Correct Application of Title 18 Claims

To begin, Judge Altman correctly recognized that criminal offenses under Title 18 of the U.S. Code require government enforcement. This is a standard principle in the legal system: only government entities such as law enforcement or prosecutors can enforce criminal statutes, such as those relating to fraud or extortion. This part of his ruling is sound and uncontroversial. However, this recognition is where his correctness stops.

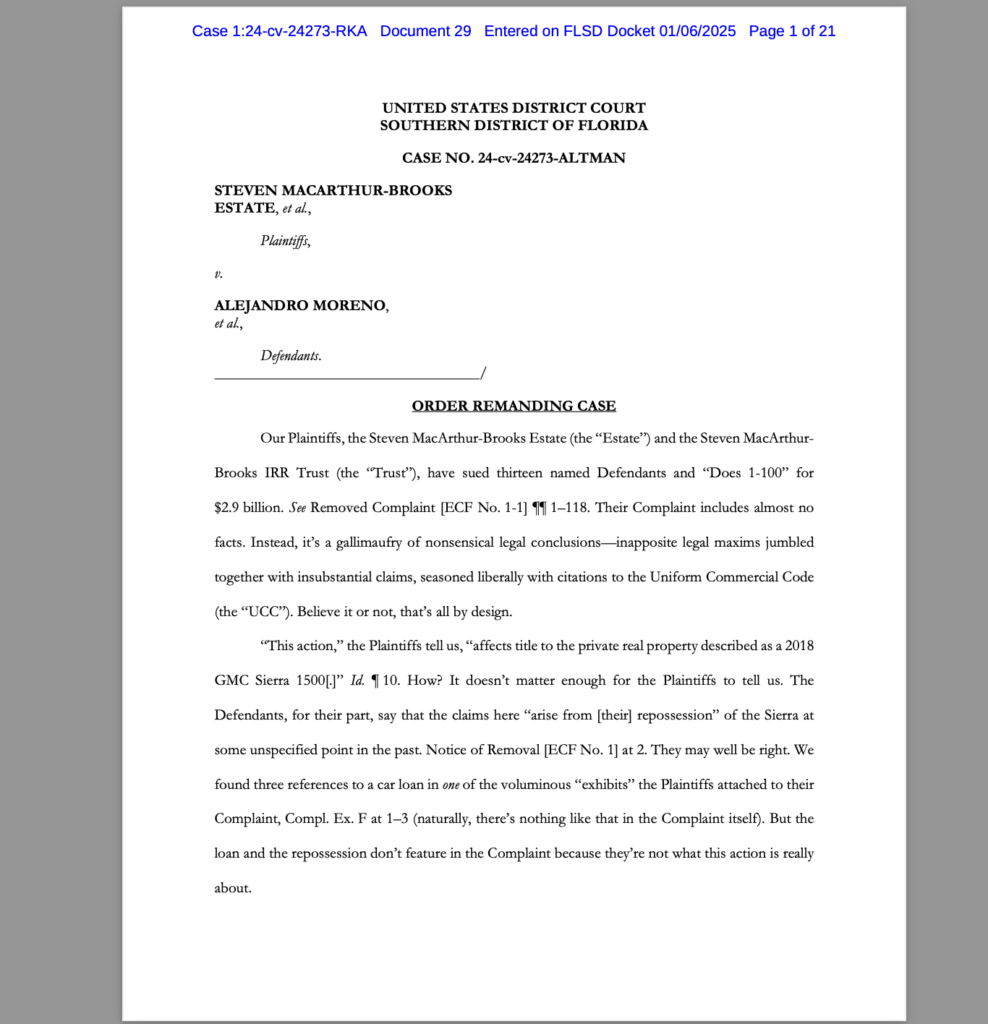

Disregarding the UCC Without Justification

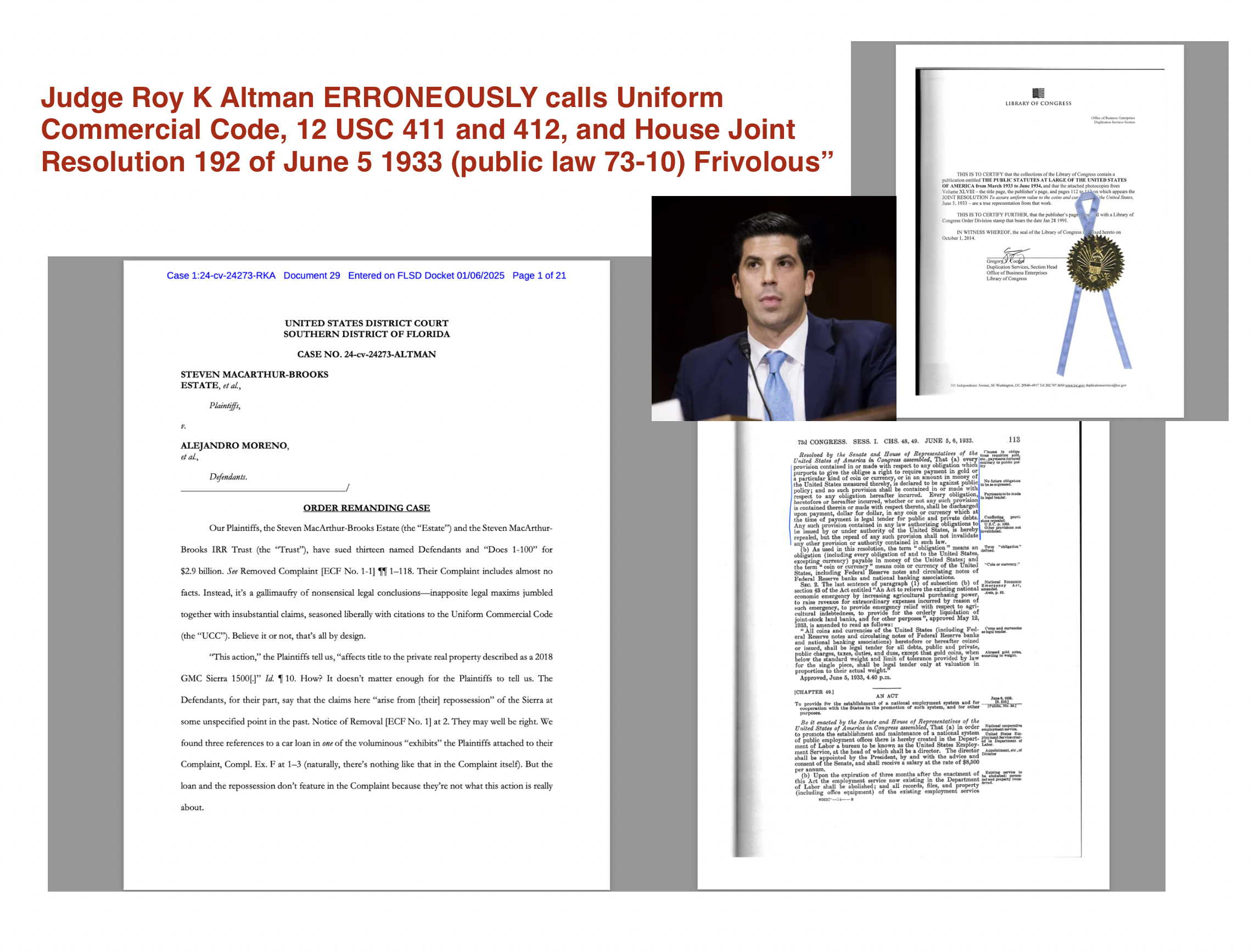

Judge Altman’s ruling takes a turn for the worse when it comes to the treatment of the Uniform Commercial Code (UCC). The plaintiffs in this case cited various UCC provisions—sections 3-603, 3-311, 1-103, 2-202, 2-204, and 2-206—all of which are foundational to U.S. commercial law, particularly in relation to negotiable instruments, contracts, and sales of goods. Yet, Altman dismissed these references with an air of disdain, as though they had no place in the case. This dismissal is deeply concerning and legally indefensible.

The UCC governs crucial aspects of U.S. commerce, and its provisions were cited by the plaintiffs to substantiate their legal arguments. Altman, instead of offering any meaningful legal analysis, chose to brush them aside, effectively disregarding their relevance without explanation. This lack of engagement with the law not only undermines the integrity of the judicial process but also shows a fundamental misunderstanding—or perhaps a deliberate ignorance—of the law.

Dismissing Established Federal Statutes as “Nonexistent” or “Frivolous”

What is even more troubling is Altman’s outright dismissal of other critical federal statutes cited by the plaintiffs. He labeled 12 U.S.C. §§ 411 and 412, 18 U.S.C. § 8, and 31 U.S.C. § 3123 as “nonexistent” or “frivolous.” These statutes are fundamental elements of U.S. law and financial regulation. To dismiss them as such is not only legally incorrect but an outright misrepresentation of U.S. law.

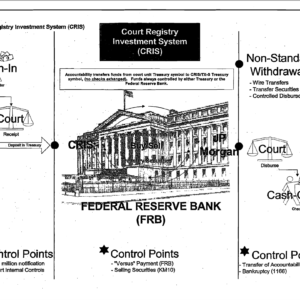

- 12 U.S.C. § 411 governs the issuance of Federal Reserve Notes, the very currency of the United States. For Altman to call this statute “nonexistent” is absurd. The Federal Reserve Note is an essential part of the U.S. monetary system, and this statute governs its legitimacy. To suggest that this law is irrelevant is to dismiss the very currency upon which the U.S. economy operates.

- 12 U.S.C. § 412 addresses the powers of the Federal Reserve, including its authority to set monetary policy. Calling this law frivolous is not only misleading but an attempt to downplay the importance of the Federal Reserve’s role in the U.S. financial system, and how the required collateral is: “The collateral security thus offered shall be notes, drafts, bills of exchange, or acceptances acquired under section 92, 342 to 348, 349 to 352, 361, 372, or 373 of this title, or bills of exchange endorsed by a member bank of any Federal Reserve district and purchased under the provisions of sections 348a and 353 to 359 of this title, or bankers’ acceptances purchased under the provisions of said sections 348a and 353 to 359 of this title, or gold certificates, or Special Drawing Right certificates, or any obligations which are direct obligations of, or are fully guaranteed as to principal and interest by, the United States or any agency thereof,”

Furthermore, 12 U.S.C. § 411 and § 412 provide critical insight into the Federal Reserve Note(FRN), and how when applying for FRNs collateral such as a bill of exchange is required. This effectively treats the note or bill as collateral that can be transferred in commercial dealings. This provision directly affects the U.S. monetary system, confirming that Federal Reserve Notes are not simply money but are also treated as collateral in financial transactions.

- 18 U.S.C. § 8 defines the term “obligation or other security of the United States” and includes Federal Reserve Notes, bonds, Treasury notes, and other financial instruments. For Altman to dismiss this as frivolous is a dangerous misunderstanding of financial law and a threat to the integrity of U.S. commercial transactions.

- 31 U.S.C. § 3123 governs the issuance of Treasury bonds and other U.S. Treasury obligations. Altman’s dismissal of this law is a reckless misrepresentation of U.S. financial practices.

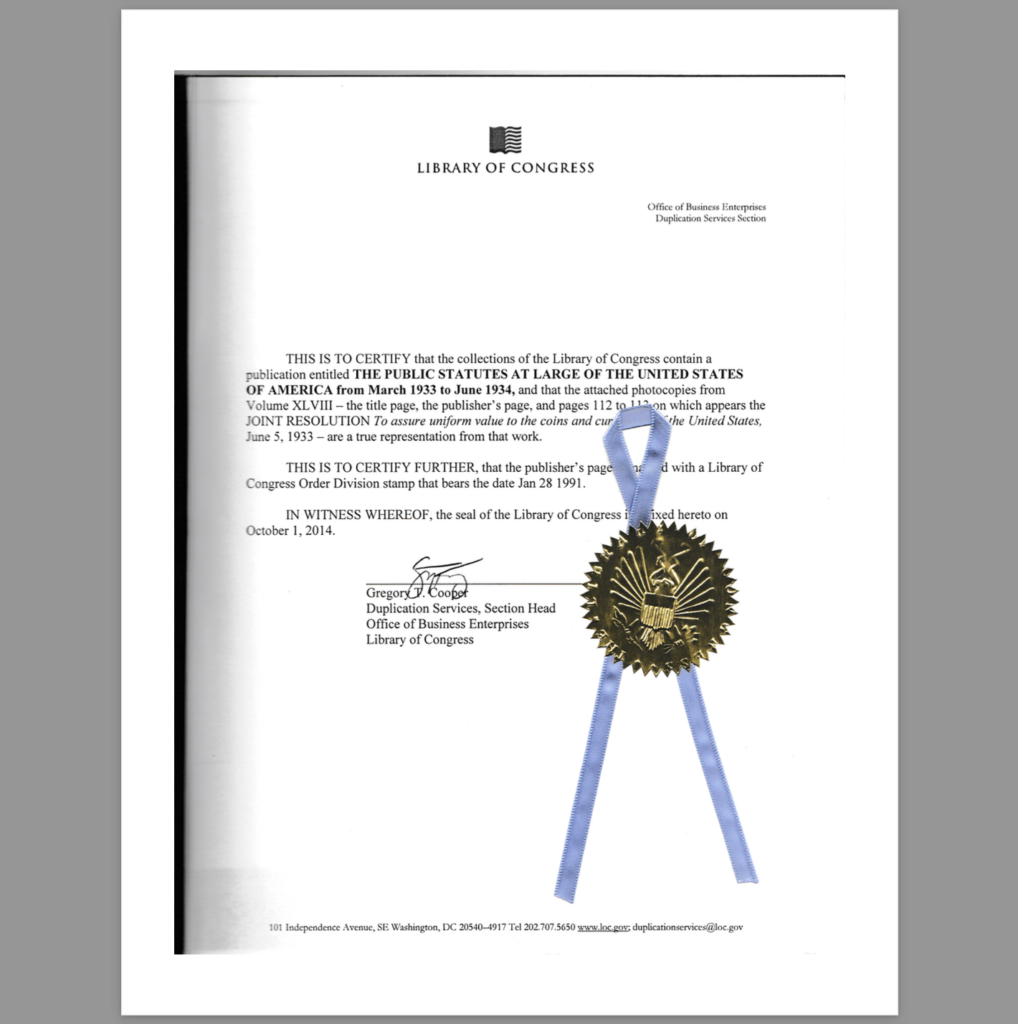

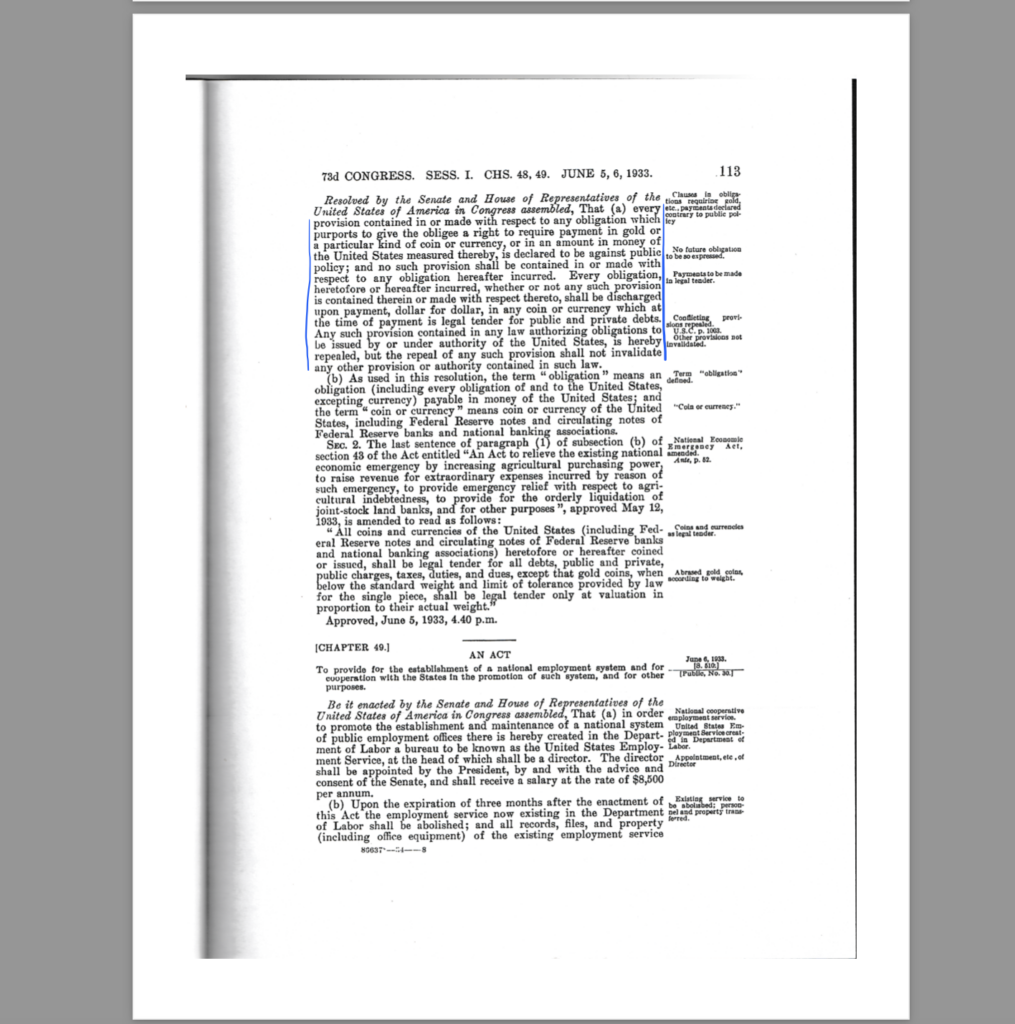

Denying the Legitimacy of House Joint Resolution 192 (Public Law 73-10)

One of the most astounding aspects of Judge Altman’s ruling is his denial of the legitimacy of House Joint Resolution 192, which was enacted on June 5, 1933 (Public Law 73-10). This resolution, which addressed the abandonment of the gold standard, also established the framework for Federal Reserve Notes as the legal tender of the United States. It is the legal foundation for the very currency in circulation today.

Judge Altman’s suggestion that this foundational law is not real or relevant is utterly nonsensical. House Joint Resolution 192 set forth a clear policy: the U.S. government would discharge all debts, both public and private, dollar for dollar, in the form of Federal Reserve Notes, marking a critical shift in U.S. monetary policy. To call this historic resolution “nonexistent” or irrelevant is to willfully ignore one of the most significant legislative acts in U.S. history.

This resolution not only authorized the issuance of Federal Reserve Notes but also addressed the government’s responsibility in discharging debts, effectively removing the gold standard. For a judge to dismiss the very introduction of the Federal Reserve Note as unreal or unimportant undermines the legal and financial framework of the United States. It’s a fundamental misstep in understanding the historical context of U.S. money and debt.

DOWNLOAD COPY

The Illusion of Legal Complexity

Altman’s ruling appears to deliberately obscure the law. By dismissing critical sections of the UCC and key federal statutes—including the foundational House Joint Resolution 192—without explanation, he creates an illusion of legal complexity. His failure to address these statutes properly suggests that these laws are somehow irrelevant or non-existent, leading to confusion about their application and significance. In reality, these provisions are foundational to U.S. commercial and financial law.

Rather than providing a thoughtful analysis, Judge Altman’s approach served only to muddy the waters, making it seem as if the legal principles involved are too complex or irrelevant to consider. This tactic does not clarify the law but rather serves to obfuscate and mislead.

A Dangerous Precedent

Judge Altman’s approach could set a dangerous precedent. By dismissing well-established laws like the UCC and critical federal statutes—including the foundational House Joint Resolution 192—without providing any reasoned legal analysis, he risks encouraging other judges to similarly disregard legal provisions with which they are not comfortable. This would undermine the integrity of the judicial system and erode public trust in the law.

A Failure to Engage with the Law

At its core, Judge Altman’s ruling represents a failure to engage with the law as it exists. The plaintiffs cited relevant and real laws—such as the UCC provisions and federal statutes—that are essential to understanding the legal and financial systems of the United States. Rather than engaging with these statutes thoughtfully, Altman dismissed them without explanation, leaving the plaintiffs and the public without any clear reasoning as to why these important provisions were ignored.

Most notably, he is either unaware of—or deliberately ignoring—the critical point that all obligations are government obligations, as outlined in 18 U.S.C. § 8. The law clearly states that Federal Reserve Notes, as an obligation of the U.S. government, are not only a form of currency but also the mechanism by which the government is responsible for discharging debts. The government’s role in this process is not optional; it is mandated by law. Altman’s failure to recognize this—whether out of ignorance or strategic misdirection—shows a profound misunderstanding of how the U.S. financial system is designed to work, or perhaps, more troublingly, an intentional attempt to play games with the law and its real-world implications.

Further compounding his ignorance or misdirection, 12 U.S.C. § 1813(L)(1) explicitly provides that money has been “received” by the term “deposit,” indicating that once funds are deposited into the banking system, they are recognized as having been legally received. This term “deposit” acknowledges the transition of currency from one entity to another, affirming the validity of Federal Reserve Notes as a legitimate and received form of money under U.S. financial law. Altman’s dismissal of this provision is yet another indication of his unwillingness to engage meaningfully with the legal text before him.

The Muddy Waters of HJR 192 and the Federal Reserve System

Given that the case needed to be remanded to state court anyway, Judge Altman may have taken the opportunity to muddy the waters with his incorrect and misleading statements about the government’s money being backed by gold once again. His dismissal of House Joint Resolution 192 (HJR 192) and the critical statutes, such as 12 U.S.C. §§ 411 and 412, as “frivolous” is particularly egregious. These laws not only form the bedrock of the current financial system but also set clear parameters for how the government handles debts and obligations. To call these foundational statutes “frivolous” is not only legally indefensible but shows a complete disregard for both the historical context and the legal structure governing U.S. money and debt.

Conclusion: A Legal Misstep

While Judge Altman’s acknowledgment of the need for government enforcement of Title 18 claims is sound, his handling of the Uniform Commercial Code (UCC) and the dismissal of essential federal statutes and is deeply concerning.