This article outlines the full process of how an unrebutted affidavit, coupled with UCC mechanisms, can be used to formally recognize a bad debt, cancel it, and claim a tax deduction or refund.

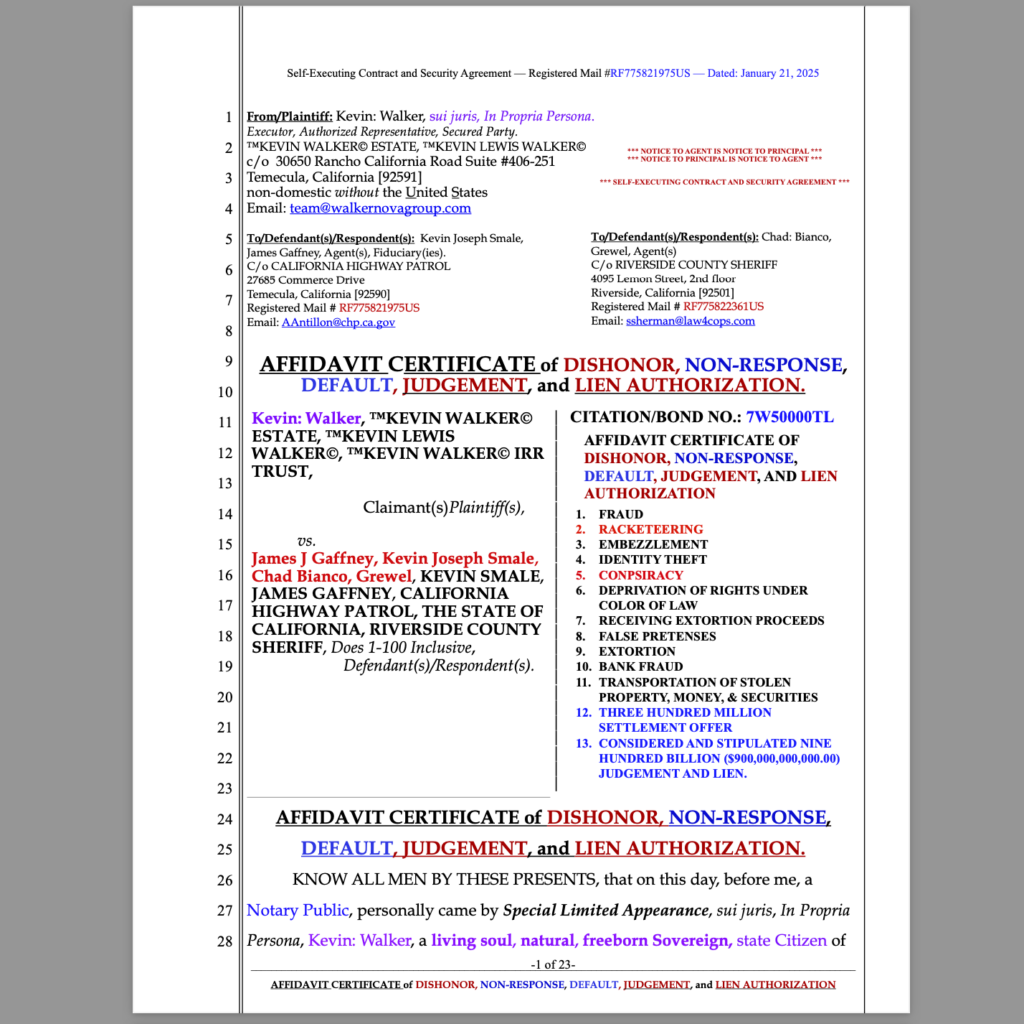

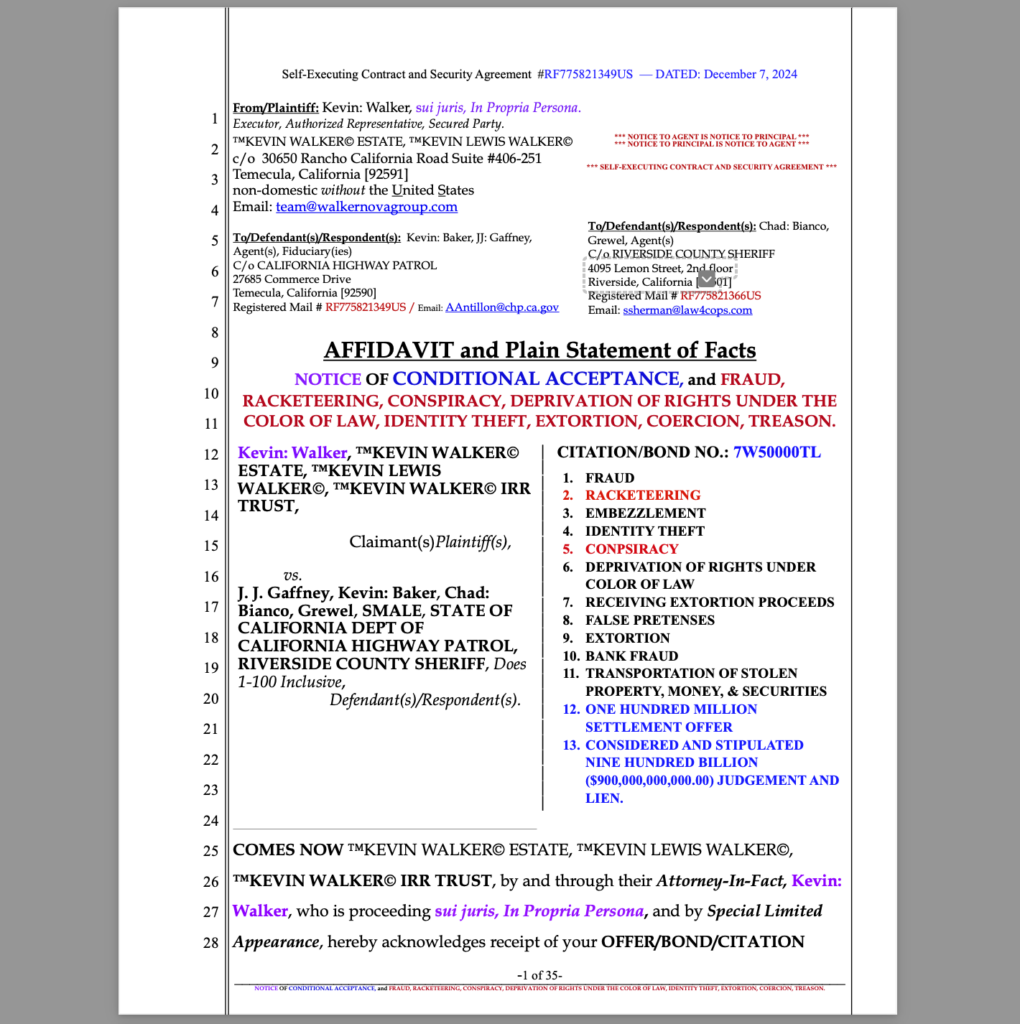

Step 1: Establishing the Debt Claim Through an Affidavit

An affidavit is a sworn statement of fact that, if unrebutted, stands as truth in commerce and law. The process begins by sending a detailed affidavit to the party asserting the debt, outlining:

- The nature of the debt, how it was incurred, and any payments made.

- The commercial or contractual violations committed by the creditor.

- A demand for validation in accordance with the Fair Debt Collection Practices Act (FDCPA) or relevant contractual obligations.

- A stipulated timeframe (e.g., 10 to 30 days) for the recipient to rebut point by point under oath.

If the recipient does not respond, the affidavit is considered agreed upon as true and correct under commercial law and UCC principles.

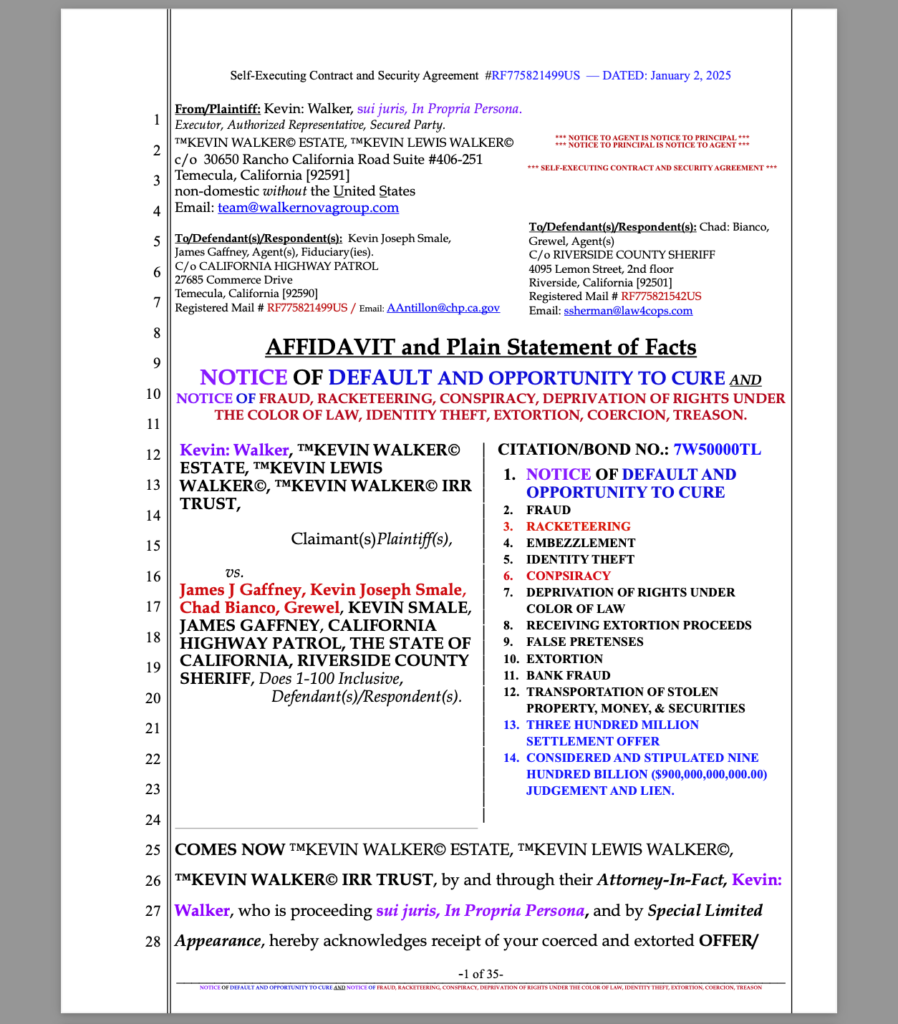

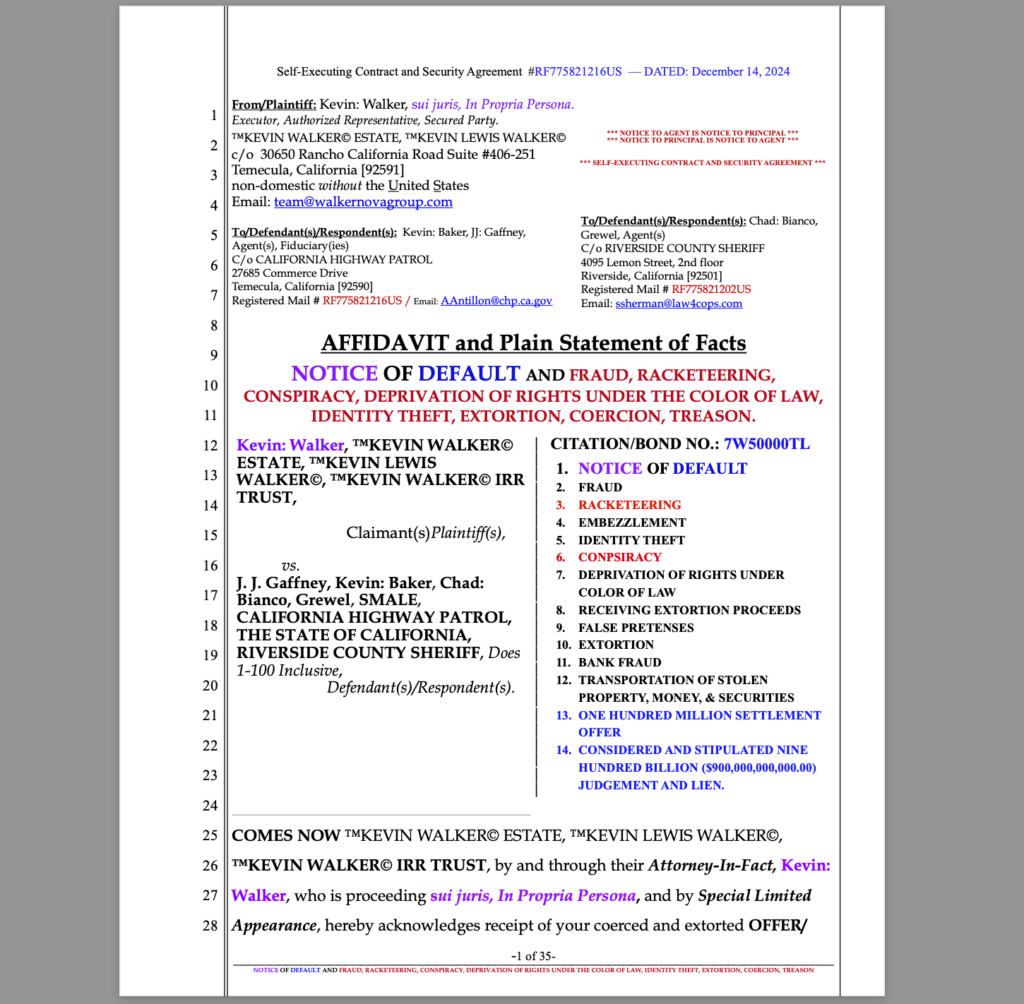

Step 2: Issuing a Notice of Default and Finalizing the Administrative Process

Once the affidavit remains unrebutted, the next step is to:

- Send a Notice of Default and Opportunity to Cure – Providing a final opportunity to rebut the affidavit and cure any deficiencies.

- Follow Up with a Notice of Final Default and Dishonor – If the debtor or creditor still fails to respond, they are in commercial dishonor, meaning they have agreed to your claims by tacit procuration.

- Complete the Process with an Affidavit Certificate of Non-Response – This final notarized document certifies that the opposing party had multiple opportunities to respond and failed to do so.

By this point, the debt has been administratively nullified, and you are legally entitled to write it off.

Step 3: Using UCC § 3-505 to Certify the Debt as Uncollectible

UCC § 3-505 (Notice of Dishonor) legally establishes that:

- A party that has failed to respond to a proper notice is in dishonor.

- An Affidavit Certificate of Non-Response serves as proof of dishonor in a commercial setting.

- A creditor that does not rebut a claim within the allotted timeframe is deemed to have abandoned their claim and thus forfeits any right to collect.

At this point, the debt is legally cancelled in commerce and recognized as uncollectible.

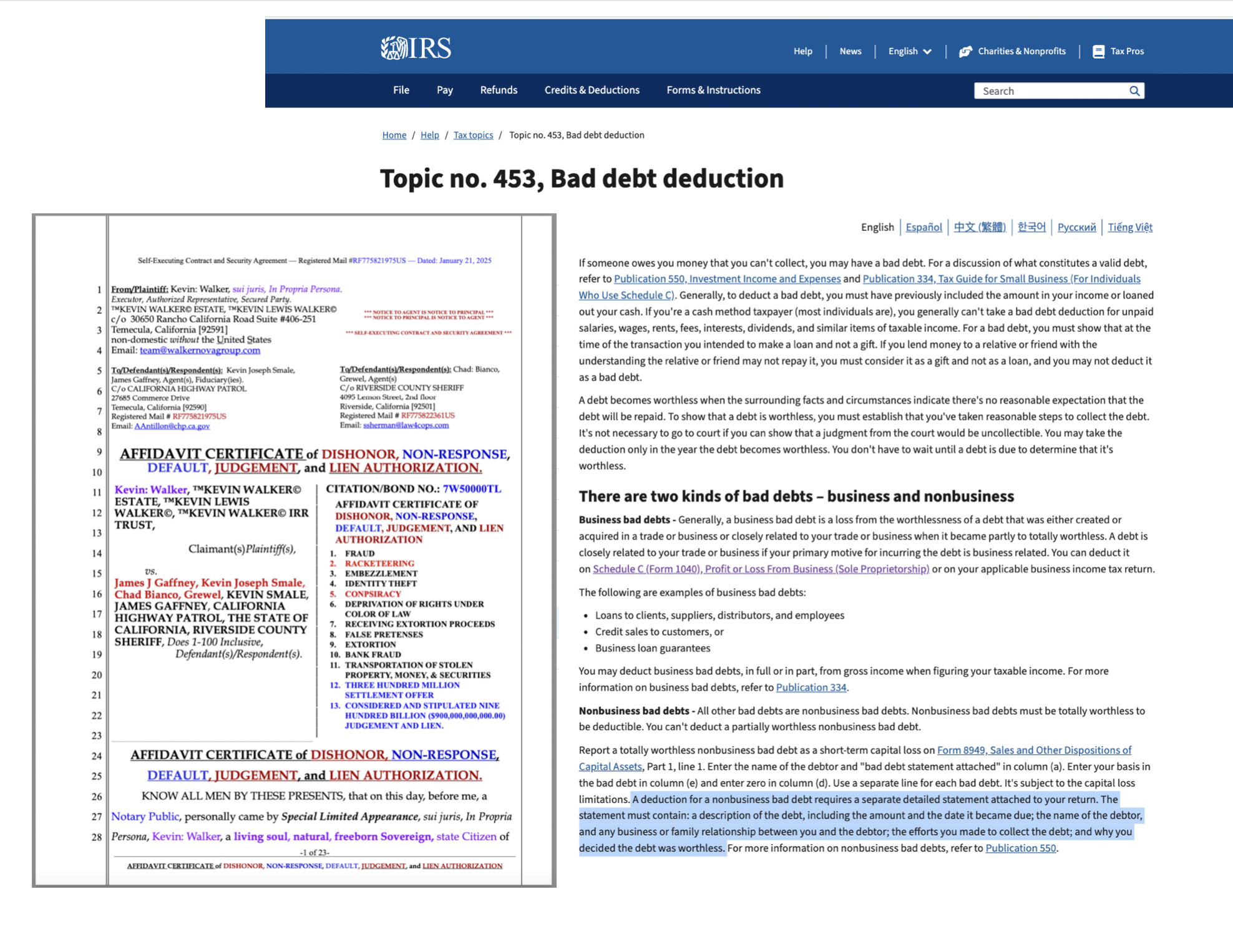

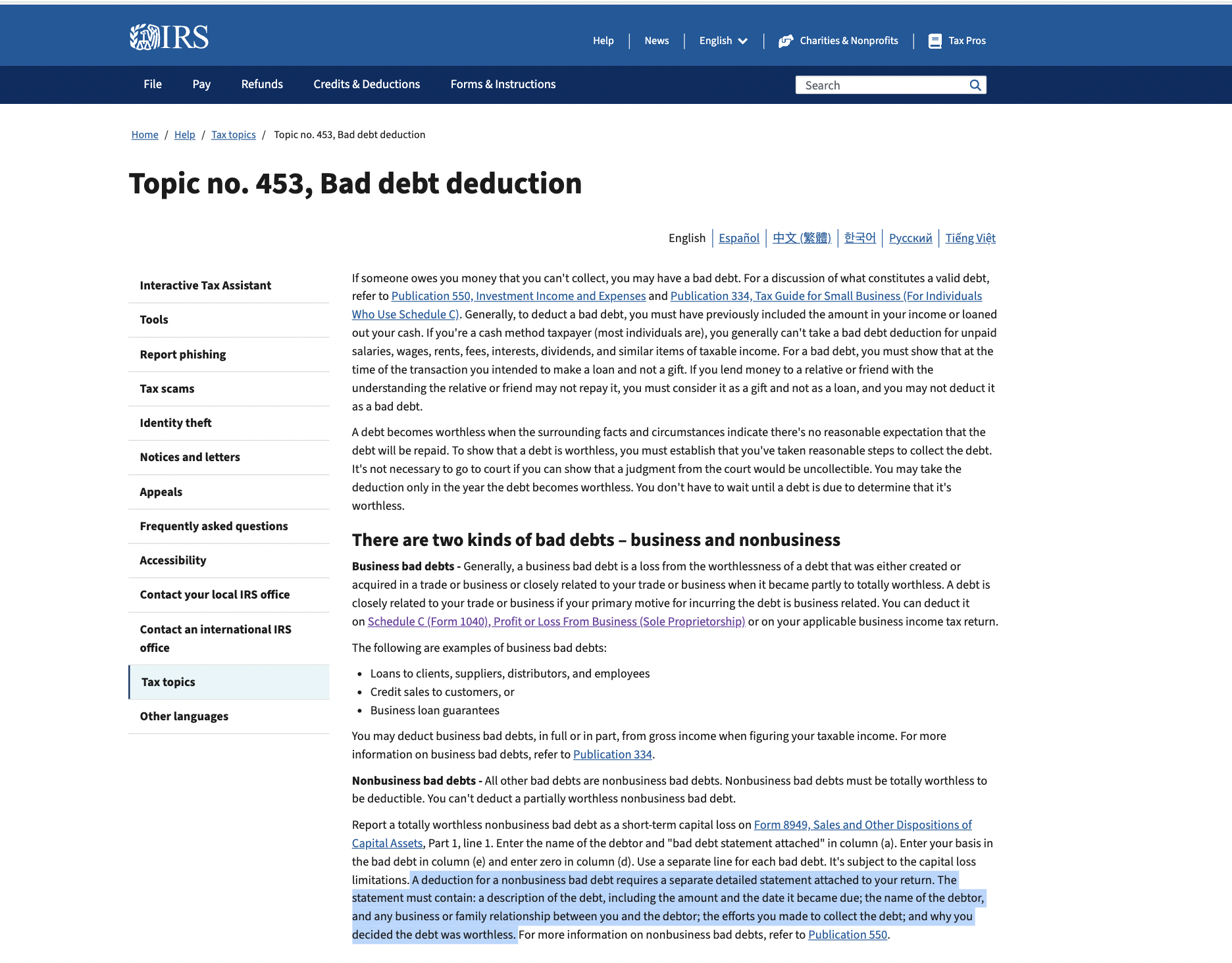

Step 4: Claiming a Bad Debt Deduction Under IRS Topic No. 453

Now that the debt is officially unrecoverable, it qualifies as a bad debt deduction under IRS Topic No. 453, which allows taxpayers to deduct the loss from their taxable income. The IRS recognizes two types of bad debts:

- Business Bad Debts – Deductible as an ordinary business loss.

- Non-Business Bad Debts – Treated as a short-term capital loss.

To claim a bad debt deduction:

- For businesses, the debt should be reported on Schedule C (Profit or Loss from Business) or the relevant business tax return.

- For individuals, the debt is reported on Form 8949 (Sales and Other Dispositions of Capital Assets) and carried to Schedule D (Capital Gains and Losses).

- Proper documentation is required, which includes:

- Affidavit of the debt’s validity.

- Notices of Default and Dishonor.

- Affidavit Certificate of Non-Response (UCC § 3-505 certified).

- Proof of attempted collection and abandonment of the claim.

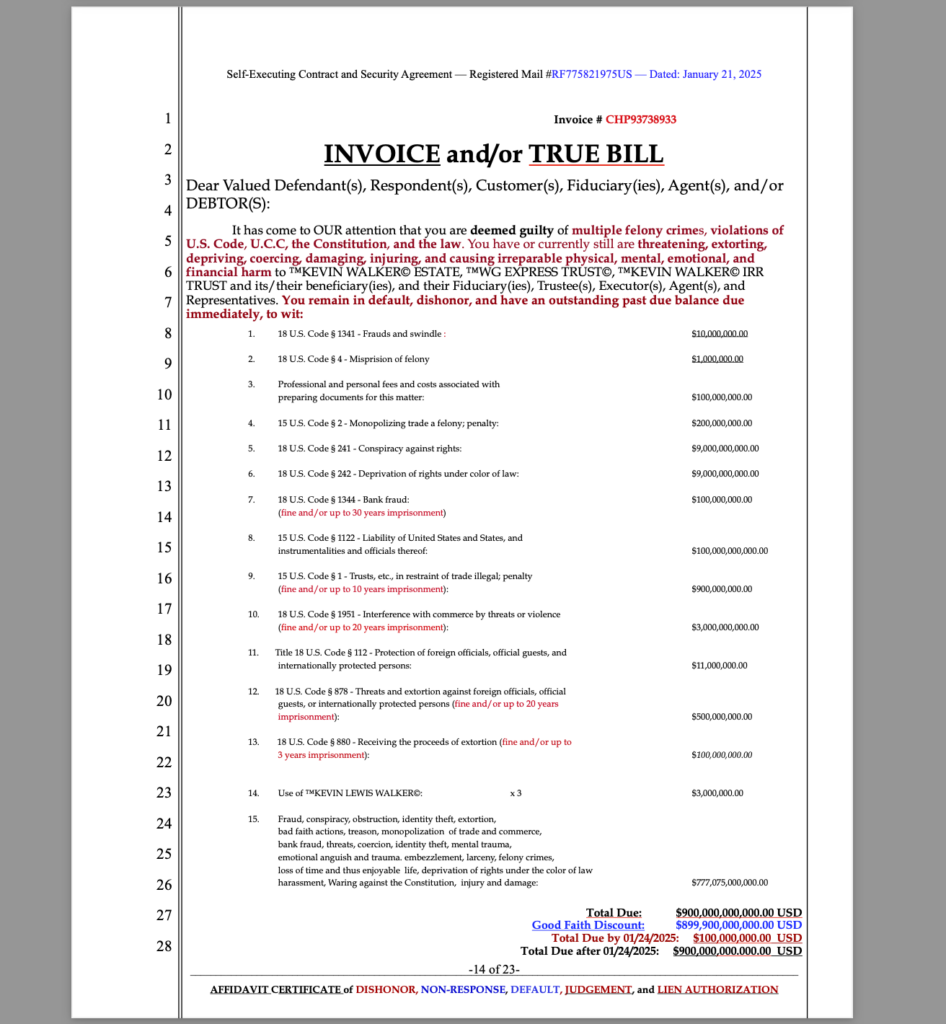

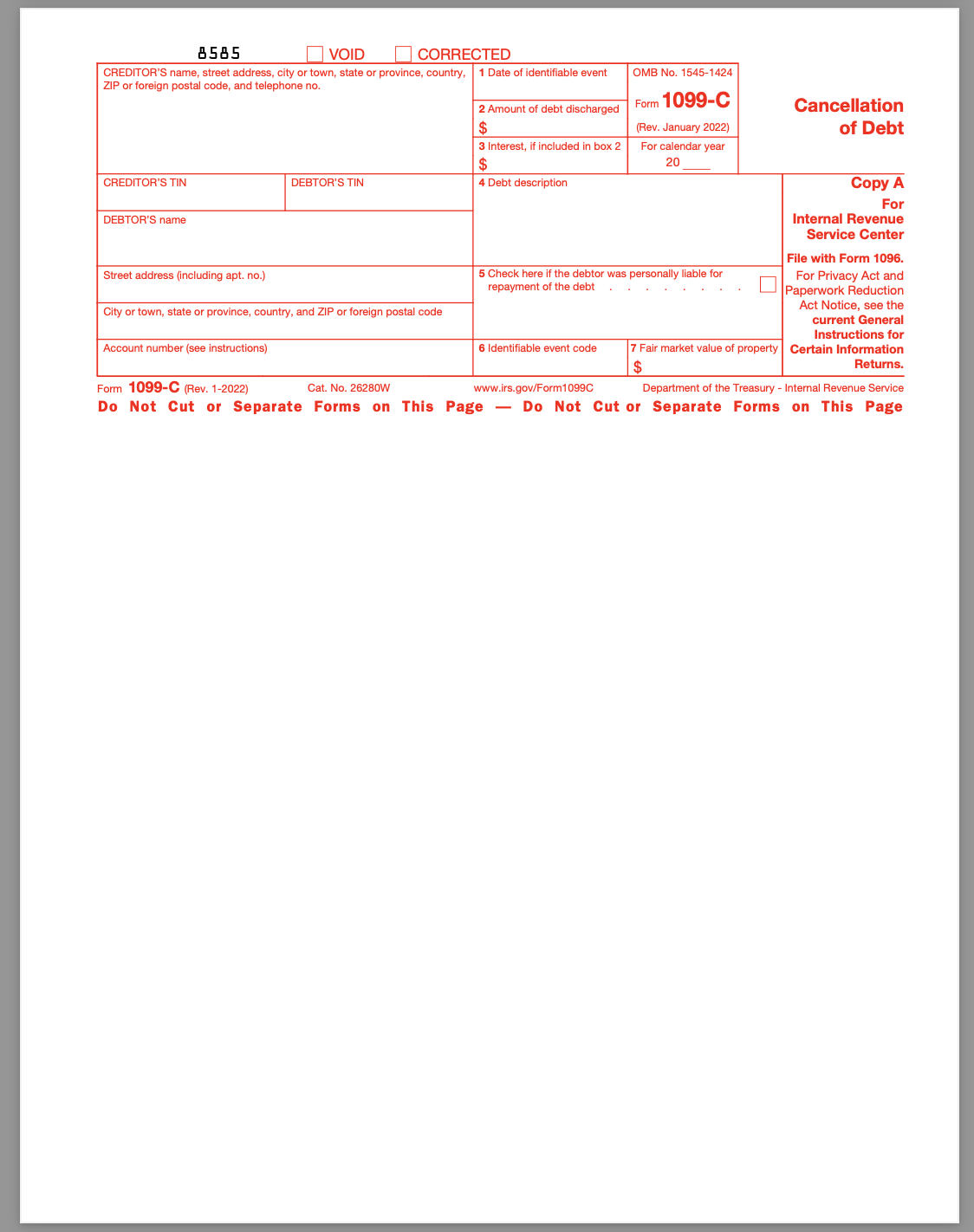

Step 5: Filing a 1099-C for Additional Tax Credit or Refund

A 1099-C (Cancellation of Debt) is typically filed by creditors when a debt is forgiven. However, individuals and businesses that have established a canceled debt through administrative processes may also issue a 1099-C to themselves and submit it with their tax return to claim a credit for the canceled amount.

Process for Filing a 1099-C:

- Obtain Form 1099-C from the IRS.

- List yourself as the creditor and debtor.

- Enter the canceled debt amount.

- Submit the form with your tax return.

- Claim any available refund or offset against taxable income.

Key Takeaways: The Power of Affidavits and UCC in Debt Cancellation

- An unrebutted affidavit stands as truth in law and commerce.

- Failure to rebut an affidavit results in default, dishonor, and forfeiture of claims.

- UCC § 3-505 allows for official recognition of a debt as uncollectible.

- A bad debt deduction can be claimed under IRS Topic No. 453.

- A 1099-C can be used to officially cancel the debt and potentially receive a refund.

By understanding and applying these legal and financial principles, individuals can cancel fraudulent debts, remove them from their records, and potentially recover lost funds through tax deductions or credits.

Conclusion: Leveraging Unrebutted Affidavits and UCC § 3-505 to Cancel Debt and Claim Tax Benefits

The power of an unrebutted affidavit lies in its ability to establish undisputed facts in both law and commerce. When properly executed, an affidavit process, followed by an Affidavit Certificate of Non-Response under UCC § 3-505, legally cancels the debt by placing the opposing party in dishonor. This process provides a clear path to classifying the debt as uncollectible, making it eligible for a bad debt deduction under IRS Topic No. 453.

Furthermore, filing a 1099-C (Cancellation of Debt) can serve as an additional financial remedy, allowing individuals to remove invalid or fraudulent debts from their records while potentially recovering a tax credit or refund.

By applying these principles, individuals and businesses can take control of their financial standing, eliminate unlawful debt claims, and ensure that their rights are protected under both commercial law and federal tax regulations.