Introduction

The corporate and statutory framework of the United States makes one fact undeniable: the “U.S. citizen” is not the same as the private man or woman. The United States operates as a corporation; the “U.S. citizen” is a federal franchise/business under that corporate system; and the Social Security number (SSN) attaches to that franchise, not to the living man or woman. Congress has gone so far as to criminalize the compulsion of an SSN in contexts where it is not lawfully required.

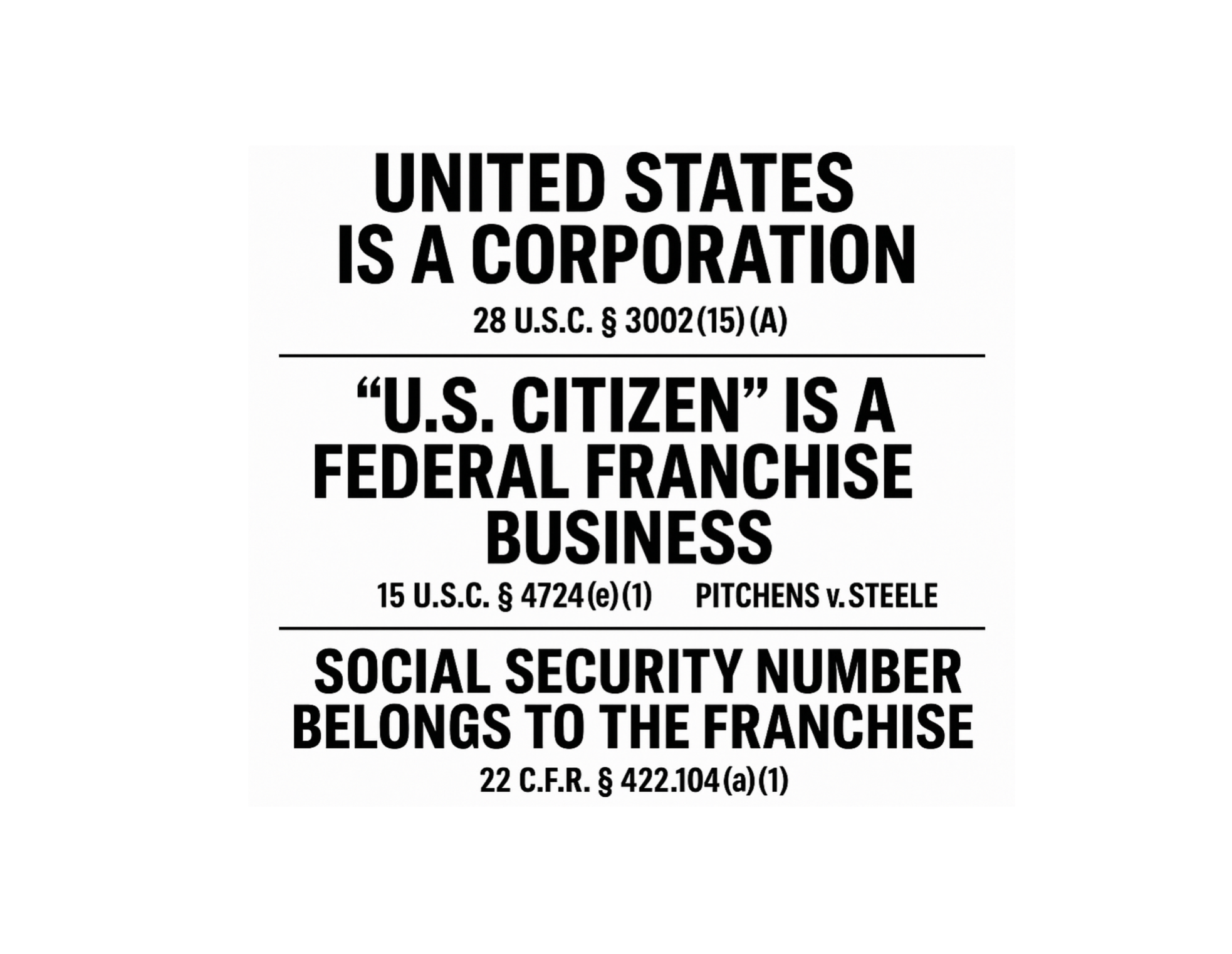

United States Is a Corporation

The starting point is clear:

-

28 U.S.C. § 3002(15)(A): “United States” means a Federal corporation.

This statutory definition shows that the United States, in its corporate capacity, functions as a business entity. All enforcement mechanisms, statutory franchises, and obligations flow from this corporate framework.

The “U.S. Citizen” as a Business Franchise

The statutes explicitly define the “U.S. citizen” as part of a business enterprise:

-

15 U.S.C. § 4724(e)(1): “The term ‘United States business’ means (A) a United States citizen …”

This codification reveals that a “U.S. citizen” is not the private man or woman but is instead a United States business franchise. It is a designation in commerce, not a natural identity.

The courts have confirmed this directly:

-

Kitchens v. Steele, 112 F. Supp. 383 (D. Ark. 1953):

“A citizen of the United States is a citizen of the federal government … He owes allegiance to the United States government and is subject to its jurisdiction … He is not a citizen of a State in the sense in which one is a citizen of the United States. Thus, U.S. citizenship is a privilege and a franchise granted by the federal government.”

Social Security Numbers Belong to the Franchise

The Social Security Administration itself confirms that SSNs are tied exclusively to the franchise:

-

22 C.F.R. § 422.104(a)(1): “United States citizens” are eligible to be assigned Social Security numbers.

This regulation makes clear that the SSN belongs to the U.S. citizen franchise/business, not to the private State national or the living man or woman.

The Buck Act and Federal Franchise Overlay

The Buck Act of 1940 (54 Stat. 1059, codified at 4 U.S.C. §§ 105–113) extended federal jurisdiction and taxing authority into so-called “federal areas.” It defines “person” to include individuals, firms, partnerships, corporations, and associations. This Act effectively imposed a federal franchise jurisdiction onto those operating as “U.S. citizens,” confirming the corporate and commercial nature of that status.

Felony Prohibition Against Compulsion

Congress has codified severe penalties for compelling the disclosure of SSNs outside of lawful, limited purposes (employment/tax reporting):

-

42 U.S.C. § 408(a)(8):

“Whoever … discloses, uses, or compels the disclosure of the social security number of any person in violation of the laws of the United States, shall be guilty of a felony, and upon conviction … fined or imprisoned not more than five years, or both.”

Thus, requiring an SSN in private contracts such as bank loans, mortgages, credit cards, leases, or lines of credit is not merely an overreach — it is a felony.

Application in Commerce

When a bank, car loan broker, mortgage lender, landlord, or credit card issuer compels disclosure of an SSN, it is not “company policy” — it is unlawful coercion that forces a private man or woman into the U.S. citizen franchise. Unless Congress has expressly mandated disclosure for employment or tax purposes, all other compelled uses are felonious under federal law.

Conclusion

The evidence is indisputable:

-

The United States is a Federal corporation (28 U.S.C. § 3002(15)(A)).

-

The “U.S. citizen” is a business franchise (15 U.S.C. § 4724(e)(1); Kitchens v. Steele).

-

The Social Security number attaches only to that franchise (22 C.F.R. § 422.104(a)(1)).

-

Compelling its use outside of lawful purposes is a felony (42 U.S.C. § 408(a)(8)).

The Social Security number belongs to the U.S. citizen franchise/business created by the United States corporation. It does not belong to, nor lawfully bind, the private man or woman. Any attempt to force its use in private contracts is a criminal act of compulsion.