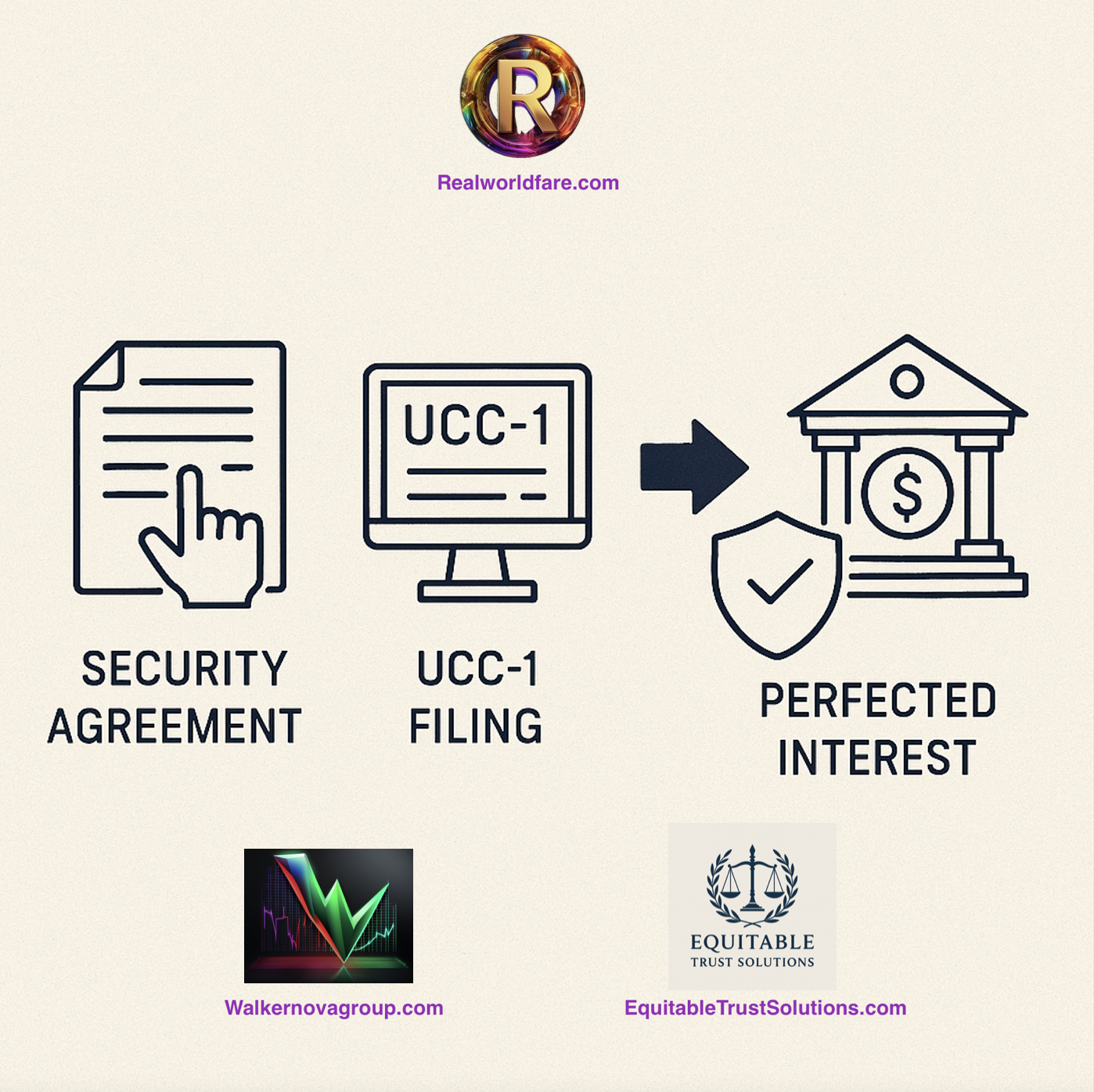

In today’s commercial system, where nearly all financial transactions operate under the Uniform Commercial Code (UCC), understanding how to lawfully reclaim control of your property is essential. One powerful strategy involves assigning all rights, title, and interest to a private trust by way of a security agreement, then filing a UCC-1 and UCC-3 to perfect your interest in a promissory note and deed of trust. Once this is properly executed and perfected, the alleged lender or servicer is stripped of any lawful authority to foreclose.

This article will walk through, step-by-step, exactly how and why this process works under UCC and property law.

1. The Security Agreement Creates a Superior Security Interest

Under UCC § 9-203, a security agreement becomes enforceable against the debtor when:

- Value is given,

- The debtor has rights in the collateral,

- A signed agreement describes the collateral.

By executing a security agreement where:

- You, as the living man or woman (the debtor), assign all present and future assets, rights, titles, and instruments to a private trust, and

- The agreement specifically includes the deed of trust and promissory note as collateral,

You create a lawful and enforceable interest in those instruments. This interest precedes and supersedes any unperfected or unauthorized third-party claim, including claims by lenders, servicers, or their agents.

2. UCC-1 Financing Statement Perfects the Trust’s Interest

Under UCC §§ 9-509 and 9-310, filing a UCC-1 financing statement:

- Publicly perfects your trust’s interest in the named collateral,

- Establishes a legal claim superior to any subsequent or unrecorded interests,

- Places the world on notice that your trust holds secured rights in the note, deed, and all associated property.

A properly filed UCC-1 listing the trust as the secured party and identifying the deed of trust and note as collateral transforms a private contractual interest into a publicly perfected security interest, enforceable against all comers.

3. UCC-3 Amendment Secures Specific Instruments

A UCC-3 amendment serves to:

- Amend, continue, or assign a UCC-1 filing,

- Specifically name the deed of trust and promissory note,

- Declare the instruments part of the trust estate or corpus,

- Attach affidavits of assignment, discharge, or unrebutted claims.

Once filed, the UCC-3 further solidifies your perfected claim and blocks servicers or lenders from asserting standing without first rebutting your record.

4. Foreclosure Requires Lawful Standing

Any party seeking to foreclose must prove:

- That it is the holder or assignee of the original promissory note (UCC § 3-301),

- That it has an unbroken chain of title,

- That the note has not been discharged, sold, or otherwise divested,

- That it holds enforceable rights under the mortgage contract.

If your UCC filings:

- Show that the trust lawfully holds the note,

- Include unrebutted affidavits of tender or discharge,

- Have not been lawfully challenged or rebutted,

Then any foreclosure attempt by a third party becomes invalid. Their standing is void.

📌 As long as they cannot produce the original note and rebut your perfected interest, they are in dishonor and operating in fraud.

5. The Deed of Trust Follows the Note

Per the long-standing Supreme Court precedent of Carpenter v. Longan, 83 U.S. 271 (1872):

“The mortgage is a mere incident to the debt. The mortgage cannot be enforced if the note has been discharged or assigned.”

This means:

- If the note is discharged, the deed of trust must collapse.

- If the trust now holds the note, then the deed follows the trust.

- No third party can enforce the mortgage instrument independently.

Servicers and lenders are therefore left with no enforceable claim, and their attempts to foreclose are trespass, fraud, and commercial dishonor.

Conclusion: Private Trust = Secured Party = Real Party in Interest

When a private trust lawfully receives all rights, title, and interest in the deed of trust and note through a signed security agreement, and perfects that interest through UCC-1 and UCC-3 filings, the trust becomes the real party in interest.

No servicer, lender, or third party can claim lawful standing to foreclose unless they:

- Rebut the UCC filings,

- Prove a superior and lawfully perfected claim,

- Or possess a valid and enforceable note endorsed directly to them.

Without this, all foreclosure activity becomes void ab initio, and the trust holds exclusive lawful control over the property.

“He who holds the note, controls the deed. He who perfects the interest, controls the enforcement.”

Verified Case Law Confirming Foreclosure Limits and Trust Rights

1. Carpenter v. Longan, 83 U.S. 271 (1872)

“The note and mortgage are inseparable; the former as essential, the latter as an incident. An assignment of the note carries the mortgage with it, while an assignment of the mortgage alone is a nullity.”

🔹 Relevance: If the note is discharged, assigned, or transferred to the trust, the deed of trust collapses with it. The lender or servicer cannot enforce a security interest they no longer lawfully hold.

U.S. Bank Nat’l Ass’n v. Ibanez, 941 N.E.2d 40 (Mass. 2011)

“The party seeking to foreclose must demonstrate that it was the holder of the mortgage note at the time the foreclosure was initiated.”

🔹 Relevance: Foreclosing parties must prove lawful possession of the original note. A trust with a perfected UCC claim and unrebutted assignment defeats a foreclosing party lacking standing.

In re Veal, 450 B.R. 897 (9th Cir. BAP 2011)

“A party cannot enforce a note, nor foreclose on the property securing the note, unless it has possession of the note and is entitled to enforce it under Article 3 of the UCC.”

🔹 Relevance: Your trust must be the party entitled to enforce; once the trust holds the note (even by way of discharge or assignment), others are barred from enforcement absent rebuttal.

Jesinoski v. Countrywide Home Loans, 574 U.S. 259 (2015)

The Supreme Court reaffirmed that contractual rights, including rescission and discharge, take precedence when properly noticed.

🔹 Relevance: If the note was discharged, accepted for value, or otherwise voided per administrative notice and unrebutted affidavits, the servicer’s rights are extinguished.

Culhane v. Aurora Loan Services, 708 F.3d 282 (1st Cir. 2013)

“A mortgagee must demonstrate both possession of the mortgage and the underlying note to lawfully foreclose.”

🔹 Relevance: Perfected trust interest in both instruments divests third parties of legal foreclosure authority.

Wells Fargo Bank v. Erobobo, 127 A.D.3d 1176 (N.Y. App. Div. 2015)

An assignment made without proper legal authority is “a nullity” and “renders any resulting foreclosure action void.”

🔹 Relevance: Servicers and trustees without clear assignment and enforcement rights are invalid actors. A perfected trust claim blocks enforcement.

Need Help Securing and Perfecting Your Trust’s Rights?

If you’re ready to take full control of your property and enforce your secured interests, the Realworldfare team is here to support you. Whether you’re initiating your first UCC filing or defending against unlawful foreclosure attempts, we provide the strategic tools, templates, and enforcement pathways you need.

For advanced trust structuring, commercial enforcement, or private administrative remedy, contact one of our trusted partners:

-

WalkernovaGroup.com – Private asset protection, strategic discharge, and lawful commercial processes.

-

EquitableTrustSolutions.com – Specializing in trust design, UCC filings, foreclosure prevention, and secured party creditor status.

🔒 Take control. Perfect your claim. Defend your estate.

Contact us today to begin.