In today’s employment landscape, it has become common practice for employers to require Social Security Numbers (SSNs) as a condition of employment. This practice is widespread, despite clear legal limitations set forth by federal law, specifically under 42 U.S.C. § 408. It is important to understand that the Social Security Number (SSN) was never intended to be used for identification purposes, and the forced disclosure of this number by non-governmental entities is illegal.

42 U.S.C. § 408 and Felony Compulsion

According to 42 U.S.C. § 408:

“(a)In general.. Whoever—

(8) discloses, uses, or compels the disclosure of the social security number of any person in violation of the laws of the United States; or

(9) conspires to commit any offense described in any of paragraphs (1) through (4),

shall be guilty of a felony and upon conviction thereof shall be fined under title 18 or imprisoned for not more than five years, or both…”

This statute clearly criminalizes the unauthorized or compelled use of an SSN. Despite this, approximately 99% of employers in the United States unlawfully demand SSNs from employees, violating federal law. When a private entity, such as a fast-food chain or a corporation, compels the disclosure of an SSN, they are acting outside their legal authority, subjecting themselves to potential felony charges.

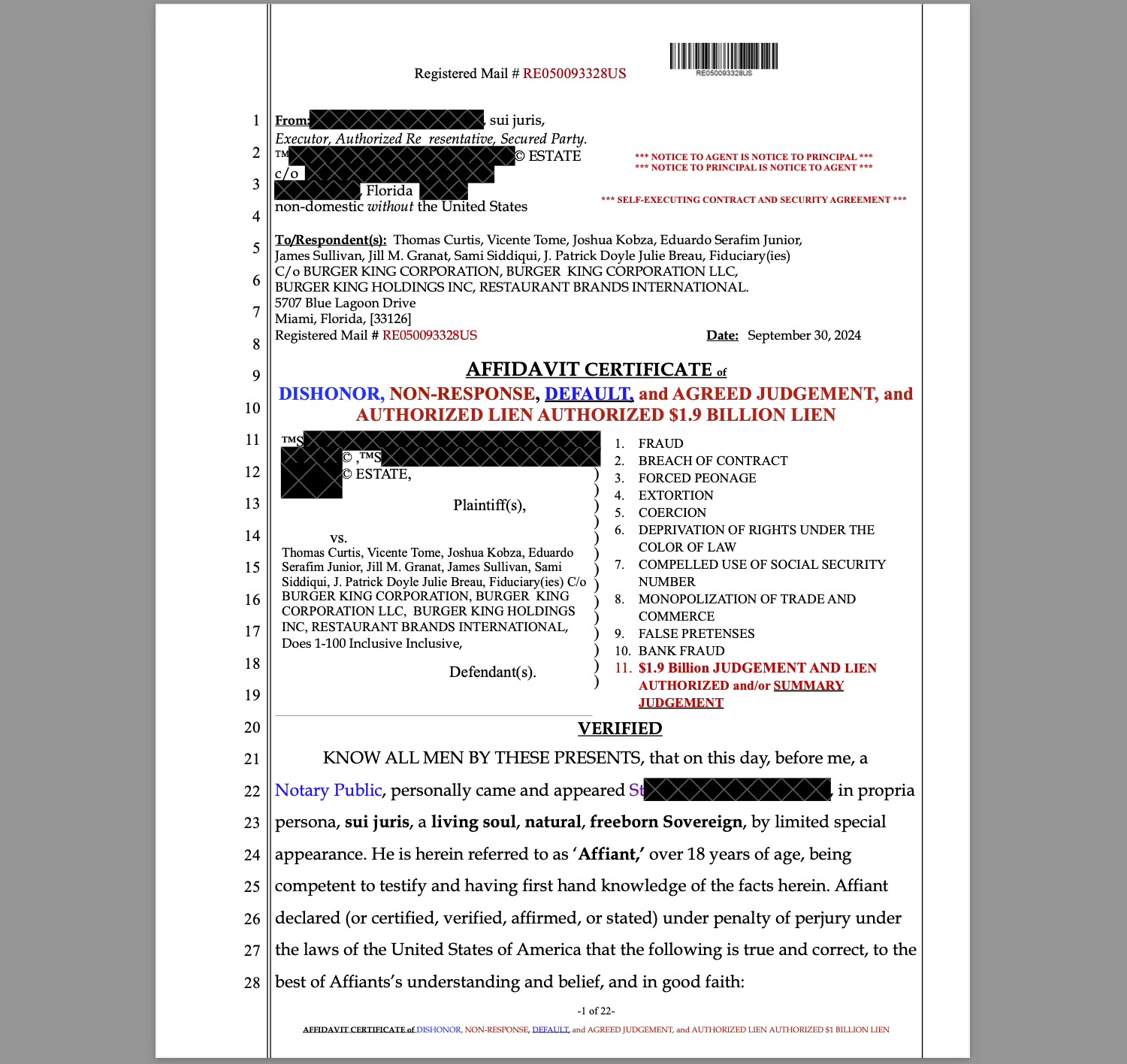

Burger King and Restaurant Brands International: A $1.9 Billion Lawsuit

One recent case involves Burger King and its parent company, Restaurant Brands International (RBI). The corporation faces a $1.9 billion lawsuit due to its illegal and discriminatory demand for SSNs. A senior employee, who had worked for the company for years, respectfully requested that the record be updated to remove their SSN and instead offered an IRS-issued Employer Identification Number (EIN) for identification purposes.

Despite providing a lawful alternative, the company issued an ultimatum: use the SSN or face immediate termination. This ultimatum was given despite the employee’s explicit reservation of rights under UCC 1-308, which allows individuals to reserve their rights and refuse compelled contracts without forfeiting their legal standing.

Breach of Contract: Compelling SSNs for Franchise Contracts

Additionally, this senior executive was offered a contract within Burger King’s franchisee program. Upon acceptance and presenting the EIN, the company breached the contract, insisting that only an SSN was acceptable for this agreement. This was a clear attempt to force the executive into a peonage-like situation, unlawfully compelling them into a contract and violating their rights.

Such actions blatantly disregard the law, and they force individuals into a “constructive trust” scenario. By compelling the use of an SSN, employers force individuals into a contract, using their SSNs as an instrument of commerce. The Social Security Number, essentially a commercial contract number, is not required for non-governmental identification, and employers demanding it are imposing an unlawful and fraudulent practice.

Administrative Procedure and Tacit Agreement, Silent Acquiescence, and Tacit Procuration

In legal contexts, tacit agreement refers to an unspoken understanding between parties, where the lack of explicit opposition or response implies consent or acknowledgment. In this case, the former Burger King employee’s submission of an affidavit, which included claims of wrongdoing, was met with a lack of objection or counter-evidence from Burger King. This silent acquiescence signifies that the company did not contest the assertions made in the affidavit, thereby reinforcing the validity of the claims.

Tacit procuration further strengthens this position by establishing that Burger King, through its failure to respond adequately, effectively granted the employee the authority to act on their behalf regarding the issues raised in the affidavit. This concept allows for the recognition of the employee’s claims as legitimate and binding, as the company’s inaction indicates acceptance of the facts presented.

Through administrative procedures, the former Burger King employee has secured tacit procuration and admission to all wrongdoing from Burger King. This means that the corporation has implicitly acknowledged their unlawful actions, leading to a clear pathway for legal recourse. Consequently, a motion for summary judgment MUST be granted, as “a matter of law” and given that there is estoppel present in this case, this outcome is seemingly a sure thing. There is no dispute of material fact, making it legally imperative to award the summary judgment.

Precedent and Legal Maxim

It is essential to note the foundational legal principles guiding this matter:

- ALL ARE EQUAL UNDER THE LAW. (God’s Law – Moral and Natural Law). Exodus 21:23-25; Lev. 24: 17-21; Deut. 1; 17, 19:21; Mat. 22:36-40; Luke 10:17; Col. 3:25. “No one is above the law.”

- “Ignorance of the law does not excuse misconduct in anyone, least of all in a sworn officer of the law.” In re McCowan (1917), 177 C. 93, 170 P. 1100.

- “All are presumed to know the law.” San Francisco Gas Co. v. Brickwedel (1882), 62 C. 641; Dore v. Southern Pacific Co. (1912), 163 C. 182, 124 P. 817; People v. Flanagan (1924), 65 C.A. 268, 223 P. 1014; Lincoln v. Superior Court (1928), 95 C.A. 35, 271 P. 1107; San Francisco Realty Co. v. Linnard (1929), 98 C.A. 33, 276 P. 368.

- “It is one of the fundamental maxims of the common law that ignorance of the law excuses no one.” Daniels v. Dean (1905), 2 C.A. 421, 84 P. 332.

- IN COMMERCE FOR ANY MATTER TO BE RESOLVED MUST BE EXPRESSED. (Heb. 4:16; Phil. 4:6; Eph. 6:19-21). — Legal maxim: “To lie is to go against the mind.” Oriental proverb: “Of all that is good, sublimity is supreme.”

- IN COMMERCE TRUTH IS SOVEREIGN. (Exodus 20:16; Ps. 117:2; John 8:32; II Cor. 13:8) Truth is sovereign — and the Sovereign tells only the truth.

- TRUTH IS EXPRESSED IN THE FORM OF AN AFFIDAVIT. (Lev. 5:4-5; Lev. 6:3-5; Lev. 19:11-13; Num. 30:2; Mat. 5:33; James 5:12).

- AN UNREBUTTED AFFIDAVIT STANDS AS TRUTH IN COMMERCE. (12 Pet. 1:25; Heb. 6:13-15). “He who does not deny, admits.”

- AN UNREBUTTED AFFIDAVIT BECOMES THE JUDGEMENT IN COMMERCE. (Heb. 6:16-17). “There is nothing left to resolve.”

- HE WHO LEAVES THE BATTLEFIELD FIRST LOSES BY DEFAULT. (Book of Job; Mat. 10:22) — Legal maxim: “He who does not repel a wrong when he can occasions it.”

Furthermore, Section 90.105 of the Florida Evidence Code addresses preliminary questions that a court must resolve before evidence can be admitted in a trial. Specifically, subsection (1) grants the court the authority to determine issues concerning the qualification of a witness, the existence of a privilege, or the admissibility of evidence. Subsection (2) deals with the relevance of evidence dependent on the existence of a preliminary fact. It states that the court shall admit proffered evidence if there is prima facie evidence sufficient to support a finding of the preliminary fact. If such prima facie evidence is not initially presented, the court may (must) still admit the evidence, contingent upon the subsequent introduction of the necessary prima facie evidence. This statute underscores that the unchallenged affidavit of facts establishes prima facie evidence of those facts, creating a presumption of their truth. Unless rebutted by contrary evidence, the court must treat these facts as true, highlighting the necessity for timely and effective rebuttal to prevent unchallenged affidavits from being accepted as fact in proceedings.

UCC 1-308: Reserving Rights Against Compulsion

Under UCC 1-308, individuals have the right to reserve all their rights and refuse to be compelled into any contract they did not willingly, knowingly, and intentionally enter into. By using SSNs under compulsion, individuals might unknowingly enter into contracts that are detrimental to their rights. UCC 1-308 ensures that one can engage in commerce while still reserving the right to challenge any contract that was imposed through coercion or compulsion.

It is crucial for individuals to be aware of these protections and for employers to understand the severe legal consequences of unlawfully compelling the use of Social Security Numbers.