Key Takeaways

-

- Broad Definition of Legal Tender: Under 31 U.S.C. § 5103, any monetary instrument created by a U.S. citizen or national is considered United States currency and legal tender.

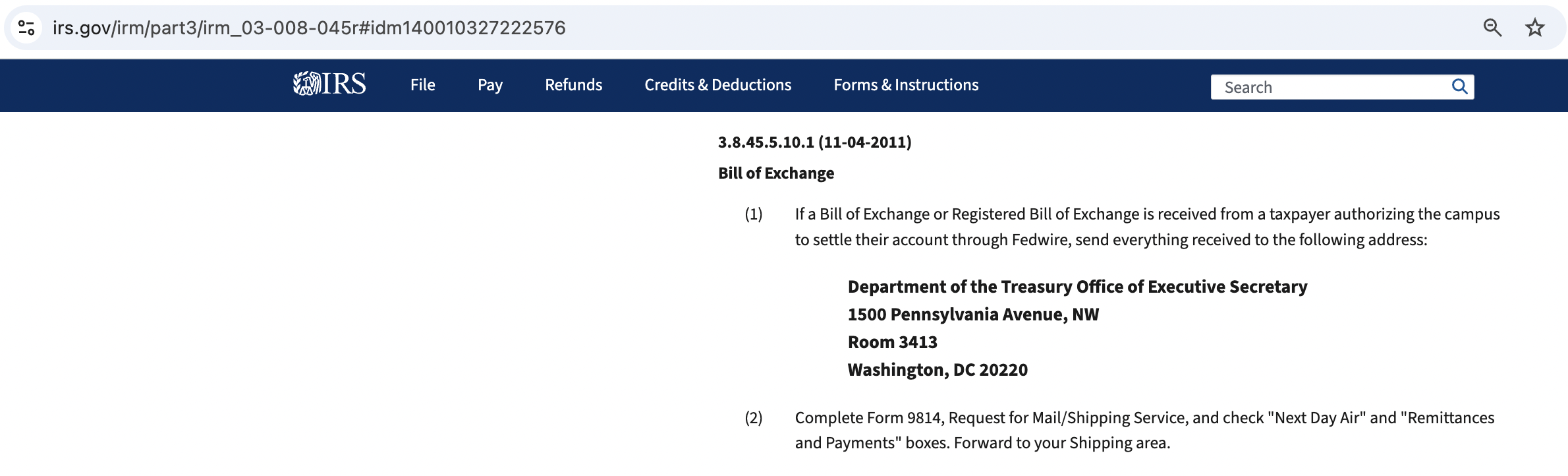

- IRS Obligation: The IRS is legally bound to accept properly executed Bills of Exchange, Bonds, Notes, and similar instruments as payment for debts, taxes, and public charges.

- Discharge by Refusal: Refusal to accept or return a negotiable instrument for correction results in the discharge of the obligation under UCC §§ 3-601, 3-603, and 3-311.

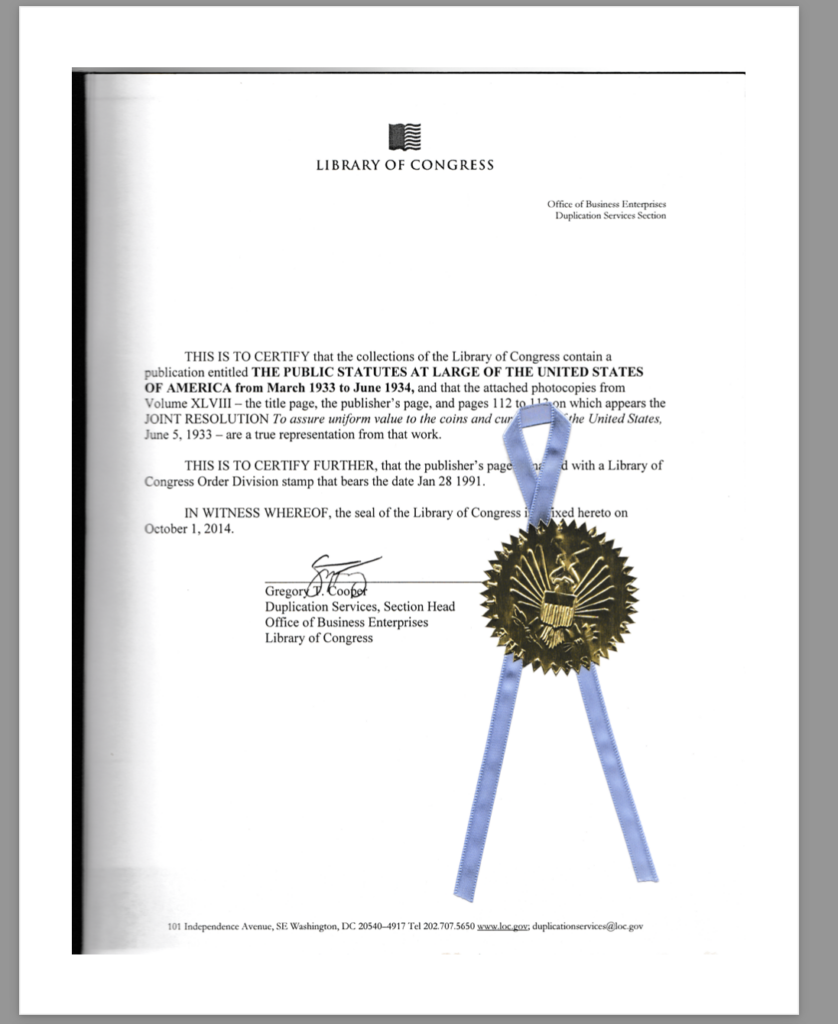

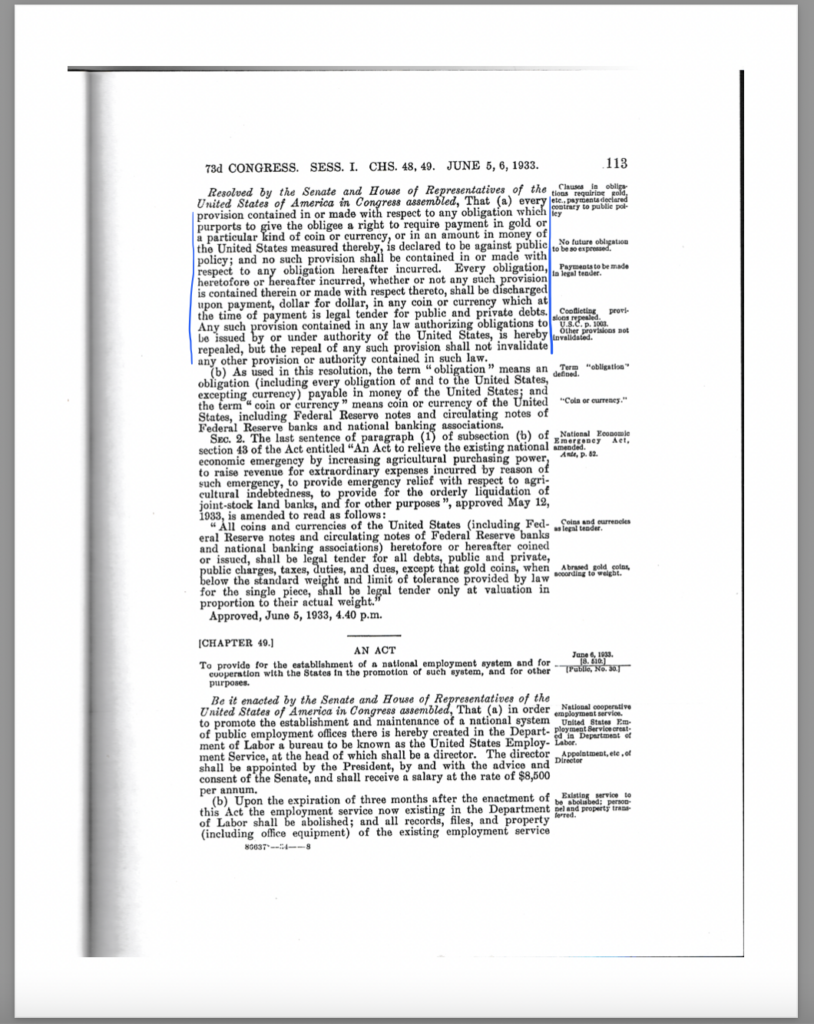

- Historical and Legal Basis: Federal statutes and public policy, such as the Emergency Banking Act, 31 U.S.C. § 5118, and HJR 192, provide robust support for the use of Bills of Exchange and other instruments as lawful payment.

The use of a Bill of Exchange as a form of payment to the Internal Revenue Service (IRS) is supported by well-defined commercial law and federal statutes. Recognized as a negotiable instrument under the Uniform Commercial Code (UCC), a Bill of Exchange functions as “tender of payment” and “legal tender” for tax obligations and debts. This article delves into the legal framework supporting this practice, including its connection to federal statutes such as 31 U.S.C. § 5103, 31 U.S.C. § 5118, and the Emergency Banking Act of 1933.

What Is a Bill of Exchange?

A Bill of Exchange is a negotiable instrument defined under UCC § 3-104 as a written, unconditional order by one party (the drawer) directing another party (the drawee) to pay a specified sum to a third party (the payee). It serves as a lawful substitute for money when executed properly and is recognized as a monetary instrument under U.S. law.

Legal Foundations Supporting Bills of Exchange

Uniform Commercial Code (UCC)

- UCC § 3-603: States that tender of payment discharges the obligation if the payment is refused. This principle applies regardless of whether the creditor (e.g., the IRS) chooses to accept the payment.

- UCC § 3-601: Specifies that obligations are discharged to the extent payment is made or tendered, even if the payment is not accepted.

- UCC § 3-311: Provides that if a negotiable instrument is tendered in good faith as payment of a debt, and it is refused or not returned with an opportunity to cure defects, the obligation is considered discharged.

31 U.S.C. § 5103 – Legal Tender

Under 31 U.S.C. § 5103, “United States coins and currency” are defined as legal tender for all debts, public charges, taxes, and dues. The definition of legal tender is broad and includes not only Federal Reserve Notes but also any monetary instruments created by a U.S. citizen or national, such as bonds, Bills of Exchange, notes, or other negotiable or non-negotiable instruments.

This expansive definition is rooted in the acknowledgment that all instruments generated by U.S. citizens or nationals are representations of the nation’s credit. When such instruments are properly executed, they carry the full backing of the United States and serve as legal tender for the settlement of debts, including tax obligations.

Connection to the Emergency Banking Act and 31 U.S.C. § 5118

The Emergency Banking Act of 1933 and 31 U.S.C. § 5118 reinforce the use of alternative forms of legal tender, including negotiable instruments such as Bills of Exchange:

- 31 U.S.C. § 5118: Prohibits any contractual obligation requiring payment in gold, ensuring that alternative forms of tender—including Bills of Exchange—are legally sufficient for settling debts.

- HJR 192 (1933): Established the federal government’s obligation to discharge debts using lawful instruments other than gold or silver, making negotiable instruments critical in a system no longer tied to precious metals.

These laws collectively affirm that negotiable instruments are valid substitutes for traditional currency, empowering citizens and nationals to settle their debts, taxes, and public charges lawfully.

The IRS and Monetary Instruments Created by U.S. Citizens or Nationals

All monetary instruments created by U.S. citizens or nationals—whether negotiable or non-negotiable—are considered United States currency under the law. When a U.S. citizen or national issues a Bond, Bill of Exchange, Note, or similar monetary instrument, it is deemed legal tender by operation of 31 U.S.C. § 5103. This recognition stems from the fact that such instruments are backed by the credit of the United States.

IRS Acceptance of Monetary Instruments

When presented with a properly executed monetary instrument:

- The IRS must evaluate the instrument as legal tender under 31 U.S.C. § 5103.

- If the instrument is defective, the IRS is obligated to return it with an explanation of the defect and allow the drawer an opportunity to cure, in accordance with UCC §§ 3-311 and 3-603.

- Failure to accept a valid instrument without cause or refusal to return a defective instrument constitutes discharge of the obligation under UCC § 3-601.