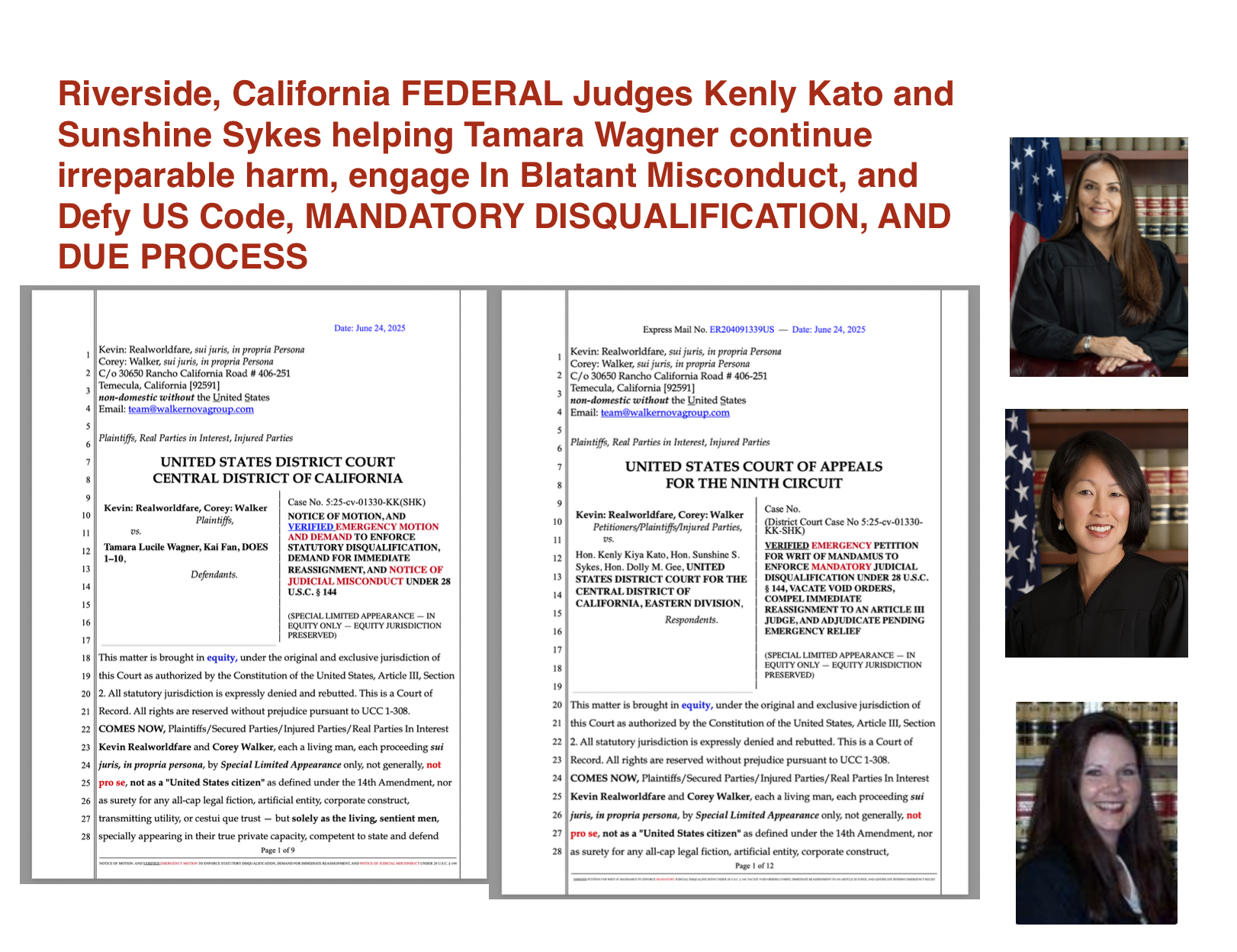

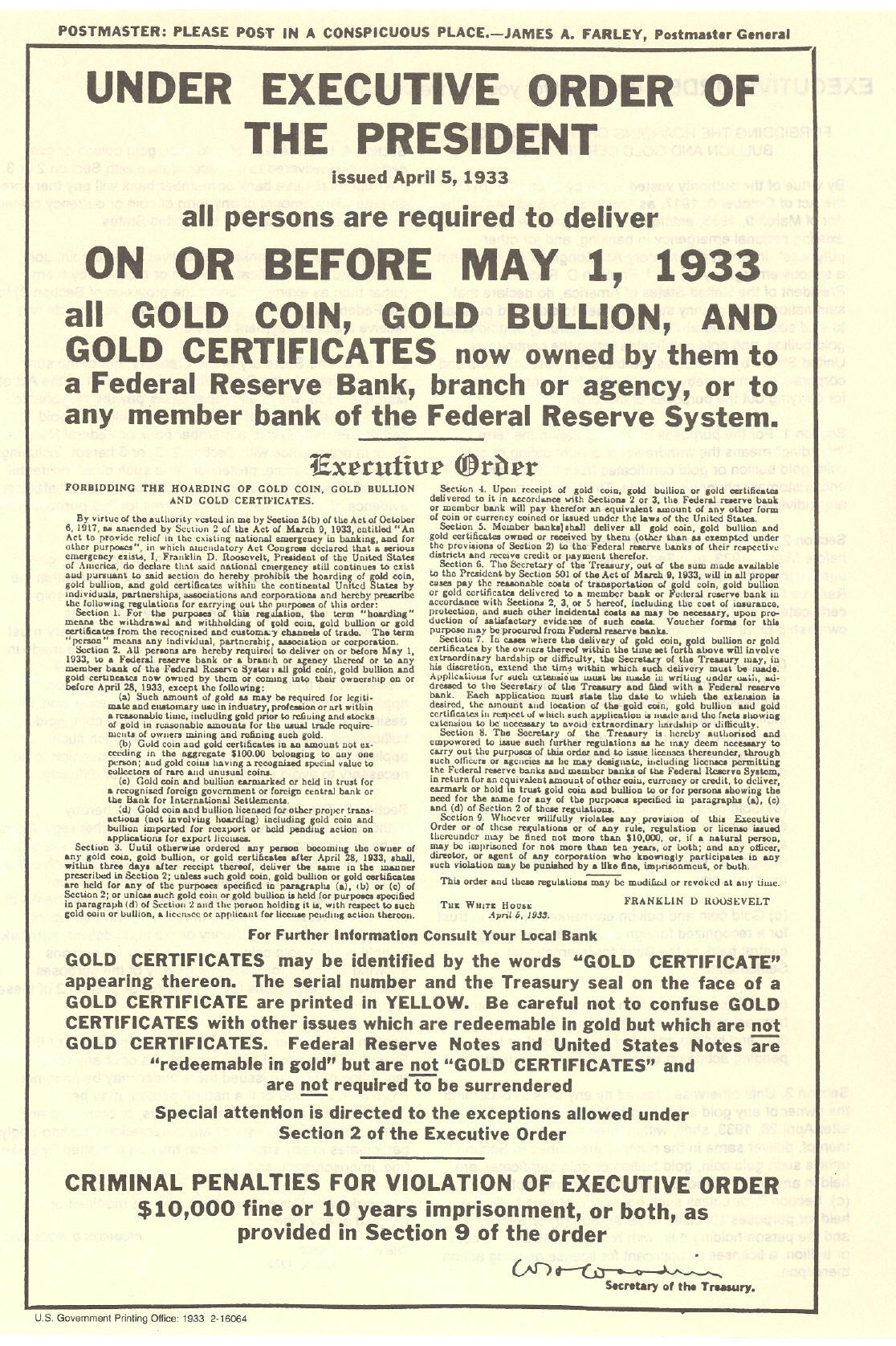

Before HJR 192 was passed, Executive Order 6102 was signed into effect by President Roosevelt. This executive order required all gold and gold certificates to be surrendered to the federal government by May 1, 1933. House Joint Resolution 192 was then passed by Congress on June 5, 1933. This law was passed to do away with the gold clause in the constitution and in all public and private contracts.

1933 was also when the United States went bankrupt, which was not the first time that it went bankrupt. In fact, the United States was so far in debt that it went bankrupt two additional time previously – once in 1789 (forming the Constitution so the state’s could sign on as security for the fed’s debts), and then in 1861 (when the Southern State’s said “No More” and wanted to succeed rather than sign on to another pledging of assets to pay the federal governments debt).

Then, in 1933, and with HJR192, they took all the Gold, all the true money, all the property (and instituted eminent domain and property taxes/divided land titles), and instituted the income tax to control the labor of the people. In addition, with HJR 192 is when they instituted the Birth Certificates to control the people and have the future American people become the collateral for all the federal governments debts. Yes…that’s right – your birth certificate is the TITLE to your body and it has been pledged as an asset. The holder has the right to the taxes and fines, fees, etc that you pay to the government through judgments, court cases, payroll, income taxes, property taxes, etc.

From the very beginning, the government was indebted to European bankers as a result of the revolution. How ironic that we had to borrow money from England to pay for the war we fought against them.

So, fast forward to the early 1900’s and you’ll come across several key events that make it quite obvious there was a master plan at work to enslave the people. If you read a book named The Creature From Jeckyll Island, you’ll become intimately acquainted with the happenings in the year 1910, when 6 men, who were either elite bankers and/or politicians, met in secret in a place named Jeckyll Island. The purpose of this meeting was to formulate plans for economics reforms for the United States. This is where the banking cartel began in this country. The idea of a central bank had always been rejected, and so the men who met on Jeckyll Island, needed to come up with a way to trick the people into allowing a central bank to be instituted.

Three years later, in 1913, President Wilson signed the Federal Reserve Act into effect, which is the current central bank in the United States, even though it is actually not governed by any agency of the Federal Government. Eight years later, in 1921, the Maternity Act was passed which required all birth to be registered with the state. So, now all key pieces were in place for the upcoming bankruptcy default and restructure.

In 1933, when the Federal Government went bankrupt, they passed Executive Order 6102 and House Joint Resolution 192 of June 5 1933, Public Law 73-10, and pledged us as collateral to back the government debt.

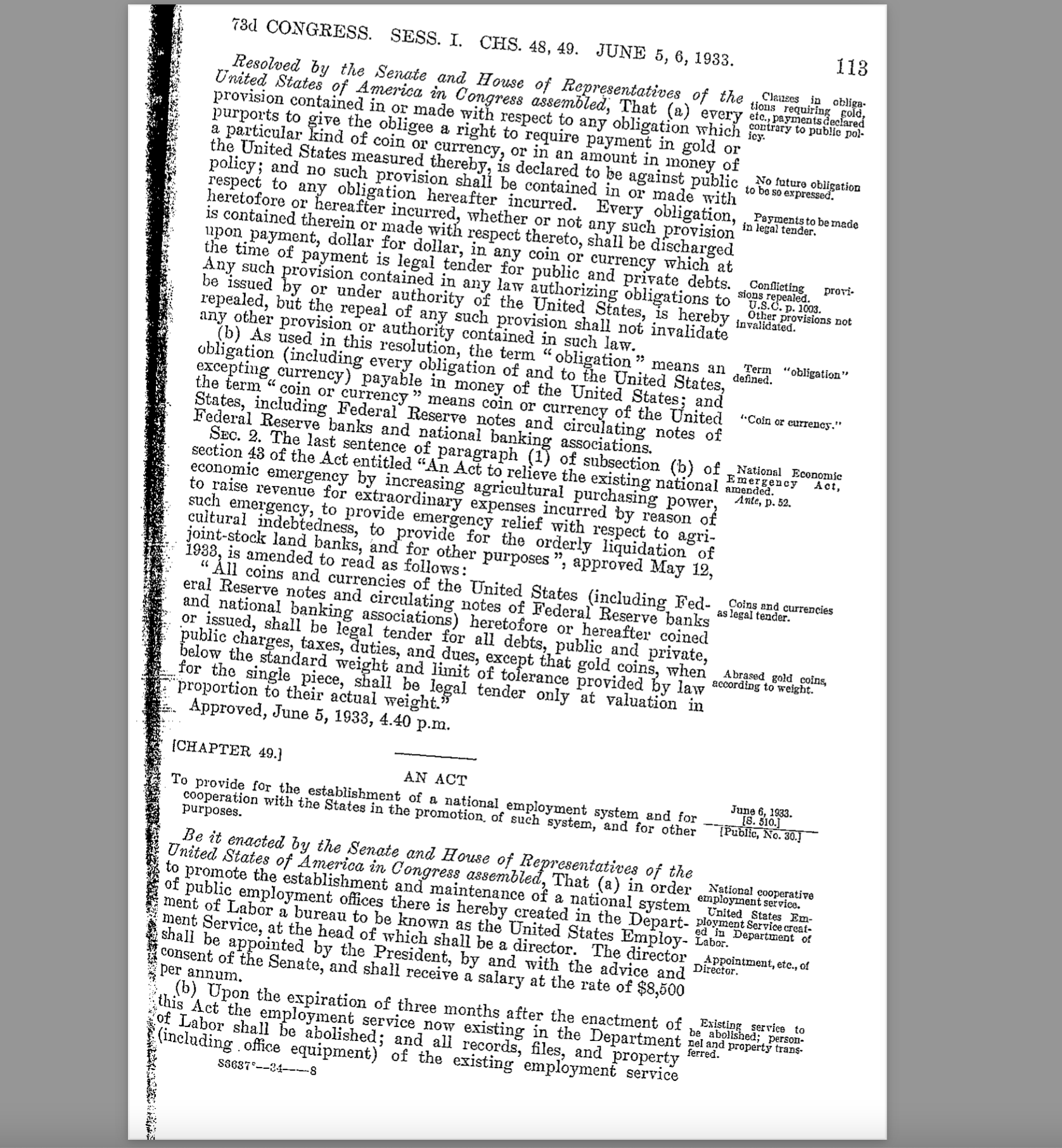

House Joint Resolution 192 of June 5 1933, Public Law 73-10 (HJR 192):

[“]Now therefore be it resolved by the Senate and House of Representatives of the United States of America in Congress assembled, That (a) every provision contained in or made with respect to any obligation which purports to give the obligee a right to require payment in gold or a particular kind of coin or currency, or in an amount in money of the United States measured thereby, is declared to be against public policy; and no such provision shall be contained in or made with respect to any obligation hereafter incurred.

Every obligation, heretofore of hereafter incurred, whether or not any such provision is contained therein or made with respect thereto, shall be discharged upon payment, dollar for dollar, in any coin or currency which at the time of payment is legal tender for public and private debts. Any such provision contained in any law authorizing obligations to be issued by or under authority of the United States, is hereby repealed, but the repeal of any such provision shall not invalidate any other provision or authority continued in such law.[“]

On June 5, 1933, Congress enacted HJR-192 to suspend the gold standard and to abrogate the gold clause. This resolution declared that “Whereas the holding or dealing in gold affect the public interest, and are therefore subject to proper regulation and restriction; and whereas the existing emergency has disclosed that provisions of obligations which purport to give the obligee a right to require payment in gold or a particular kind of coin or currency. . . are inconsistent with the declared policy of congress. . . in the payment of debts.

This resolution declared that any obligation requiring “payment in gold or a particular kind of coin or currency, or in an amount in money policy; and . . . Every obligation heretofore or hereafter incurred, shall be discharged upon payment, dollar for dollar, in any coin or currency which at the time of payment is legal tender for public and private debts.”

A farm control bill around the same time period had attached to it a clause making Federal Reserve notes legal tender. In 1937, the Supreme Court struck down the Farm Control Act, thus carrying with it the legal tender status of Federal Reserve notes. Prior to 1933, Federal Reserve notes were used for inter-bank transfers. Around 1945, Congress passed a bill which called for the withdrawal of Federal Reserve notes from public circulation; but, they are still with us. . . *NOTE that the words do not talk about “payment” of debt, but clearly states that “Every Obligation . . . Shall be discharged.”

In the case of Stanek v. White, 172 Minn. 390, 215 H.W. 784, the court explained the legal distinction between the words “payment” and “discharge”: “There is a distinction between a `debt discharged’ and a `debt paid.’ When discharged the debt still exists though divested of its character as a legal obligation during the operation of the discharge. Something of the original vitality of the debt continues to exist, which may be transferred, even though the transferee takes it subject to its disability incident to the discharge. The fact that it carries something which may be a consideration for a new promise to pay, so as to make an otherwise worthless promise a legal obligation, makes it the subject of transfer by assignment.”

Thus, it is clear that, as a result of HJR 192 and from that day forward (June 5, 1933), no one has been able to pay a debt. The only thing they can do is tender in transfer of debts, and the debt is perpetual. The suspension of the gold standard, and prohibition against paying debts, removed the substance for our Common Law to operate on, and created a void, as far as the law is concerned. This substance was replaced with a “Public National Credit” system where debt is money (The Federal Reserve calls it “monetized debt”) over which the only jurisdiction at is Admiralty and Maritime.

HJR-192 was implemented immediately. The day after President Roosevelt signed the resolution the treasury offered the public new government securities, minus the traditional “payable in gold” clause. Article I, Section 10, Clause 1, proscribes the States making any thing but gold and silver coin a tender in payment of debt — but, this Article does not contain an absolute prohibition against the States making something else a tender in transfer of debt.

HJR-192 prohibits payment of debt and substitutes, in its place, a discharge of an obligation — thereby not only subverting, but totally bypassing the “absolute prohibition” so carefully engineered into the Constitution. There is, now, nothing for this Article to operate on, just as there is nothing for Common Law to operate on. Perpetual debt, bills, notes, cheques and credits fall within a totally different jurisdiction than contemplated by Article I, Section 10, Clause 1 — and that jurisdiction belongs exclusively to the Law of Admiralty and Maritime. Now, it is easy to see how “bills” as plenty as oak leaves, “polluted the laws after the War For Independence, as described by Peletiah Webster”. This is how we lost access to substantive Common Law — the very law the Minute Men fought to regain.

HJR-192 places every person who deals in the public national credit in the legal position of a merchant, and the only jurisdiction over any controversy involving this subject matter is Admiralty and Maritime. Obviously, if we cannot pay our debts at law, we are also benefiting from limited liability under the Limited Liability Act when we use this credit– and, that is marine insurance!

The definitions of “liability” and “insure” will help convince us of this fact — in analyzing these definitions, keep in mind the distinction between “payment” and “discharge”. Liability: The word is a broad term. It has been defined to mean: all character of debts and obligations. . . any kind of debt or liability, either absolute or contingent, express or implied . . . condition which creates a duty to perform an act immediately or in the future . . . duty to pay money or to perform some other service . . . the state of being bound or obligated in law or justice to do, pay, or make good something. “Insure: “To engage to indemnify a person against pecuniary loss from specified perils or possible liability”.

QUESTION #1: Who do you suppose took possession of the treasury of the State of Pa. on June 5, 1933, — the moment HJR-192 made it impossible for the State of Pennsylvania to pay its debts?

QUESTION #2: Land titles being allodial in Pennsylvania, what was the State Assembly’s authority and jurisdiction to pledge these allodiums to the Federal Reserve as security for loan contracts from the Federal Government?

QUESTION #3: If the individual citizens of Pennsylvania were indeed “sovereign” under the Common Law — What was the authority and jurisdiction of the State Assembly to pledge their labor to the Federal Reserve pool?

Clearly, the alleged authority and jurisdiction is the so-called public policy declared by Congress.

If all the assets of the United States have been hypothecated to the Federal Reserve “pool” as security for the maritime loan and insurance underwriting policy, then that raises a couple of questions: QUESTION #1: If the United States “dies” (or is merged) under a One World government, who gets the pool? QUESTION #2: If the Federal Reserve “dies” by way of getting its charter rescinded, who gets the pool?

The answers can be found in the Federal Reserve Act itself: “Should a Federal Reserve bank be dissolved or go into liquidation, any surplus remaining, after the payment of all debts, dividend requirements as herein before provided, and the par value of the stock, shall be paid to and become the property of the United States and shall be similarly applied”.

31 USC 315B provided that: “No gold shall after January 30, 1934, be coined, and no gold coin shall after January 30, 1934, be paid out or delivered by the United States; provided however, that coinage may continue to be executed by the mints of the United States for foreign countries”. This exception was necessary because foreign countries, being recognized or sovereign, could not be held to the internal public policy of the United States. HJR-192 was binding only upon those individuals who were beneficiaries of public policy; that being the privilege of limited liability for payment of debt arising out of participation in the Federal Reserve Public Credit System.

HJR-192 automatically extended the privilege to renege on debts to every person using the Federal Reserve banking system; however, never forget that when you operate on a privilege, you have to respect the ruler of the giver of that privilege. Furthermore, in the case of Great Falls Mfg. Co. v. Attorney General, 124 U.S. 581, the court said: “The court will not pass upon the constitutionality of a statute at the instance of one who has availed himself of its benefits.” Thus, if you avail yourself of any benefits of the public credit system you waive the right to challenge the validity of any statute pertaining to, and conferring “benefits” of this system on the basis of constitutionality.

Article 1 Section 10 of the Constitution States:

No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts; pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts, or grant any Title of Nobility.

No State shall, without the Consent of the Congress, lay any Imposts or Duties on Imports or Exports, except what may be absolutely necessary for executing it’s inspection Laws: and the net Produce of all Duties and Imposts, laid by any State on Imports or Exports, shall be for the Use of the Treasury of the United States; and all such Laws shall be subject to the Revision and Controul of the Congress.

No State shall, without the Consent of Congress, lay any Duty of Tonnage, keep Troops, or Ships of War in time of Peace, enter into any Agreement or Compact with another State, or with a foreign Power, or engage in War, unless actually invaded, or in such imminent Danger as will not admit of delay.

They made us slaves. But they couldn’t technically make us slaves, because that would be illegal. So, they had to give us a remedy. So what is the HJR 192 Remedy? It is that the government has the obligation to discharge and settle any debts we may incur in our daily lives. Yes, this includes mortgages, car loans, utilities, etc…

The provisions that brought us into having no money of substance still exist and apply. In other words, we didn’t go back to using “real money” (gold/silver) again; and therefore, the maxim of “whoever brings the obligation must bring the remedy” still applies. So, the government still has the fiduciary duty to discharge and settle your debts, because we still don’t have access to money of real substance, AND because the USA is still in bankruptcy mode. So, the Secretary of the Treasury is still the “Receiver” in a Bankruptcy. Your birth certificate is still a bond and your debts are still prepaid by your future labor, property, and taxes that they are assuming the Administration of as the Office of the Executor of the ESTATE of the ALL CAPS JOHN H DOE name. They still hypothecated the Birth Certificate and made Billions of the birth (or Naturalization) of every new citizen. In fact, in every court case over $7,000, there are new bonds created and traded off your BC ESTATE.