Introduction

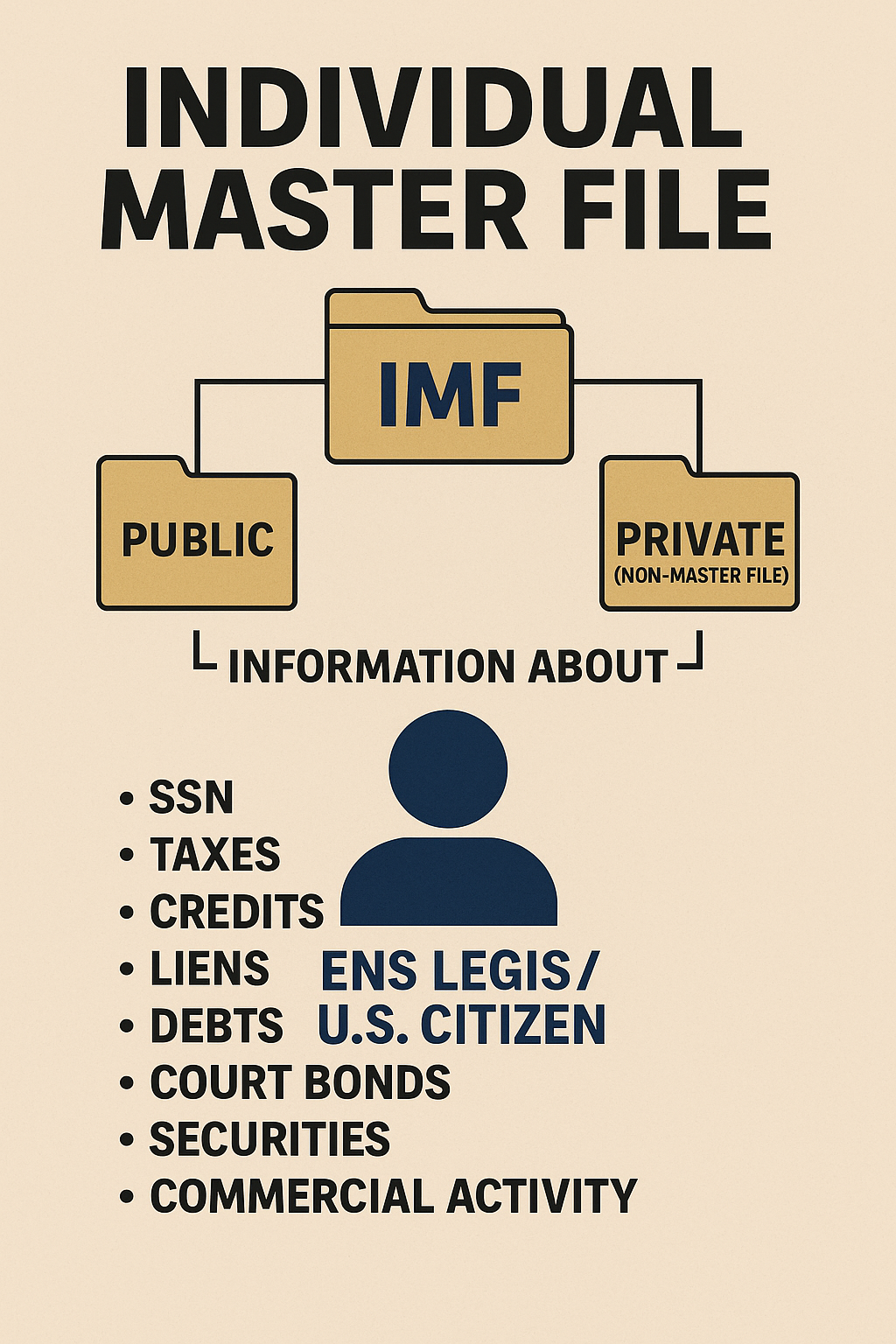

Every “U.S. citizen” is not the living man or woman — it is the ens legis, a legal entity or corporate franchise created and recognized by the federal government. This entity is tracked through the Individual Master File (IMF), maintained by the Internal Revenue Service (IRS) under the Department of the Treasury. The IMF and the “Non-Master File” are databases that document every commercial, tax, and financial activity associated with the legal fiction.

Understanding these files is essential for anyone asserting the distinction between their private capacity as a living man/woman and the public franchise the government compels into statutory compliance.

The Individual Master File (IMF)

The IMF is the IRS’s central database that records transactions linked to an individual taxpayer identification number (most often the Social Security Number). It tracks assessments, credits, withholdings, liens, and offsets. The IMF operates under authority granted to the IRS by Congress.

-

26 U.S.C. § 6103(b)(2) defines “return information” as including data “received by, recorded by, prepared by, furnished to, or collected by the Secretary with respect to a return.” This is precisely the type of information stored in the IMF.

-

26 C.F.R. § 301.6103(b)-1 (Treasury Regulation) clarifies what constitutes return information and IRS recordkeeping.

The IMF is not a simple tax account. It is an extensive commercial record that can link to securities, bonds, and obligations tied to the ens legis.

The Non-Master File (NMF)

When a transaction or filing cannot be processed through the normal IMF system, the IRS uses a Non-Master File (NMF). This often occurs when there is an unusual instrument, bond, trust matter, or off-cycle assessment.

The NMF is critical because it shows that the IRS (and Treasury) track obligations and credits outside of the “public” system. For example, certain liens, levy actions, or “special handling” instruments bypass the IMF and are instead logged in the NMF.

The Ens Legis and U.S. Citizen Entity

The distinction between the living man/woman and the “U.S. citizen” entity is central.

-

28 U.S.C. § 3002(15)(A) defines the “United States” as a federal corporation.

-

Black’s Law Dictionary (4th ed.) defines ens legis as: “An entity created by law and without existence except by law. Such as a corporation.”

This means that what the IRS is tracking in the IMF/NMF is not the living man or woman — it is the statutory person (the “U.S. citizen”), which functions as collateral and security for federal obligations.

Title 25 and Treasury Regulations

Though Title 25 of the U.S. Code primarily addresses Indians and tribal matters, it illustrates how federal trusteeship and fiduciary obligations operate when the government manages assets, land, and commercial rights of another party.

-

25 U.S.C. § 2 assigns the Commissioner of Indian Affairs the duty of managing “all matters arising out of Indian relations.” This shows the federal pattern of trusteeship, parallel to how the Treasury manages the ens legis through IMF/NMF records.

-

25 U.S.C. § 9 grants authority to issue regulations for the management of Indian affairs. Treasury regulations under 26 C.F.R. operate in a similar way for “U.S. citizens.”

In both contexts, the federal government manages property, credits, and obligations of an entity it regards as under its wardship.

Treasury Oversight and Fiduciary Role

The Department of the Treasury, through the IRS, acts as custodian over these IMF and NMF records.

-

31 U.S.C. § 321 grants the Secretary of the Treasury authority to manage the financial operations of the federal government.

-

31 C.F.R. Part 225 governs the acceptance of bonds secured by government obligations, linking back to how financial instruments tied to a Social Security Number or ens legis are securitized.

This means that every entry in the IMF or NMF is not just an “accounting line” — it represents a commercial security tracked under Treasury authority.

Conclusion

The Individual Master File and Non-Master File are the backbone of how the federal government records, tracks, and monetizes the activities of the ens legis — the “U.S. citizen.” Title 25 shows the template of trusteeship, and Treasury regulations confirm that obligations and credits are administered commercially under the Secretary of the Treasury.

The takeaway is simple: the IRS and Treasury are not managing the private living man or woman. They are managing the corporate franchise, the ens legis. Awareness of this distinction is the first step toward asserting private rights, reclaiming credits, and refusing unlawful compulsion under color of law.