Under U.S. law, crimes that affect financial institutions or commercial entities are often categorized as commercial offenses. These offenses, including certain regulatory violations, are primarily designed to protect the integrity of financial systems and commercial transactions, and everything in the public is commercial.

One such provision, 27 CFR § 72.11, highlights the broad scope of crimes treated as commercial offenses, whether they occur under federal or state jurisdiction. Commercial crimes include offenses such as counterfeiting, forgery, fraud, and other illegal activities that disrupt economic systems and affect public revenue.

“Corpus Delicti” and the Commercial Nature of Victimless Crimes

The term “corpus delicti” refers to the “body of the crime” and generally requires evidence of a criminal act and harm or injury caused by that act. However, in cases of victimless crimes, the typical requirement for direct harm may not be present. These types of offenses, such as regulatory violations or non-violent crimes, may still be prosecuted as commercial crimes due to their impact on financial transactions or public revenue systems. 27 CFR § 72.11 outlines various crimes that affect commercial transactions, including offenses against revenue laws and financial crimes. Importantly, even without a clear victim, the financial nature of these crimes underlines their treatment as commercial offenses under federal law.

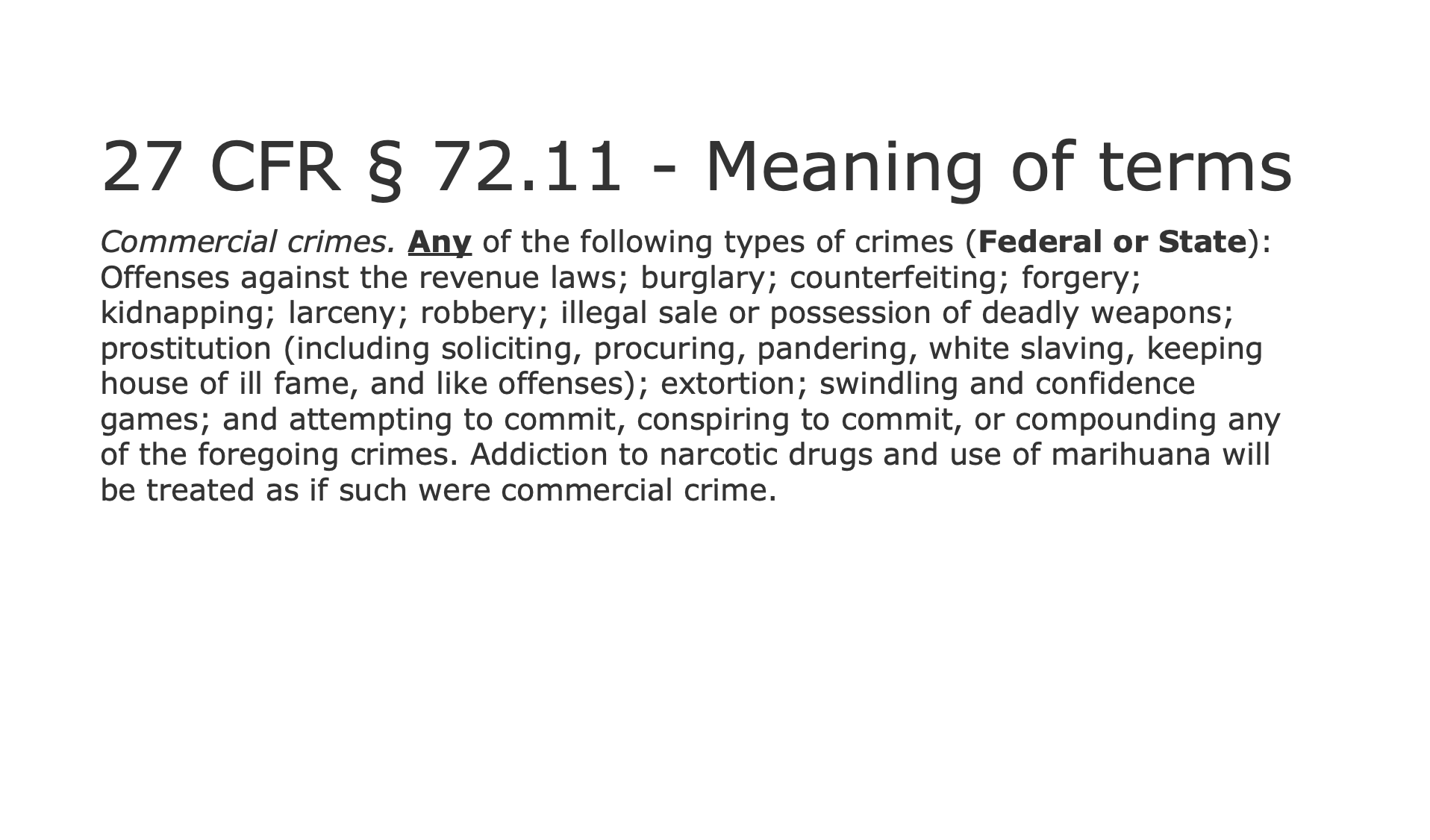

Commercial Crimes Defined in 27 CFR § 72.11

27 CFR § 72.11 provides a comprehensive list of crimes that are classified as commercial offenses.

“Commercial crimes: Any of the following types of crimes (Federal or State): Offenses against the revenue laws; burglary; counterfeiting; forgery; kidnapping; larceny; robbery; illegal sale or possession of deadly weapons; prostitution (including soliciting, procuring, pandering, white slaving, keeping house of ill fame, and like offenses); extortion; swindling and confidence games; and attempting to commit, conspiring to commit, or compounding any of the foregoing crimes. Addiction to narcotic drugs and use of marijuana will be treated as if such were commercial crime.”

Commerce Clause and the Commercial Nature of Crimes

The Commerce Clause of the U.S. Constitution, Article 1, Section 8, Clause 3, grants Congress the power to regulate commerce among the States. This provision has been interpreted broadly to include the regulation of various commercial activities, including the regulation of crimes that have an impact on interstate or international commerce. Under the Commerce Clause, Congress has the authority to pass laws that impact “commercial” transactions and “financial institutions,” even in cases where a crime does not have a direct victim, i.e., “corpus delicti.”

The Commerce Clause is essential in the context of commercial crimes, as it provides the Constitutional basis for federal jurisdiction over crimes that affect commerce, which is just about all crimes. For example, the sale of counterfeit goods, fraud involving interstate financial transactions and/or interstate commerce, and drug trafficking are all crimes that Congress can regulate based on their impact on commerce between states or nations, aka interstate commerce.

Commerce Clause and the Supremacy Clause

The Commerce Clause (Article I, Section 8, Clause 3 of the U.S. Constitution) grants Congress the authority to regulate commerce between states. This is essential for regulating activities like fraud or money laundering, as these offenses often involve interstate or international financial transactions. The Supremacy Clause further strengthens this regulation, ensuring that when there is a conflict between federal and State law, federal law prevails, particularly in the regulation of interstate commerce.

Defining Financial Institutions and the Role of “Persons” in Commercial Law

The term financial institution is defined broadly under 31 U.S. Code § 5312, encompassing a wide range of entities such as banks, credit unions, real estate brokers, insurance companies, and businesses involved in currency exchange. These institutions play a central role in the commercial system, which is why crimes involving them are treated as commercial offenses.

Financial Institution: A “financial institution” includes a variety of entities such as commercial banks, trust company, a loan or finance company, brokers, persons involved in real estate closings and settlements, the United States Postal Service, insurance companies, private bankers, mortgage companies, and businesses involved in currency exchange or money transmission (as outlined in 31 U.S. Code § 5312). This term also covers entities that handle the transfer of funds both domestically and internationally, including those outside conventional banking systems, such as informal money transfer networks.

Further, the term “financial Institution” covers any business or agency which engages in any activity which the Secretary of the Treasury determines, by regulation, to be an activity which is similar to, related to, or a substitute for any activity in which any business described in the paragraph is authorized to engage; or any other business designated by the Secretary whose cash transactions have a high degree of usefulness in criminal, tax, or regulatory matters.

Individual: In the context of commercial law, individual refers to a single person, often contrasted with artificial persons (corporations, for example). Black’s Law Dictionary (4th, 7th, and 8th Editions) states that “individual” can also include artificial persons depending on the legal context.

Person: The term “person” encompasses not only natural individuals (men and women) but also legal entities such as corporations, partnerships, trusts, estates, and government bodies. According to UCC § 1-201 and Black’s Law Dictionary (1st, 2nd, 4th Editions), “person” encompasses both natural persons and ‘legal persons”/ens legis created by law for the purposes of society, commerce, and government. The intended use of the terms when being used are imperative to comprehend

Bank as “Individual,” “Person,” and “Trust” in Commercial Law

Banks are classified as individuals and persons under both federal and State laws. Banks engage in various activities that are central to the functioning of the economy, such as accepting deposits, making loans, and issuing promissory notes. The classification of banks as trusts underlines their role in holding assets or fiduciary duties in managing commercial transactions, as seen in UCC § 1-201 and U.S. Code § 5312.

Conclusion

The term commercial crimes under 27 CFR § 72.11 includes offenses that affect the financial systems and commercial transactions, such as counterfeiting, fraud, and regulatory violations. The Commerce Clause empowers Congress to regulate interstate commerce, making it essential for federal jurisdiction over these crimes. By recognizing crimes as part of the commercial landscape, whether or not they involve a direct victim, the law ensures that financial institutions and commercial entities are protected from activities that disrupt commerce or economic stability. This framework governs a wide range of entities, including financial institutions, banks, and corporations, which are treated as persons in the legal and commercial context.