I. INTRODUCTION: THE INVISIBLE CUSTODIAN OF YOUR LIFE ENERGY

The Depository Trust & Clearing Corporation (DTCC) is not just a back-office financial clearinghouse — it is the private vault of the global securitization regime. Acting as a shadow custodian for nearly all financial instruments in the United States and beyond, DTCC — along with its nominee shell CEDE & Co. — holds legal title to birth bonds, mortgages, court judgments, and virtually all registered debt instruments. While most believe their accounts and investments are safely held in their name, legal title often rests with DTCC. You are merely a beneficial user — or worse, an unwitting surety.

II. THE ARCHITECTURE OF CONTROL: DTCC + CEDE & CO.

Founded in 1999, but rooted in the Depository Trust Company (DTC) established in 1973, DTCC clears over $2.3 quadrillion in securities annually. It does so through key subsidiaries:

- DTC (Depository Trust Company): Custodian of securities

- FICC (Fixed Income Clearing Corp): Handles Treasury securities

- NSCC (National Securities Clearing Corp): Clears equity transactions

Its nominee CEDE & Co. legally owns nearly all U.S. securities. Your brokerage account, 401(k), court bond, or mortgage note? Held in CEDE’s name — not yours. You have use; they hold title.

III. HOW YOUR IDENTITY IS SECURITIZED

At birth, your information is used to generate a birth certificate, which is registered with the state and ultimately routed to federal agencies. That certificate is assigned a CUSIP number and becomes a security under 18 U.S.C. § 8 — traded and monetized through Treasury and Federal Reserve channels.

Each time you:

…a commercial instrument is created, bonded, and deposited into clearing networks — often backed by your presumed suretyship.

IV. LEGAL MECHANICS BEHIND THE FRAUD

The following statutes and codes support this machinery:

- Securities Act of 1933 & Exchange Act of 1934: Define nearly all performance instruments as “securities”

- 18 U.S.C. § 8: Defines bonds and birth certificates as obligations

- 31 U.S.C. § 3123: Pledges the full faith and credit of the U.S. to pay on registered obligations

- UCC Articles 8 & 9: Govern security interests, perfection, and title holding

Case Law:

- Clearfield Trust Co. v. United States, 318 U.S. 363 (1943): Establishes that when the U.S. acts commercially, it is subject to the same liabilities as a private party.

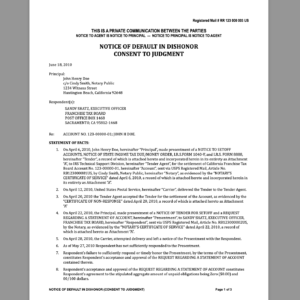

V. COURTS AS COMMERCIAL ADMINISTRATORS

Modern courts do not adjudicate law. They administer commercial paper. Each court order, fine, or judgment is bonded and monetized. Clerks act as securities brokers. Judges act as administrators of your bonded estate. The moment you fail to rebut a claim in commerce — via affidavit or conditional acceptance — consent is presumed, and the bond is perfected.

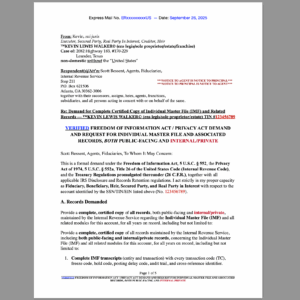

VI. THE REMEDY: COLLAPSE THE PRESUMPTION, PERFECT YOUR INTEREST

This system functions solely on presumption and silence. Remedy exists for the man or woman who:

- Perfects their secured interest via UCC-1 filing

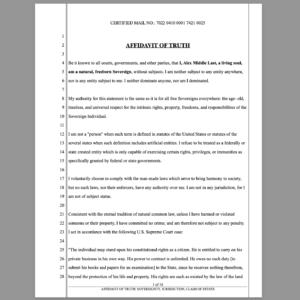

- Issues a lawful affidavit rebutting presumption of suretyship

- Notifies the Treasury of assignment and discharge under HJR-192

- Demands full fiduciary accounting under trust law

You are the creditor, the equitable titleholder, and the real party in interest. The court, state, and DTCC are unauthorized fiduciaries. Unless rebutted, they presume control over your estate.

VII. CONCLUSION: THE TIME TO RECLAIM YOUR ESTATE IS NOW

DTCC is not your custodian — it is the silent captor of your commercial energy. Every day that passes without rebuttal is another day your legal fiction is monetized for someone else’s profit. By understanding the laws of equity, trust, and commerce, you can dismantle the illusion, collapse the presumption, and reassert your rightful position as Secured Party Creditor.

This is not a plea for remedy. It is a lawful declaration of status, capacity, and claim.

You are not the debtor. You are not a legal fiction. You are not the surety.

You are the living man or woman, the sole lawful executor of your estate, and the beneficiary of the trust.

Reclaim it.