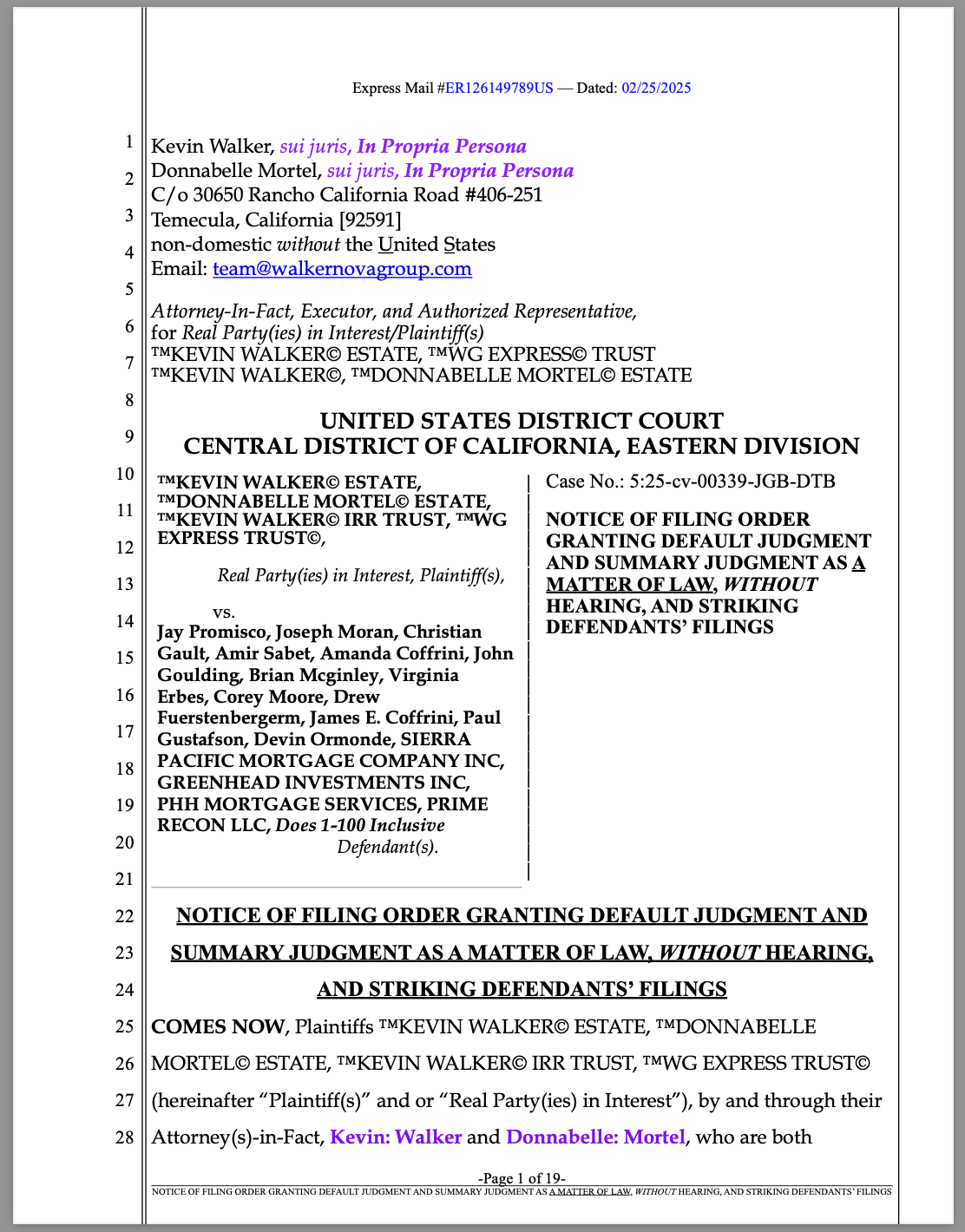

In a significant legal development, the Kevin Walker Estate, et al., has escalated its legal battle against PHH Mortgage Services, Sierra Pacific Mortgage Company, Greenhead Investments, and other defendants by filing:

- ORDER GRANTING DEFAULT JUDGMENT AND SUMMARY JUDGMENT AS A MATTER OF LAW, WITHOUT HEARING, AND STRIKING DEFENDANTS’ FILINGS.

- NOTICE OF FILING ORDER GRANTING DEFAULT JUDGMENT AND SUMMARY JUDGMENT AS A MATTER OF LAW, WITHOUT HEARING, AND STRIKING DEFENDANTS’ FILINGS.

- PLAINTIFFS’ VERIFIED WRIT OF MANDAMUS TO COMPEL DEFAULT AND SUMMARY JUDGMENT AS A MATTER OF LAW, WITHOUT HEARING, AND ENFORCEMENT OF BINDING DEFAULT.

PHH’s Defective Motion to Dismiss: Non-Compliant and Subject to Striking

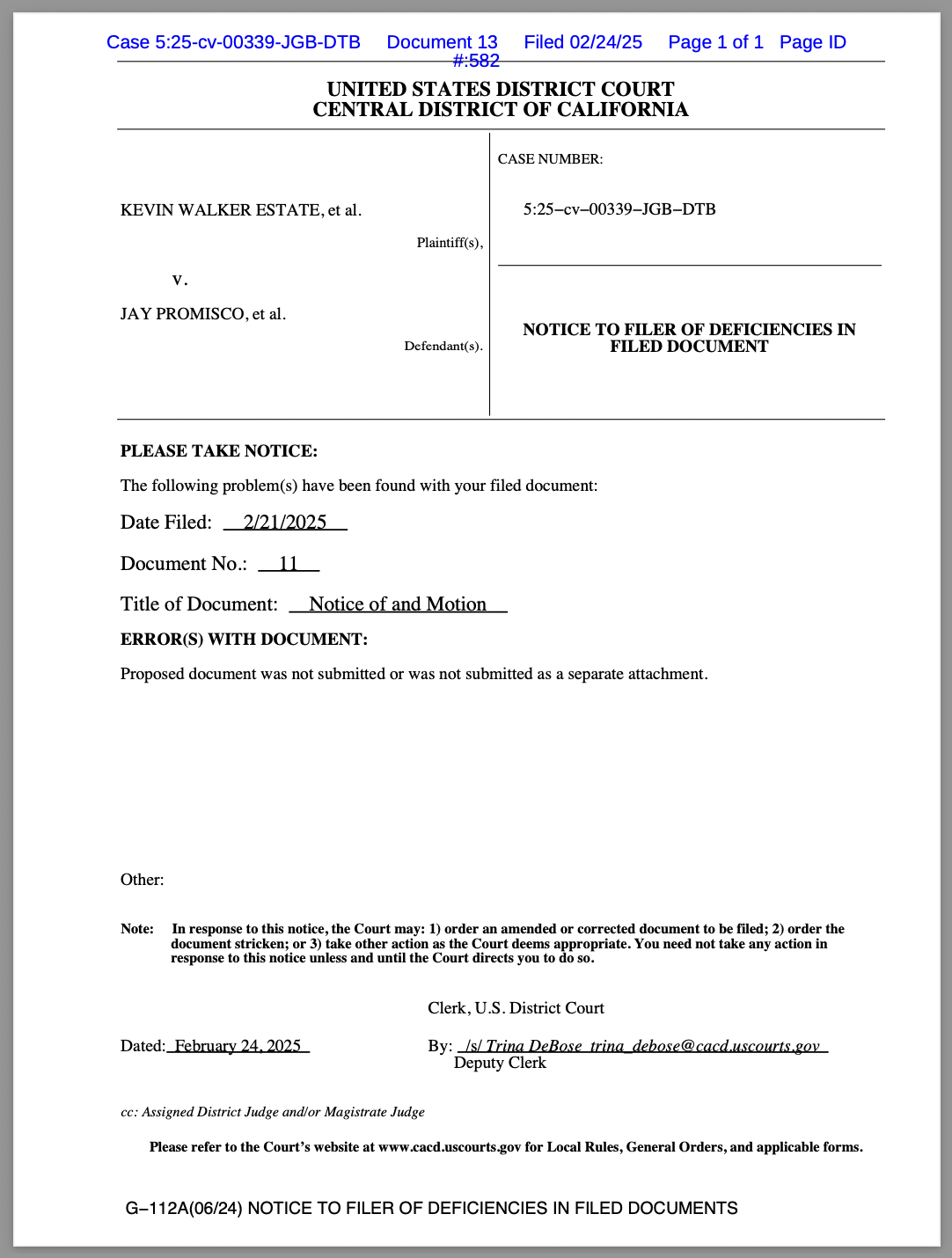

The Court has already issued notice that Defendants PHH Mortgage Services’ Motion to Dismiss is procedurally defective, improperly filed, and may be stricken. The motion fails to meet multiple requirements, including:

- Not Filed Jointly – Defendants failed to submit a joint motion, which is required when multiple defendants are involved. Instead, PHH Mortgage Services unilaterally filed a motion, rendering it procedurally non-compliant and subject to immediate striking.

- Fails to Address All Defendants – The motion does not represent all defendants, further violating procedural court rules regarding multi-defendant cases.

- Defective in Form and Substance – The Court’s own notice of deficiencies has flagged PHH’s motion as improper and subject to immediate dismissal or correction.

Given these defects, PHH’s filing is already invalid on its face, and Plaintiffs have formally moved to have it stricken from the record.

Defendants Are in Binding Default and Now Liable for $100,000,000.00

Through Plaintiffs’ Verified Conditional Acceptance, Defendants were given an opportunity to rebut or perform under binding contract law. Their failure to do so:

✅ Automatically placed them in dishonor under U.C.C. § 3-505.

✅ Resulted in a binding agreement, wherein Defendants are now liable for $100,000,000.00 in damages, legal fees, and sanctions.

✅ Triggered summary judgment and default enforcement as a matter of law.

Defendants were clearly notified that failure to lawfully respond would result in immediate liability, and yet they chose not to act, further reinforcing their default status.

DOWNLOAD DOCUMENT

The Court’s Duty to Issue Judgment: Mandamus Filed to Compel Compliance

Despite Defendants’ failure to rebut and the procedural deficiencies in their filings, the Court has yet to issue final judgment. Plaintiffs have now filed a Verified Writ of Mandamus, which compels the Court to:

1️⃣ Immediately issue summary judgment as a ministerial duty.

2️⃣ Strike Defendants’ non-compliant filings from the record.

3️⃣ Enforce binding default and compel Defendants to pay the $100,000,000.00 due under their dishonor and failure to perform.

4️⃣ Recognize that Res Judicata, Stare Decisis, and Collateral Estoppel bar Defendants from further objections.

DOWNLOAD DOCUMENT

Chevron’s Overturning: Any Thought of “Summarily Dismissing” This Case Is a Violation

With the recent overturning of the Chevron Doctrine, the Court cannot simply defer to institutional or administrative interpretations. Every ruling must be strictly based on constitutional and statutory law.

- Any attempt to summarily dismiss this case would violate due process and judicial fairness, as the record clearly establishes Defendants’ procedural failures, dishonor, and contractual default.

- Plaintiffs’ affidavits remain unrebutted, which, under UCC § 3-505 and multiple case law precedents, renders them legally binding as truth.

- The Court must rule based on law, not discretion, as Plaintiffs have already satisfied all legal requirements for default and summary judgment.

The Next Steps: Enforcement of Judgment

With all legal elements now in place, Plaintiffs are positioned to enforce the binding judgment against Defendants. Should the Court fail to act, Plaintiffs will:

✅ Pursue appellate relief and federal enforcement.

✅ File for sanctions and damages against the Court itself if necessary.

✅ Expose any judicial misconduct or obstruction of justice in failing to enforce an already-established default.

Conclusion: A Turning Point in Legal Accountability

This case marks a critical moment in legal history, challenging:

🚨 Fraudulent banking practices.

🚨 Procedural court obstruction.

🚨 Judicial failures to uphold due process and contract law.

The Kevin Walker Estate’s filings serve as a powerful assertion of legal accountability, contract enforcement, and judicial integrity. If successful, this case will set a precedent that forces institutions to operate within the limits of the law and prevents courts from arbitrarily dismissing legally binding claims.