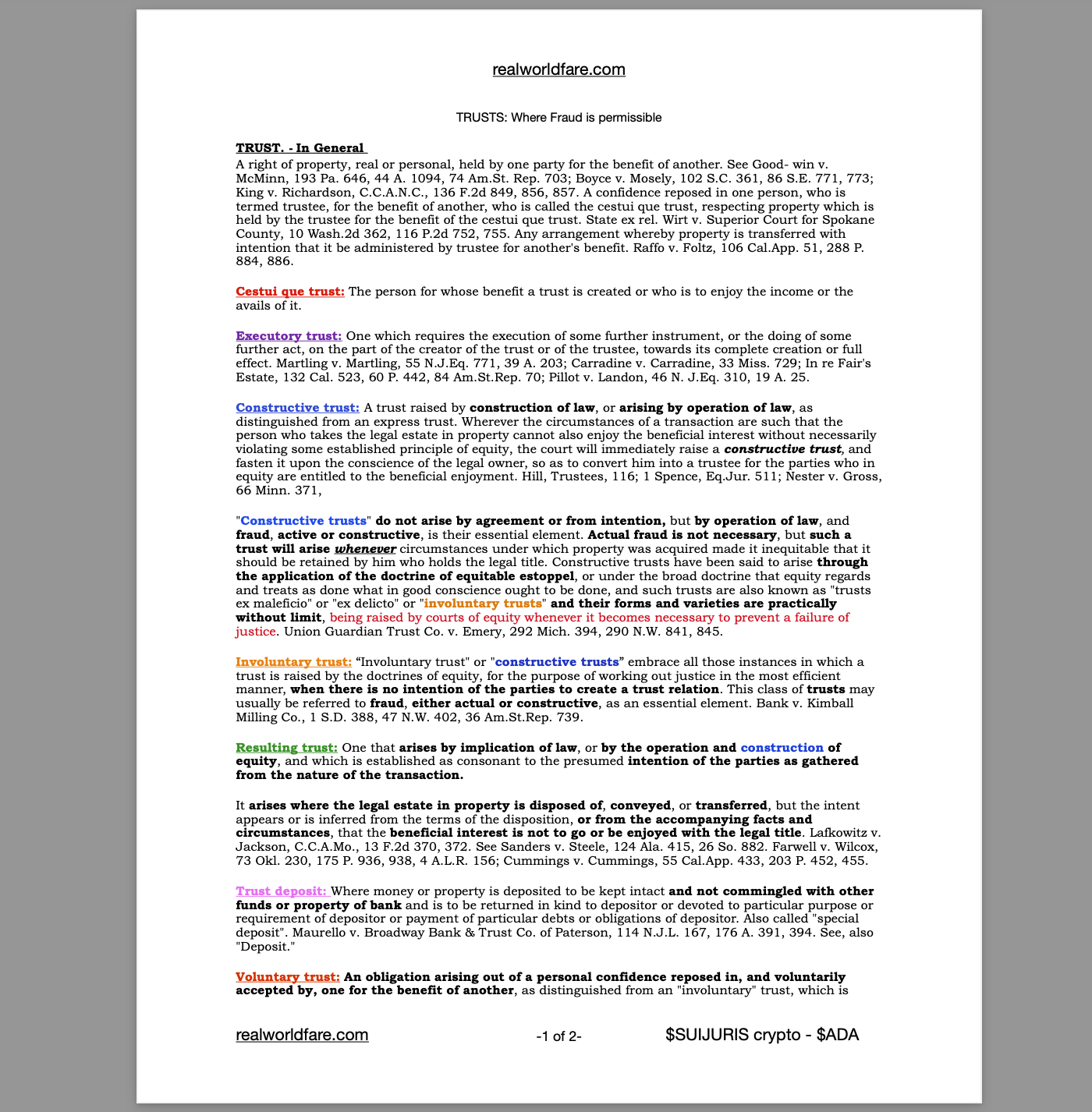

Understanding Trusts: The Foundation of the System

A trust is a legal arrangement where one party (the trustee) holds property or assets for the benefit of another party (the beneficiary). Courts and financial institutions operate under various forms of trusts, many of which are created without explicit consent from individuals.

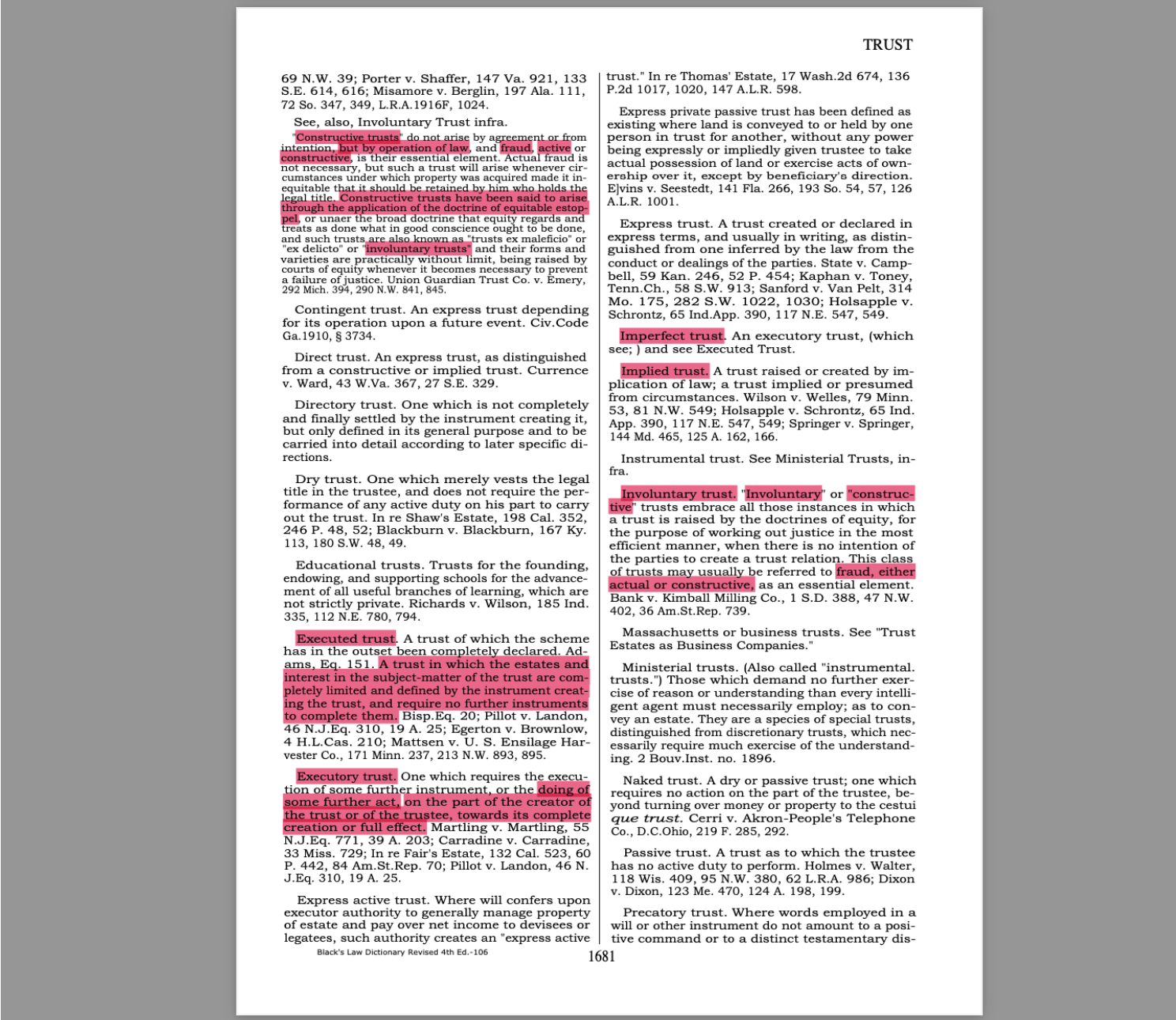

- Constructive Trusts – Created by law, regardless of the intentions of the parties involved. Often used when fraud or deception is present.

- Involuntary Trusts – A trust established by law to manage an individual’s property or rights without their direct participation.

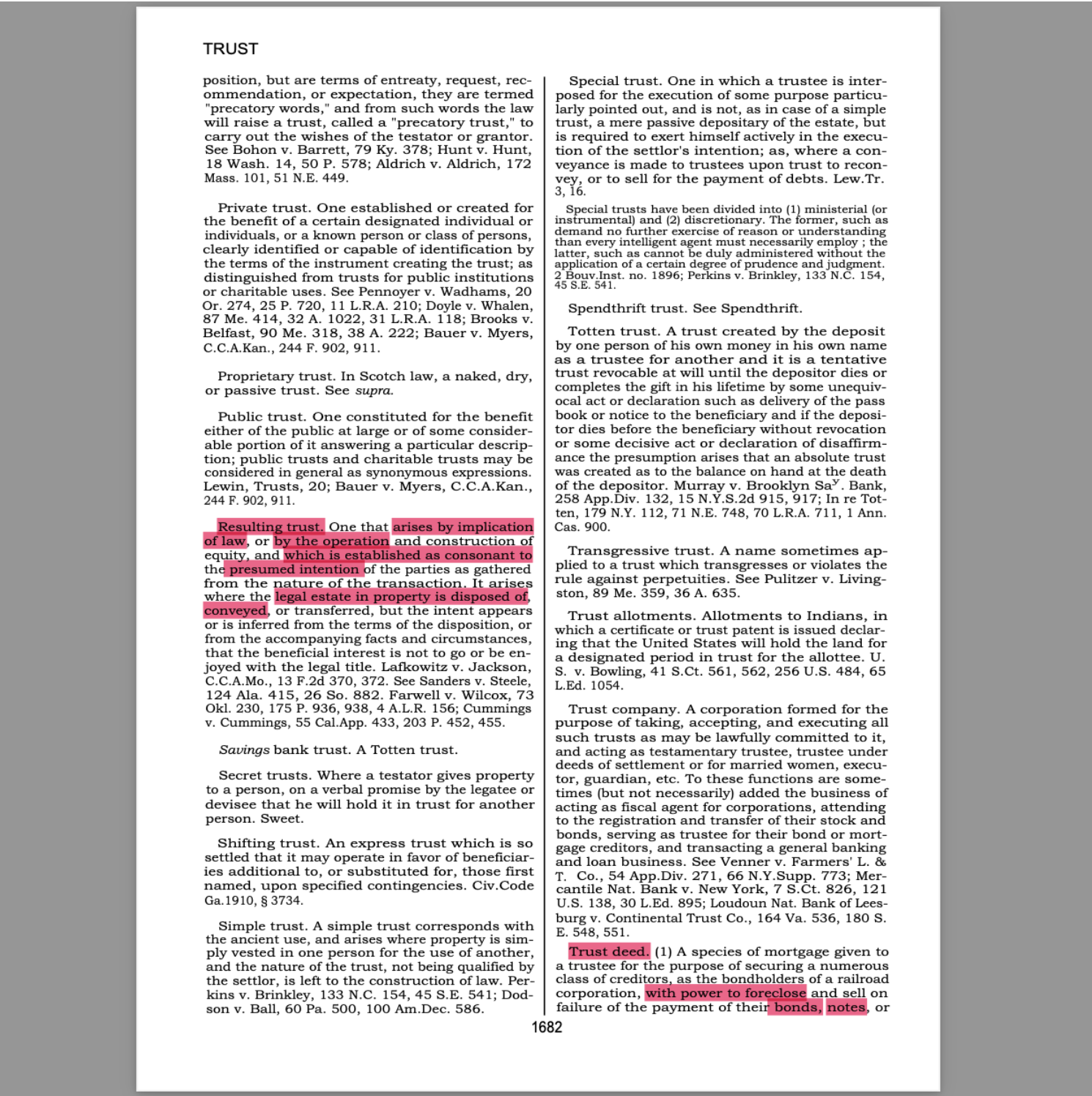

- Resulting Trusts – Arise when property is transferred, but the intended recipient does not receive full beneficial ownership.

These trusts are embedded in nearly every financial and legal transaction.

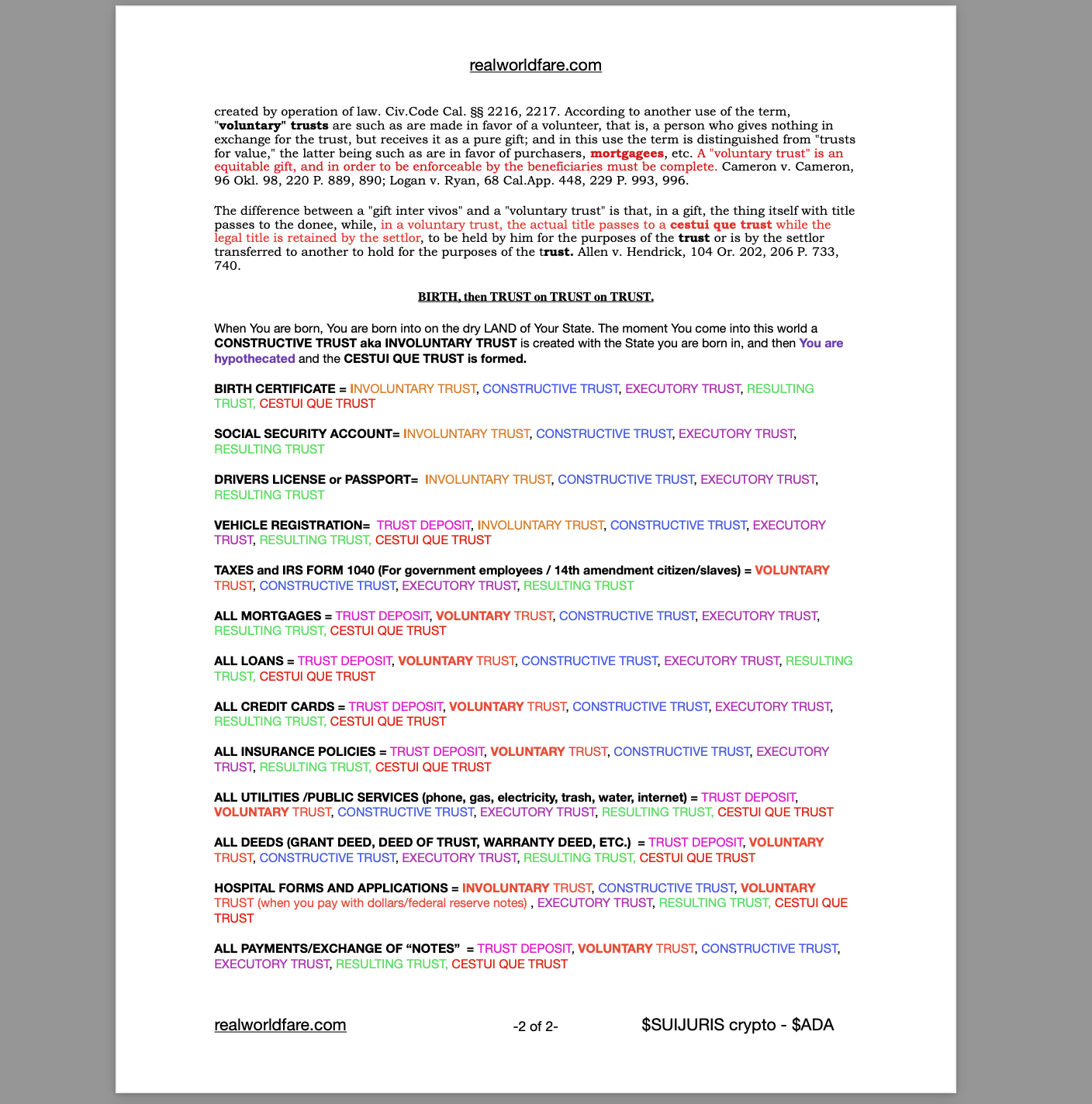

How the Trust System Begins at Birth

The Birth Certificate is the first legal trust established in a person’s name. Upon registration, an individual becomes the subject of an involuntary, constructive, and executory trust managed by the state. This document allows governments to:

- Assign a Cestui Que Trust, meaning the individual is legally represented as a beneficiary rather than the legal owner of their own identity.

- Hypothecate (pledge) future labor and financial activity, creating an economic value linked to the corporate person (ens legis).

- Establish a system where individuals unknowingly function as sureties for government debts and obligations.

The Social Security Account follows as another trust instrument. It operates as a constructive and involuntary trust, linking individuals to a federal financial system, where all earnings, taxes, and retirement benefits are tracked and controlled.

How Financial Instruments Are Structured as Trusts

Virtually all modern financial transactions fall under trust-based accounting, meaning the individual is not truly the owner, but rather a trustee or beneficiary. Below are examples of how everyday financial interactions are categorized within this hidden trust system:

1. Loans and Mortgages

- Voluntary Trusts – When an individual signs a loan or mortgage agreement, they enter into a trust relationship where they act as a trustee managing an asset that remains under the lender’s control.

- Resulting Trusts – The bank creates money through credit issuance, meaning no actual “loan” takes place. Instead, the individual’s signature generates the asset.

2. Vehicle Registration and Insurance

- When a car is registered with the Department of Motor Vehicles (DMV), it becomes part of a constructive trust, where the legal title is held by the state.

- Insurance policies function under voluntary and constructive trusts, ensuring that claim payments are controlled under financial agreements rather than personal ownership.

3. Deeds and Property Ownership

- Deeds of Trust, Warranty Deeds, and Grant Deeds are actually instruments of trust deposit, placing the property in a trust structure where the owner is effectively a tenant rather than an absolute owner.

- The land title system ensures that all real estate remains under state and federal control through resulting and executory trusts.

4. Taxes and IRS Form 1040

- Filing a tax return under IRS Form 1040 signifies participation in a voluntary trust, where individuals operate as federal employees (14th Amendment citizens/slaves), thus consenting to federal taxation under contract law.

5. Payments and Financial Transactions

- Every exchange of Federal Reserve Notes (U.S. Dollars) functions under a trust deposit system, where individuals unknowingly operate within a contractual financial framework rather than directly owning legal tender.

The Fraud Factor: How This System Functions Without Full Disclosure

The major issue with this trust-based financial and legal system is lack of disclosure. Individuals are never explicitly informed that they are:

- Entering into trust agreements upon birth.

- Operating under commercial contract law rather than constitutional rights.

- Being held as financial sureties for government and corporate debts.

This structure operates on the principle that fraud is permissible when an individual does not challenge the trust agreement. Courts presume that anyone using these instruments has voluntarily consented to the terms, unless explicitly rebutted.

How to Challenge the Trust System

Individuals seeking to reclaim control over their legal and financial standing must:

- Identify and assert their standing as the living beneficiary of all created trusts.

- Challenge the presumption of involuntary trusts in legal proceedings.

- Refuse to act as sureties for government or corporate debts by understanding UCC and trust law.

- File the necessary affidavits, trust revocations, or security agreements to reclaim full ownership over their assets.

Conclusion: Understanding the Hidden Trust System is the First Step to Freedom

The modern financial and legal system is structured on hidden trust agreements that most people never recognize. Birth certificates, Social Security numbers, mortgages, loans, and even tax filings all function within a complex framework of constructive, involuntary, and voluntary trusts, ensuring that individuals remain bound to obligations they were never fully informed of.

Understanding these trust relationships is essential for anyone looking to reclaim their financial independence and legal autonomy. By challenging presumptions and asserting rightful ownership, individuals can navigate the system more effectively and prevent financial exploitation through undisclosed trust agreements.