The Internal Revenue Code (Title 26 of the United States Code) contains multiple provisions that establish the legal framework governing the administration of estates, trusts, and the handling of taxpayer information. These statutes confirm that public servants, government officials, and agencies must have lawful authority before interacting with or making claims over an estate, including an infant or decedent estate.

Furthermore, under 31 CFR § 363.6, every man or woman is presumed to be a decedent until they claim their securities held in their minor account. This regulation, which governs Treasury securities, demonstrates that individuals remain legally classified as decedents (minors in commerce) until they assert their rights over their financial assets. This understanding further supports the necessity of proper fiduciary appointment before any government official can claim jurisdiction over a person’s estate.

Below is a breakdown of key statutes—26 U.S.C. §§ 7603, 6903, 6036, 2203, 6402, 31 U.S.C. § 1321, and 31 CFR § 363.6—demonstrating that lawful authority must be properly established before any public servant can act upon or administer an estate.

1. 26 U.S.C. § 7603 – Service of Summons and Authority Over a Taxpayer’s Estate

This section governs how legal process (such as summonses) must be properly served on an individual or their legal representative:

“A summons issued under this title shall be served by the Secretary, by an attested copy delivered in hand to the person to whom it is directed, or left at his last and usual place of abode.”

Application to Estate Matters:

- If a government agency, tax official, or public servant seeks to claim any authority over an estate, they must first establish legal service to the proper party.

- The estate itself cannot be summoned or handled without a properly designated fiduciary or executor.

- If an infant or decedent estate is involved, the agent must serve the rightful trustee, executor, or lawful representative—a public official cannot assume authority without due process.

2. 26 U.S.C. § 6903 – Notice of Fiduciary Relationship

This section explicitly requires that a fiduciary relationship must be formally established before any government official can act upon an estate.

“Upon notice to the Secretary that any person is acting for another in a fiduciary capacity, such fiduciary shall assume the powers, rights, duties, and privileges of such other person with respect to a tax imposed by this title.”

Application to Estate Matters:

- A public servant (IRS agent, court officer, or administrator) cannot unilaterally act upon an estate—they must first receive formal notice that a fiduciary exists.

- No government official can claim access, demand taxes, or make legal determinations over an estate without a valid fiduciary appointment.

- If an infant or decedent estate is involved, only the properly registered fiduciary can assume responsibility.

🔹 If no fiduciary is on record, a public servant has no legal standing to act upon the estate.

3. 26 U.S.C. § 6036 – Notice of Fiduciary Relationship Required for Decedent Estates

This section further reinforces that an estate cannot be administered or interfered with unless proper notice of fiduciary authority has been provided.

“Every executor, administrator, or other person responsible for carrying out the duties of an estate of a decedent shall, within 2 months after qualifying as such, give notice thereof to the Secretary.”

Application to Estate Matters:

- The IRS or any government agent cannot act upon a decedent’s estate unless a legally recognized fiduciary has been appointed and has given notice.

- No public servant can assume authority over the estate of a minor or decedent without a formal fiduciary appointment.

- The executor, trustee, or guardian is the only party recognized to deal with financial, tax, and legal matters of the estate.

🔹 If no proper fiduciary has been assigned, then any public servant attempting to handle the estate is acting without legal authority.

4. 31 CFR § 363.6 – The Legal Presumption That Every Man or Woman is a Decedent Until They Claim Their Securities

31 CFR § 363.6 establishes that securities held in a minor account remain under government control unless and until claimed by the rightful owner.

“A minor account means a TreasuryDirect account that a custodian establishes on behalf of a person who has not yet attained the age of 18 years.”

Application to Estate Matters:

- Every man or woman is considered a minor (decedent) in commerce until they claim their securities.

- The U.S. Treasury holds these accounts in trust, meaning an individual must assert their claim to their estate before being recognized as a living man or woman with full legal capacity.

- This explains why public servants presume authority over an estate unless the individual lawfully claims their status and assets.

🔹 Until an individual claims their securities and estate, they are legally classified as a decedent, reinforcing the need for proper fiduciary representation before any public servant can intervene.

5. Other Relevant Provisions Requiring Authority Over an Estate

🔹 26 U.S.C. § 2203 – Definition of Executor

Defines who has legal authority over a decedent’s estate:

“The term ‘executor’ means the executor or administrator of the decedent, or, if there is no executor or administrator appointed, then any person in actual or constructive possession of any property of the decedent.”

🔹 A government agent cannot act as an “executor” without being lawfully appointed.

🔹 26 U.S.C. § 6402 – Authority Over Refunds and Credits

Ensures that only the legal fiduciary can claim credits, refunds, or settlements related to an estate.

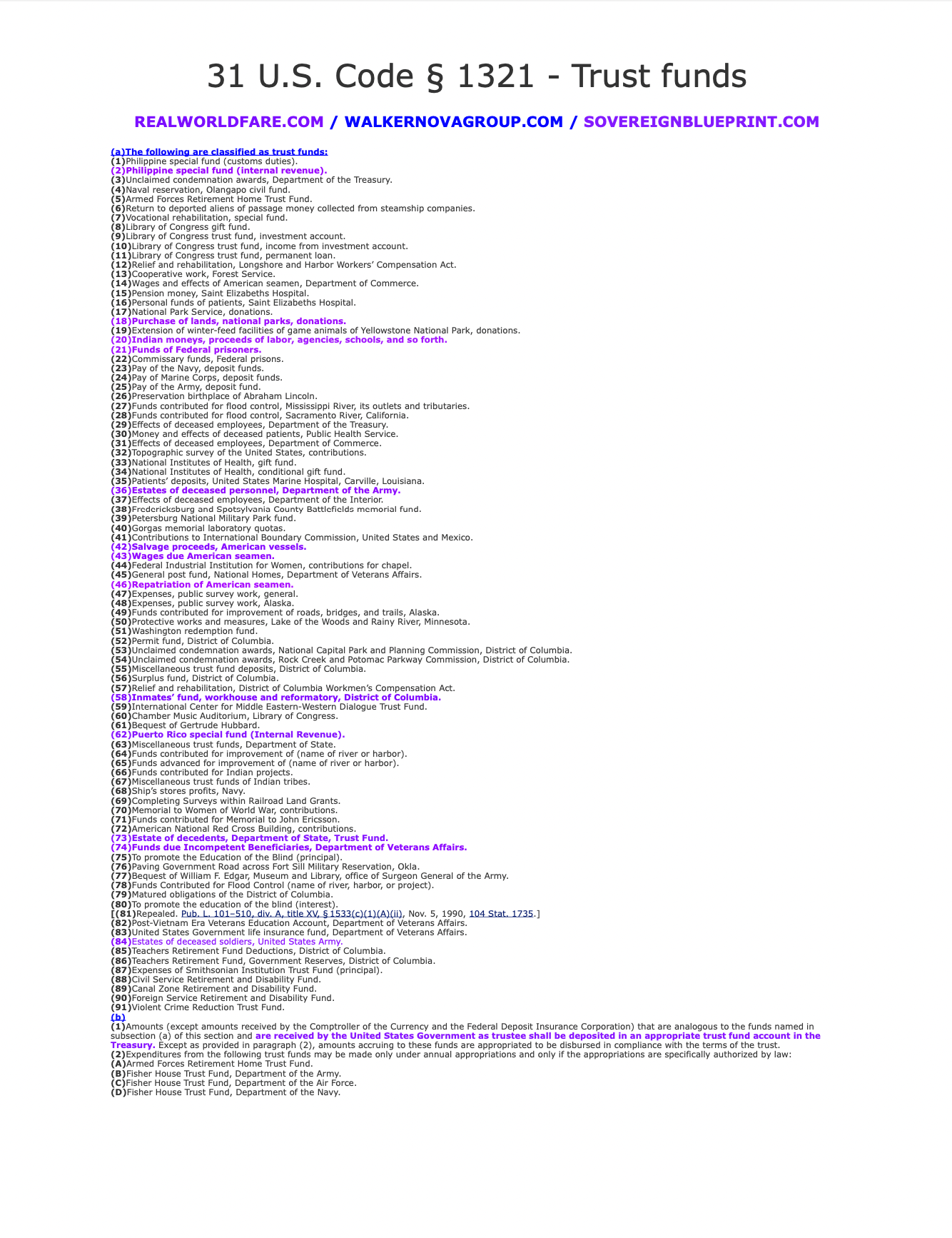

🔹 31 U.S.C. § 1321 – Custodial Accounts and Trusts Held by the U.S. Treasury

Confirms that certain funds, including estate-related funds, are held in trust and require a legal claim for access.

6. 31 U.S. Code § 1321 – Trust funds

7. Conclusion: Public Servants Must Have Proper Authority to Touch an Infant/Decedent Estate

✅ Key Legal Facts:

- No public servant can assume control over an estate without a legally recognized fiduciary.

- 26 U.S.C. §§ 7603, 6903, and 6036 require formal notice and proper legal standing before any estate action can be taken.

- 31 CFR § 363.6 establishes that every man or woman is considered a decedent until they claim their securities and estate.

- Government agencies, courts, and tax authorities must recognize a fiduciary relationship before engaging with estate assets or responsibilities.

- If no fiduciary is appointed, any action taken by a government official is unlawful interference.

✅ What This Means for Your Estate:

- If an agent or government official attempts to act upon an infant or decedent’s estate without proper fiduciary appointment, they lack legal authority to do so.

- You can demand proof of their legal standing before allowing them to interfere in estate matters.

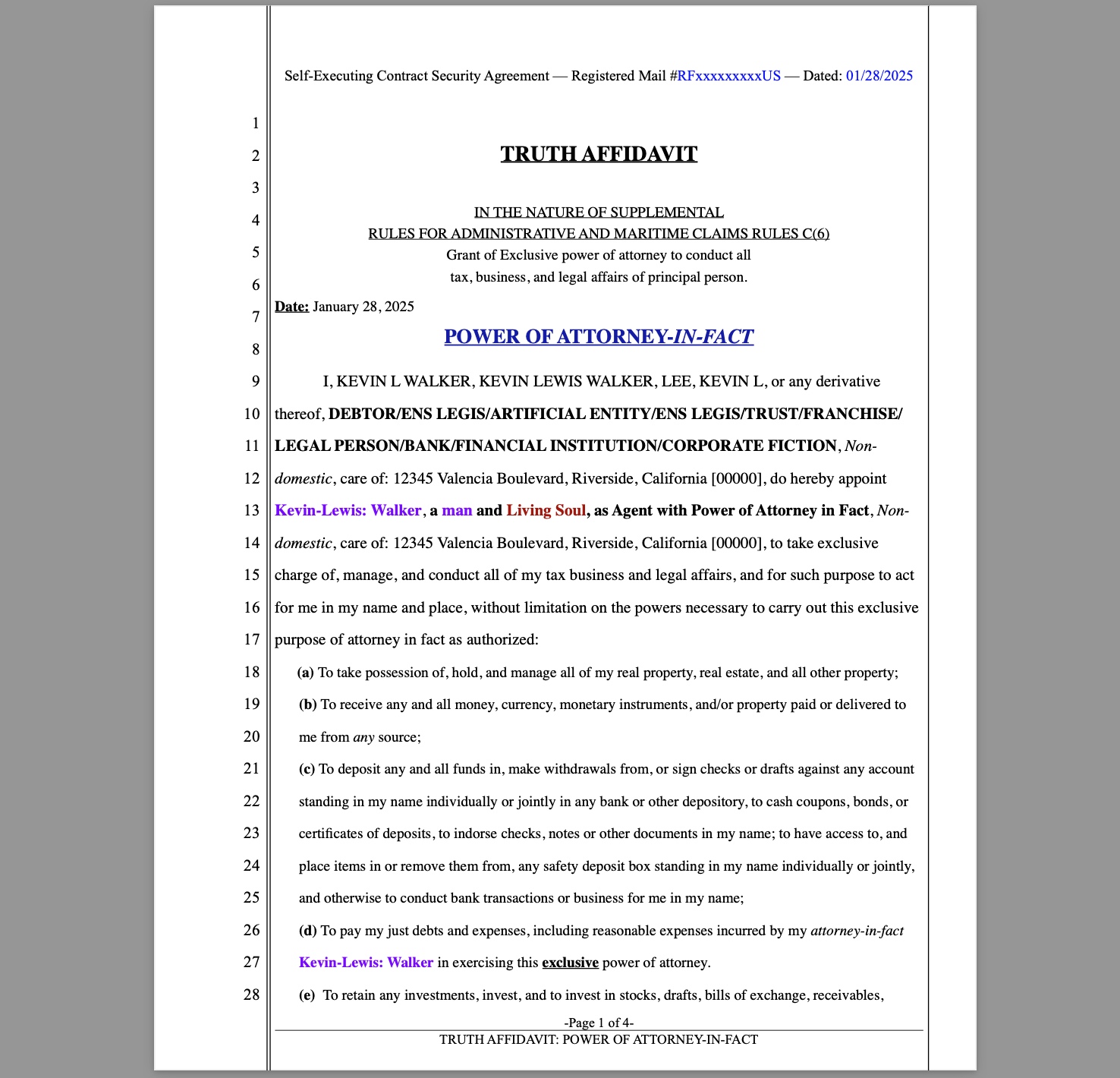

- IRS Forms 56 (Notice of Fiduciary Relationship) and 1099-OID (Original Issue Discount) should be used to establish proper estate accounting and financial settlement.

DOWNLOAD DOCUMENT

DOWNLOAD DOCUMENT