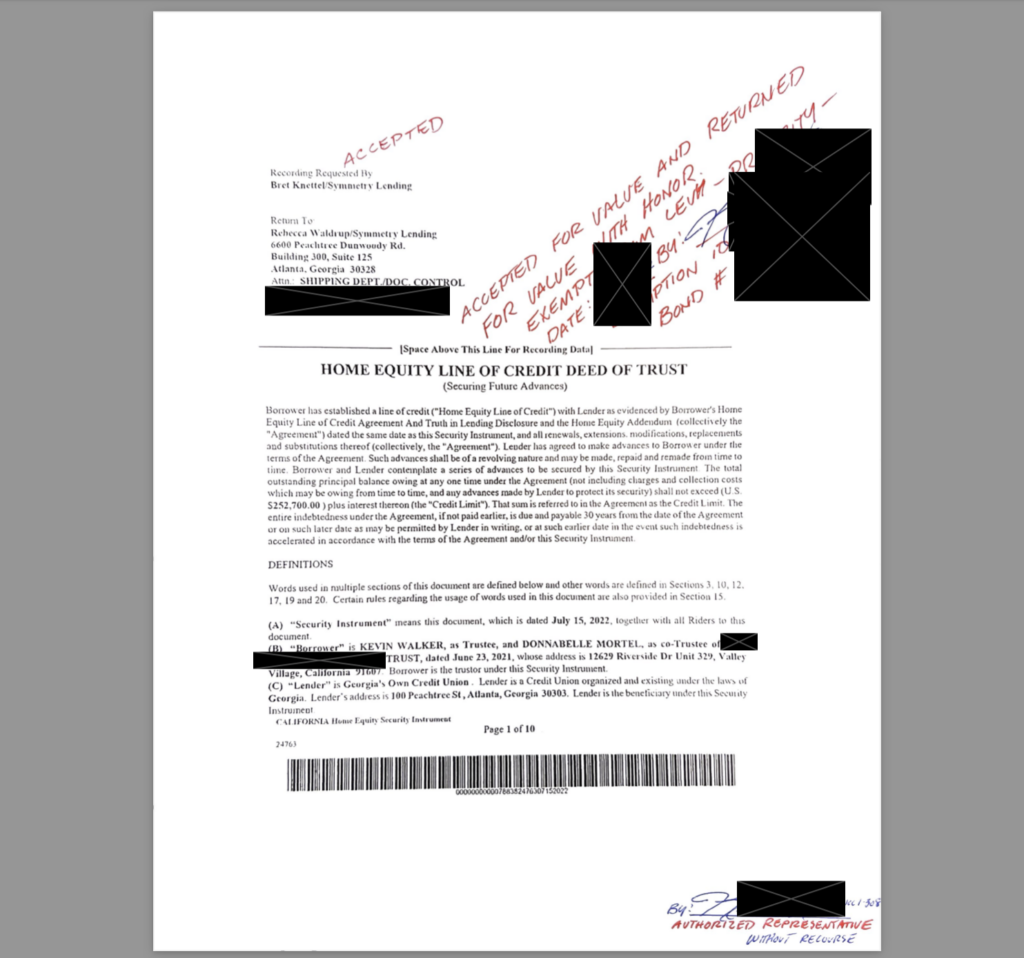

1. Establishing Control Over the Instrument

- Control Under UCC § 9-105:

Control is achieved when you, as the holder, assert authority over the instrument. This grants you superior rights to enforce or assign obligations associated with it. - Holder in Due Course (UCC § 3-302):

By becoming a holder in due course, you secure the legal right to enforce the instrument free of most defenses. This status is achieved when you:- Take the instrument for value.

- Act in good faith without notice of any defects or competing claims.

2. Claiming Ownership and Perfecting Interest

- Claiming the Instrument (UCC § 3-306):

Filing a UCC-3 Amendment publicly claims ownership of the instrument and perfects your interest, giving legal priority over others. This establishes your rights and creates a secure standing.

3. Acceptance and Transfer for Discharge

- Acceptance Under UCC § 3-409:

Acceptance acknowledges the instrument’s validity as negotiable, initiating the process of obligating the receiving party. - Transfer for Value (UCC §§ 3-203 & 3-303):

The instrument is then tendered for value and consideration, fulfilling contractual obligations.

4. Obligations of the Receiving Party

- Requirement to Discharge Debt:

According to 18 U.S.C. § 8, obligations involving a bill or note are legally considered obligations of the United States, a federal corporation as defined by 28 U.S.C. § 3002(15). The receiving party must discharge the debt in accordance with these statutes.- Presentment (UCC § 3-501):

The receiving party is obligated to make presentment of the instrument. Failure to present or act constitutes dishonor.

- Presentment (UCC § 3-501):

5. Automatic Discharge by Law

- Discharge of Obligations (UCC § 3-603):

If the receiving party refuses to act on the instrument, the obligation is automatically discharged by operation of law. - Full Satisfaction (UCC § 3-311):

If your tender of payment explicitly states it is in “full satisfaction”, the debt is fully discharged upon tender.

6. Legal Foundations of Payment

- House Joint Resolution 192 of 1933 (Public Law 73-10):

This resolution prohibits creditors from demanding payment in a specific currency (e.g., gold or Federal Reserve Notes). It ensures that debts can be settled using any valid form of tender, effectively removing the obligation to pay in legal tender backed by gold.

7. Secured Party Status

- Secured Party (UCC § 9-102):

To enforce your rights and obligations effectively, you must establish yourself as the secured party. Filing a UCC-3 Amendment perfects your interest and grants priority over competing claims, ensuring legal control of the instrument.

8. Administrative Process and Presumption of Dishonor

- AFFIDAVIT CERTIFICATE:

If the receiving party fails to act, you may issue an AFFIDAVIT CERTIFICATE as part of the administrative process. Under UCC § 5-505, this creates a presumption of dishonor, strengthening your claim and completing the process administratively.

9. Key Legal Foundations and Integration

- Returning the Instrument for Value:

Returning the accepted instrument activates its value, triggering the receiving party’s obligation under the following UCC provisions:- UCC § 3-104: Confirms the instrument as negotiable.

- UCC § 1-103: Preserves common law principles within the UCC framework.

- UCC §§ 2-204 & 2-206: Establish offer, acceptance, and contract formation.

- Holder’s Rights and Enforcement:

As the holder in due course (UCC § 3-302), you control the instrument, claim its value (UCC § 3-306), and ensure compliance with obligations.

10. Summary of the Process

- Establish Control:

Assert authority over the instrument as the holder in due course under UCC §§ 9-105 & 3-302. - Claim Ownership:

File a UCC-3 Amendment to publicly claim the instrument and perfect your secured interest. - Tender for Full Satisfaction:

Accept and transfer the instrument for value under UCC §§ 3-203, 3-303, and state payment is in full satisfaction (UCC § 3-311). - Obligation to Discharge:

The receiving party must discharge the obligation as required by law (18 U.S.C. § 8) and make presentment (UCC § 3-501). - Administrative Remedy:

Issue an AFFIDAVIT CERTIFICATE under UCC § 5-505 if the receiving party fails to act, creating a presumption of dishonor. - Discharge by Operation of Law:

If the receiving party refuses, the obligation is automatically discharged under UCC §§ 3-603 & 3-311.