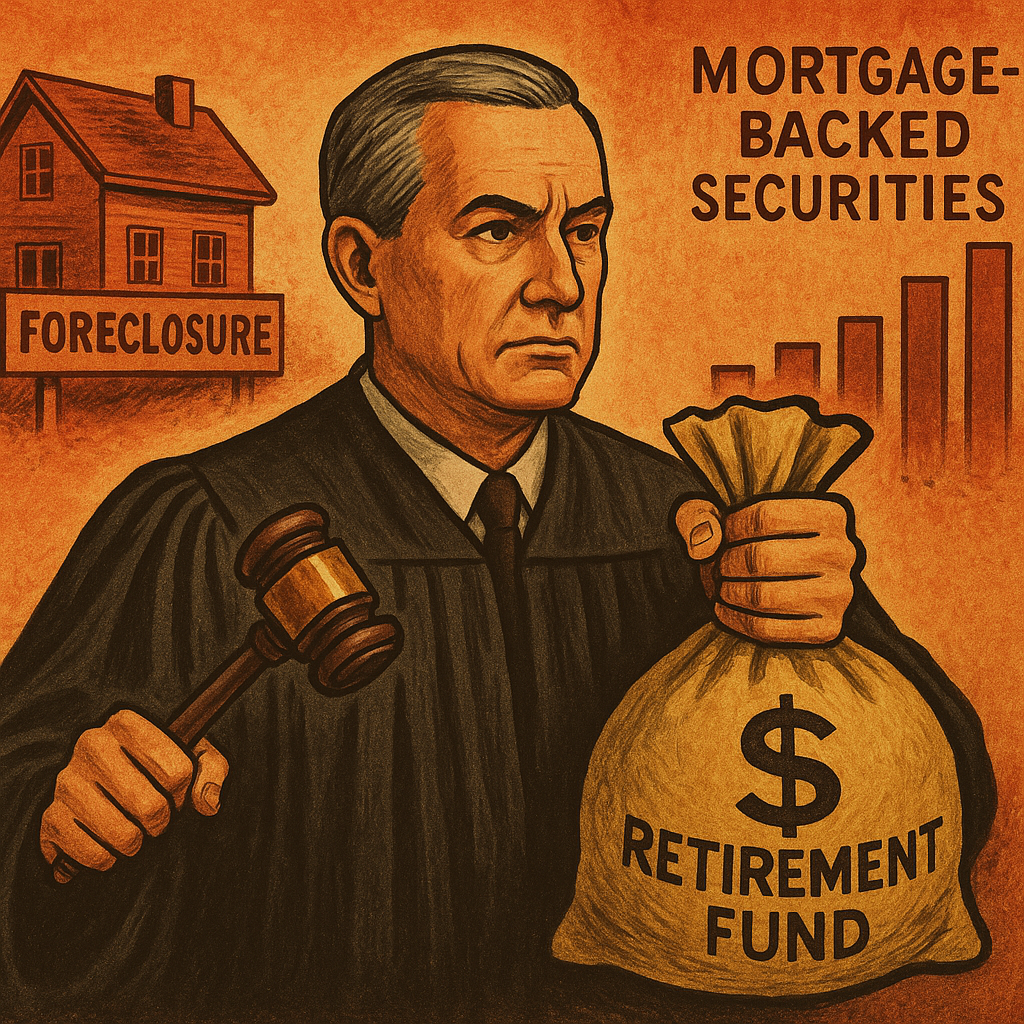

“Justice” For Sale: The Hidden Financial Pipeline Between the Bench and Wall Street

While millions of Americans are dragged through foreclosure, eviction, and asset seizure proceedings, few realize a horrifying truth: the very judges presiding over their cases are financially incentivized to rule against them. This isn’t metaphorical—it’s literal. State and federal judges, by way of their public pension plans, are direct beneficiaries of mortgage-backed securities (MBS), foreclosure recoveries, and asset liquidation.

This article unmasks the rigged system—where impartial justice is a fantasy, and property rights are systematically looted under the guise of lawful process.

📉 MORTGAGE-BACKED SECURITIES: THE FINANCIAL FUEL OF THE COURTS

Mortgage-backed securities are the financial instruments that fueled the 2008 crash—and they’re still alive, weaponized, and quietly underwriting the modern American judicial pension system.

Here’s how the racket works:

-

Lenders originate mortgages, often with predatory or deceptive terms.

-

These mortgages are bundled into securities, sliced into “tranches,” and sold to institutional investors.

-

State and federal judicial pension funds—like CalPERS, FERS, and others—buy these securities for their high yields.

-

When a borrower defaults, the foreclosure process is initiated, triggering the seizure of the property and sale at auction.

-

The pension fund (and its asset managers) profit from the default via liquidation, fees, and principal recovery.

-

The judge, whose pension depends on those funds, is then called to rule on the legality of the foreclosure—essentially ruling on the continued solvency of their own retirement.

That is a textbook conflict of interest.

🔥 JUDICIAL RETIREMENT SYSTEMS: WHO’S INVESTED IN WHAT?

Every judge in America—state or federal—is part of a retirement system that is a major institutional investor. Most retirement portfolios include:

-

Fannie Mae / Freddie Mac MBS Pools

-

Private-label mortgage securities (e.g., Goldman Sachs, JPMorgan, BlackRock)

-

REITs (Real Estate Investment Trusts)

-

Foreclosure-based bond instruments and servicing rights

📊 Real Examples:

-

CalPERS (California): Over $2 billion in MBS and mortgage-related holdings as disclosed in its CAFR.

-

Florida Retirement System (FRS): Invests in BlackRock and Vanguard funds packed with mortgage-backed paper.

-

FERS (Federal Employees Retirement System): Holds structured pools of MBS—mortgages from the very cases before Article III judges.

All of this is discoverable via:

-

CAFRs (Comprehensive Annual Financial Reports)

-

SEC Form 13F filings

-

Pension fund investment reports and public disclosures

⚖️ CONFLICT OF INTEREST: DEFINED AND VIOLATED

A conflict of interest occurs when a judge’s personal financial well-being is materially impacted by the outcome of a case. In the context of foreclosure and mortgage litigation, this isn’t speculative—it’s proven.

Tumey v. Ohio, 273 U.S. 510 (1927): A judge must recuse when they have a “direct, personal, substantial pecuniary interest” in a proceeding’s outcome.

Under Canon 2 and Canon 3 of the ABA Model Code of Judicial Conduct, judges must not only avoid actual impropriety, but even the appearance of bias.

Yet how many judges disclose that their own retirement accounts grow every time they rule against a homeowner and in favor of a foreclosure trust?

Virtually none.

This is not mere negligence. This is fraud.

🧨 THE HIDDEN PROFIT MODEL OF FORECLOSURE

Let’s be crystal clear: foreclosure is not a loss for these investors—it’s a structured liquidation event.

-

Late fees, penalties, legal fees = revenue.

-

Auction sale = capital recovery.

-

Asset seizure = value boost to the trust.

In many cases, the note has already been paid multiple times through credit default swaps, TARP bailouts, or advance insurance payments from the servicer. Yet the “debt” is enforced anyway.

The judge signs off.

The sheriff enforces.

The pension fund profits.

This system doesn’t just rob homeowners—it feeds the very system tasked with upholding justice.

💣 THE CONSEQUENCES

1. Judicial Objectivity Is Dead

When judges financially benefit from enforcing the very contracts under dispute, there is no possibility of impartiality.

2. Quiet Title Actions Are Systemically Sabotaged

Even when a homeowner proves standing, defective assignment, robo-signing, or fraudulent foreclosure, judges are routinely hostile—because every successful quiet title action is a threat to the performance of the MBS portfolios backing their retirements.

3. Evictions and Unlawful Detainers are Fast-Tracked

Summary proceedings, like unlawful detainer or ejectment, are often rubber-stamped by judges without reviewing title or chain of custody. Why? Because time is money—and pension systems don’t profit from equitable resolution. They profit from quick dispossession and resale.

4. State Courts Are Hostile Forums for Homeowners

Most quiet title, wrongful foreclosure, or ejectment defenses are systematically denied in state court. The reason? State judges are embedded in the state retirement system, which is invested in the debt instruments tied to those very homes.

🛡 WHAT CAN BE DONE? — REMEDY AGAINST JUDICIAL FRAUD, CORRUPTION & SYSTEMIC COLLUSION

When a judge is financially invested in the outcome of your foreclosure or property case, you are not in a court of law — you are in a rigged asset-stripping machine. But you are not powerless. Here’s how to go on the offensive and turn the system on its head:

🔍 1. Demand Judicial Disclosure and Disqualification

File a Verified Motion to Disqualify under 28 U.S.C. § 144 (federal) or equivalent state disqualification statutes. Demand the judge disclose under penalty of perjury:

-

Participation in any pension fund holding mortgage-backed securities (MBS), REITs, or debt instruments.

-

Financial interests or third-party affiliations with servicing banks, foreclosure trusts, or asset management firms (BlackRock, Vanguard, etc.).

-

Any past or current MBS litigation holdings, bonuses, or equity interests arising from prior judicial positions or advisory roles.

If the judge refuses? That’s willful concealment, grounds for removal and civil suit.

⚖ 2. Assert Civil Rights Removal Under 28 U.S.C. § 1443(1)

When a state judge’s financial interest destroys your chance of a fair hearing, removal to federal court is not optional — it is your federal civil right.

Under § 1443(1):

-

You can remove your state foreclosure, eviction, or quiet title case to federal court if your civil rights are being denied under color of state law.

-

Judicial bias, denial of equitable remedies, and refusal to adjudicate valid claims due to systemic financial conflict is textbook civil rights obstruction.

🔥 3. Sue the Judge Individually Under 42 U.S.C. § 1983 and Bivens

“Judges are not immune when they act in clear absence of all jurisdiction or engage in administrative fraud.”

-

File a civil action under 42 U.S.C. § 1983 for deprivation of rights under color of law.

-

Use Bivens v. Six Unknown Named Agents, 403 U.S. 388 (1971) to sue federal actors directly for constitutional violations — including due process and equal protection infringements by judges.

-

Judicial immunity does not protect administrative fraud, willful concealment of financial interest, or extra-judicial acts involving collusion with pension funds or banks.

File in the U.S. District Court for the District of Columbia — the proper venue for federal actors engaged in constitutional violations and systemic abuse of office.

🧨 4. Sue the Federal Government in the U.S. Court of Federal Claims

Under 28 U.S.C. § 1491, the Court of Federal Claims has jurisdiction over:

-

Takings Clause violations (Fifth Amendment)

-

Breach of fiduciary duty by federal employees

-

Systemic fraud and unlawful forfeiture of property by federal actors tied to mortgage enforcement

When your home is taken via a process where the adjudicator profits from the taking, that is a constitutional taking under false color of law. Sue them.

🧾 5. File Formal Judicial Misconduct Complaints

Under 28 U.S.C. § 351, you can file a formal complaint for:

-

Financial conflicts of interest

-

Failure to disclose economic ties to the subject matter of a case

-

Participating in rulings from which the judge personally benefits

Each state also has a Judicial Conduct Commission or equivalent. Use it. Demand public hearings.

🧨 6. Invoke Equity and Demand Immediate Injunctions

-

File in federal equity jurisdiction (especially when trust assets, constitutional rights, or unlawful dispossession is involved).

-

Seek temporary restraining orders, preliminary injunctions, and declaratory relief on the basis of constructive fraud, structural bias, and unrebutted affidavits of material fact.

📢 7. Blow the Whistle — Publicly

-

Use CAFRs, Form 13F, pension fund disclosures, and court rulings to expose the exact financial instruments the judge is profiting from.

-

Publish. Send to media. File bar complaints. Post on judicial review databases. Name names.

-

Truth is the most powerful disinfectant. Shine the spotlight on the roaches.

🧨 8. File Verified Affidavits and Force Default Judgments

Use unrebutted affidavits of material fact to:

-

Establish judicial dishonor, default, and violation of oath of office

-

Perfect claims under UCC 1-308, UCC 3-603, and applicable contract/equity principles

-

Trigger self-executing relief under Rule 55 when the court and opposing parties fail to rebut sworn facts

🧠 9. Demand That State Courts Abide by Federal Equity and Title Jurisprudence

If they won’t — REMOVE, SUE, or SANCTION.

You are not required to sit idle while your home is taken by a judge invested in your loss

🧠 CONCLUSION: The Judiciary Is Not Neutral

When a judge sits on the bench with one hand on the gavel and the other in a Wall Street portfolio tied to the homes of the people before them, we no longer have a justice system—we have a liquidation machine.

This is not conspiracy—it’s capital markets meeting courtroom corruption.

If you or someone you know is fighting a foreclosure, eviction, or quiet title battle, understand this: You are not just up against a bank. You are up against a system where the judge profits from your loss.