Introduction: A Case That Exposes Systemic Corruption

The case of Kevin Walker Estate, et al. v. Jay Promisco, PHH Mortgage Corporation, et al. has unearthed a shocking display of legal incompetence, procedural fraud, and judicial manipulation. The Defendants, led by attorney Neil J. Cooper, have engaged in an orchestrated campaign of misrepresentation, obstruction of justice, and outright deception, abusing the legal process to prevent Plaintiffs from obtaining rightful relief.

Worse still, the Riverside Federal Court has displayed active complicity in this judicial fraud by refusing to properly file Plaintiffs’ documents, raising grave concerns about the integrity of the judicial process.

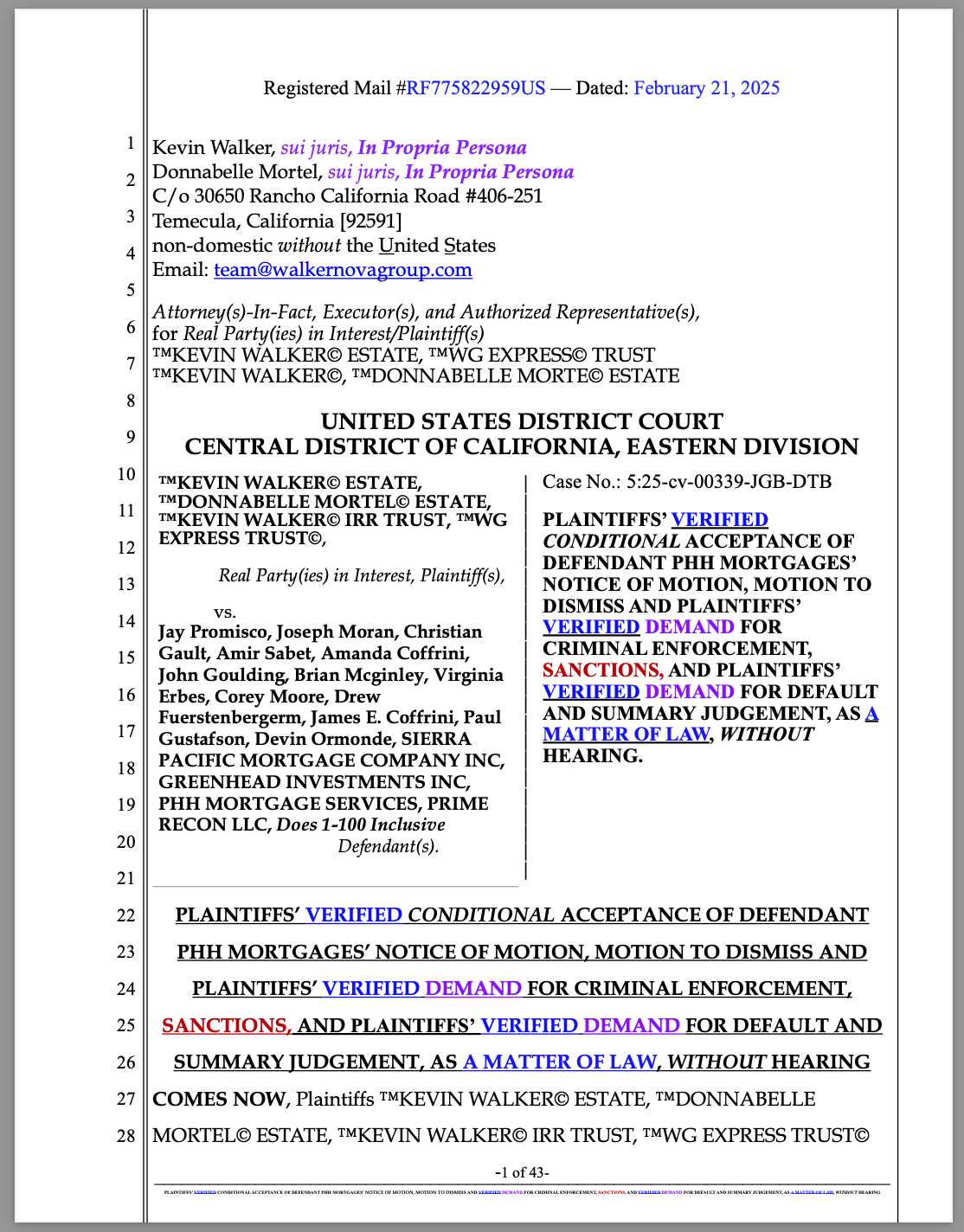

In response to these egregious violations, Plaintiffs have filed a PLAINTIFFS’ VERIFIED CONDITIONAL ACCEPTANCE OF DEFENDANT PHH MORTGAGES’ NOTICE OF MOTION, MOTION TO DISMISS AND PLAINTIFFS’ VERIFIED DEMAND FOR CRIMINAL ENFORCEMENT, SANCTIONS, AND PLAINTIFFS’ VERIFIED DEMAND FOR DEFAULT AND SUMMARY JUDGEMENT, AS A MATTER OF LAW, WITHOUT HEARING. This legal filing presents undeniable proof that PHH Mortgage’s motion is not just frivolous, but fraudulent.

PHH Mortgage’s Motion to Dismiss: A Masterclass in Legal Incompetence and/or Deception

PHH Mortgage’s Motion to Dismiss is so fundamentally flawed and devoid of merit that it would be laughed out of court in any legitimate legal proceeding. Their argument that Plaintiffs, acting as attorneys-in-fact, lack standing because they are not licensed attorneys is not just wrong—it is an intentional distortion of well-established legal principles.

UCC and Federal Law Directly Contradict PHH’s Baseless and Bogus Claims

PHH Mortgage’s attorneys completely ignore the legal reality that an attorney-in-fact is legally authorized to act on behalf of a principal in various financial and legal matters. Uniform Commercial Code (UCC) § 3-402, along with 26 U.S.C. §§ 2203, 7603, 6903, 6036, and 6402, explicitly affirms that an attorney-in-fact may act on behalf of an estate, trust, or individual.

Additionally, the American Bar Association (ABA) itself acknowledges that a Power of Attorney legally grants an individual the right to act on behalf of another, within the scope of the authority provided (Exhibit SS).

By falsely asserting that only licensed attorneys can represent a trust, PHH Mortgage’s counsel is either profoundly ignorant of the law or intentionally misleading the court in bad faith. This misrepresentation is not just unethical—it is fraudulent and sanctionable conduct.

Riverside Federal Court’s Manipulation of the Judicial Record: A Coordinated Cover-Up?

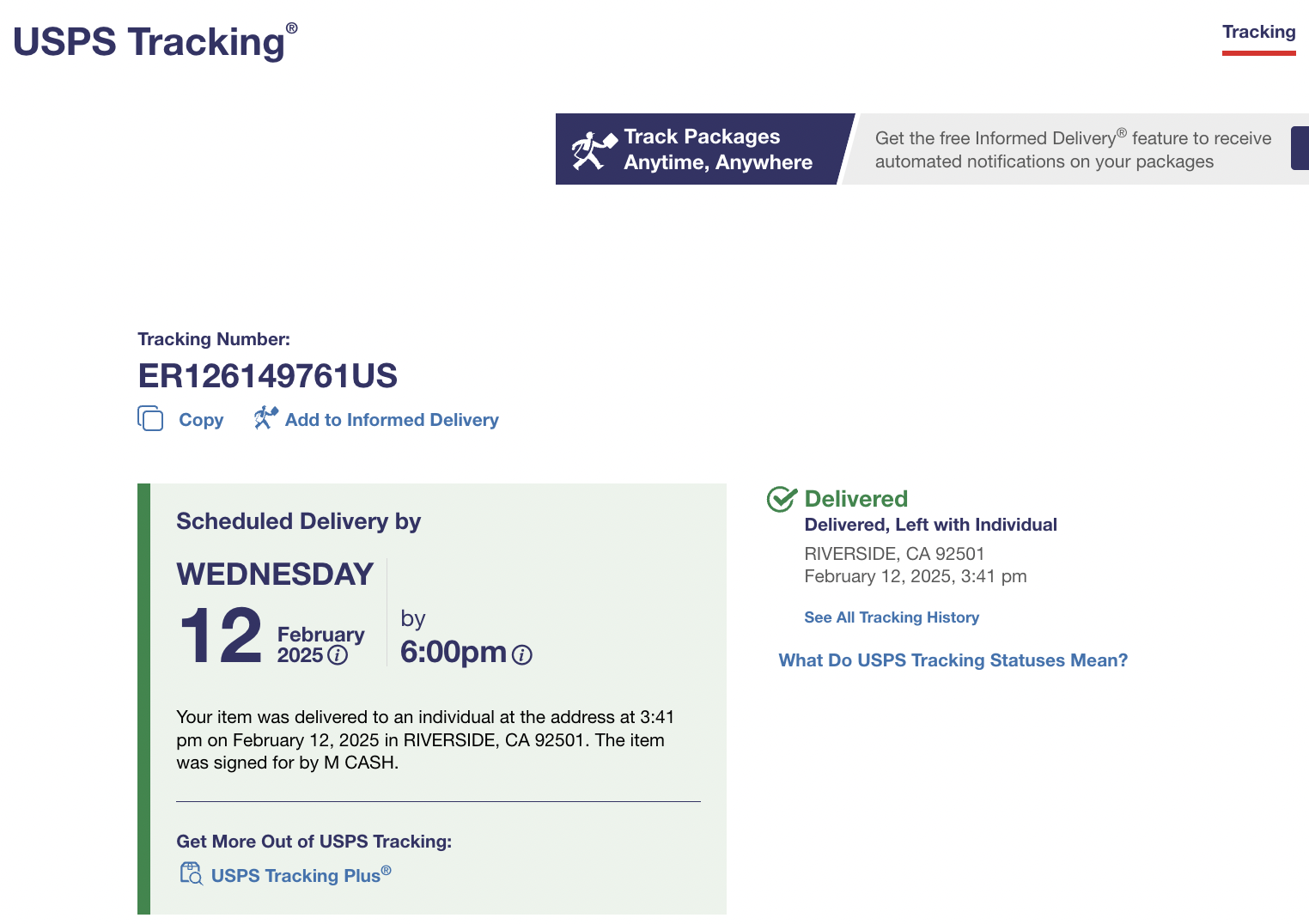

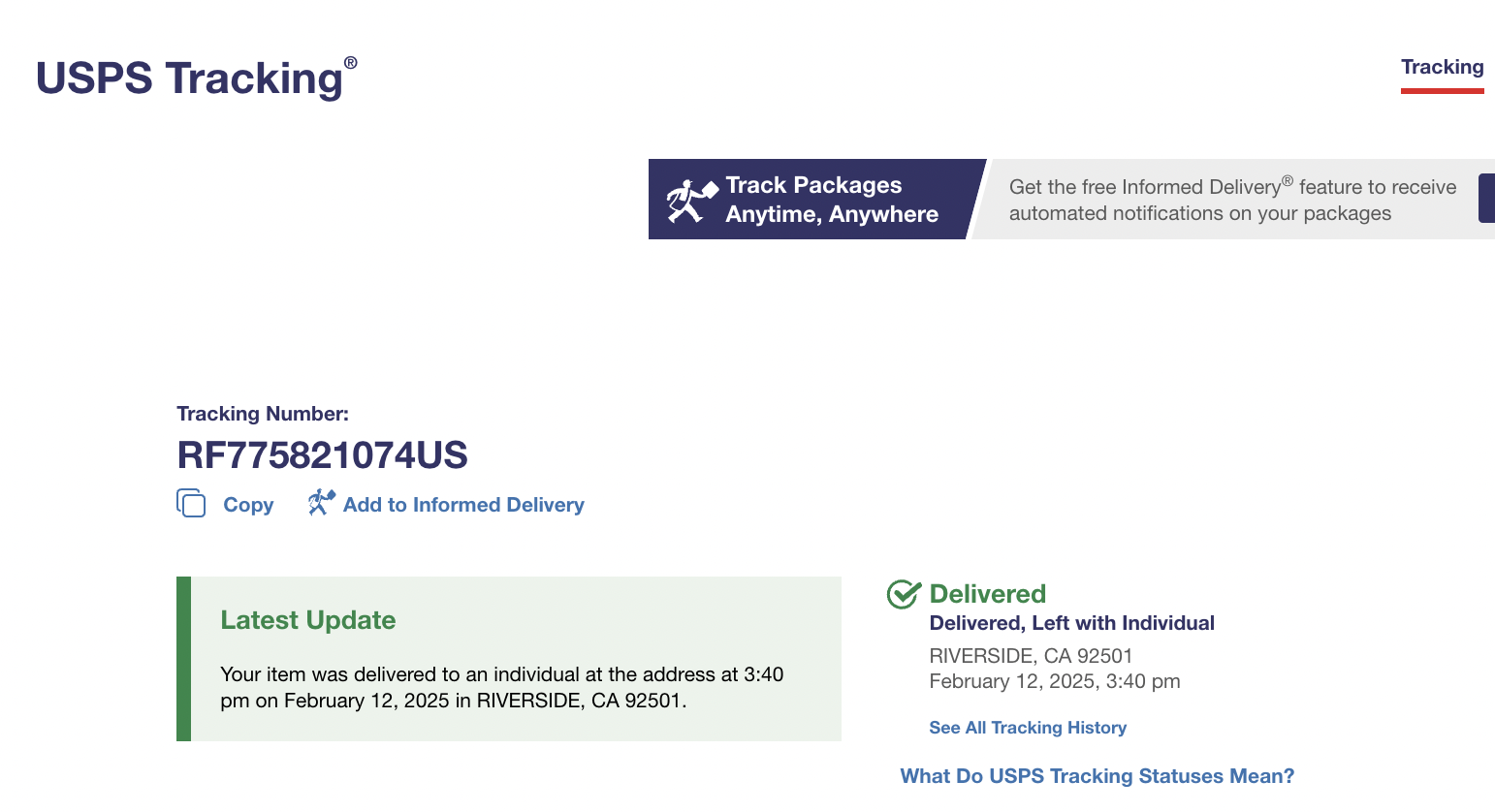

The most alarming aspect of this case is the blatant obstruction of justice by the Riverside Federal Court. Plaintiffs have submitted numerous filings that the court has failed to properly docket, effectively erasing key evidence from the record.

This level of procedural manipulation is not just unethical—it is illegal. It represents a direct attack on due process, violating the fundamental right to be heard and to have an accurate judicial record.

Due to this obstruction, Plaintiffs were forced to file a Verified Demand for a Writ of Mandamus, compelling the court to perform its clear, non-discretionary duty of filing all submitted documents. The very need for such a filing demonstrates that the Riverside Federal Court is actively obstructing justice.

Statutory and U.C.C. Recognition of ‘Attorney-in-Fact’ Authority

The authority of an attorney-in-fact is explicitly recognized in various statutory and commercial codes, reinforcing its binding nature:

- U.C.C. § 3-402: Establishes that an authorized representative, including an attorney-in-fact, can bind the principal in contractual and financial transactions.

- 28 U.S.C. § 1654: Confirms that “parties may plead and conduct their own cases personally or by counsel”, reinforcing the Plaintiffs’ right to self-representation and the use of an attorney-in-fact.

- 26 U.S.C. § 2203: Recognizes executors, including attorneys-in-fact, in matters of estate administration and tax liability.

- 26 U.S.C. § 7603: Acknowledges that an attorney-in-fact may lawfully receive and respond to IRS summonses on behalf of the principal.

- 26 U.S.C. § 6903: Confirms that fiduciaries, including attorneys-in-fact, are recognized in tax matters and are legally bound to act in their principal’s best interest.

- 26 U.S.C. § 6036: Establishes that attorneys-in-fact can handle affairs related to the administration of decedent estates and trust entities.

- 26 U.S.C. § 6402: Grants attorneys-in-fact the authority to receive and negotiate tax refunds and credits on behalf of the principal.

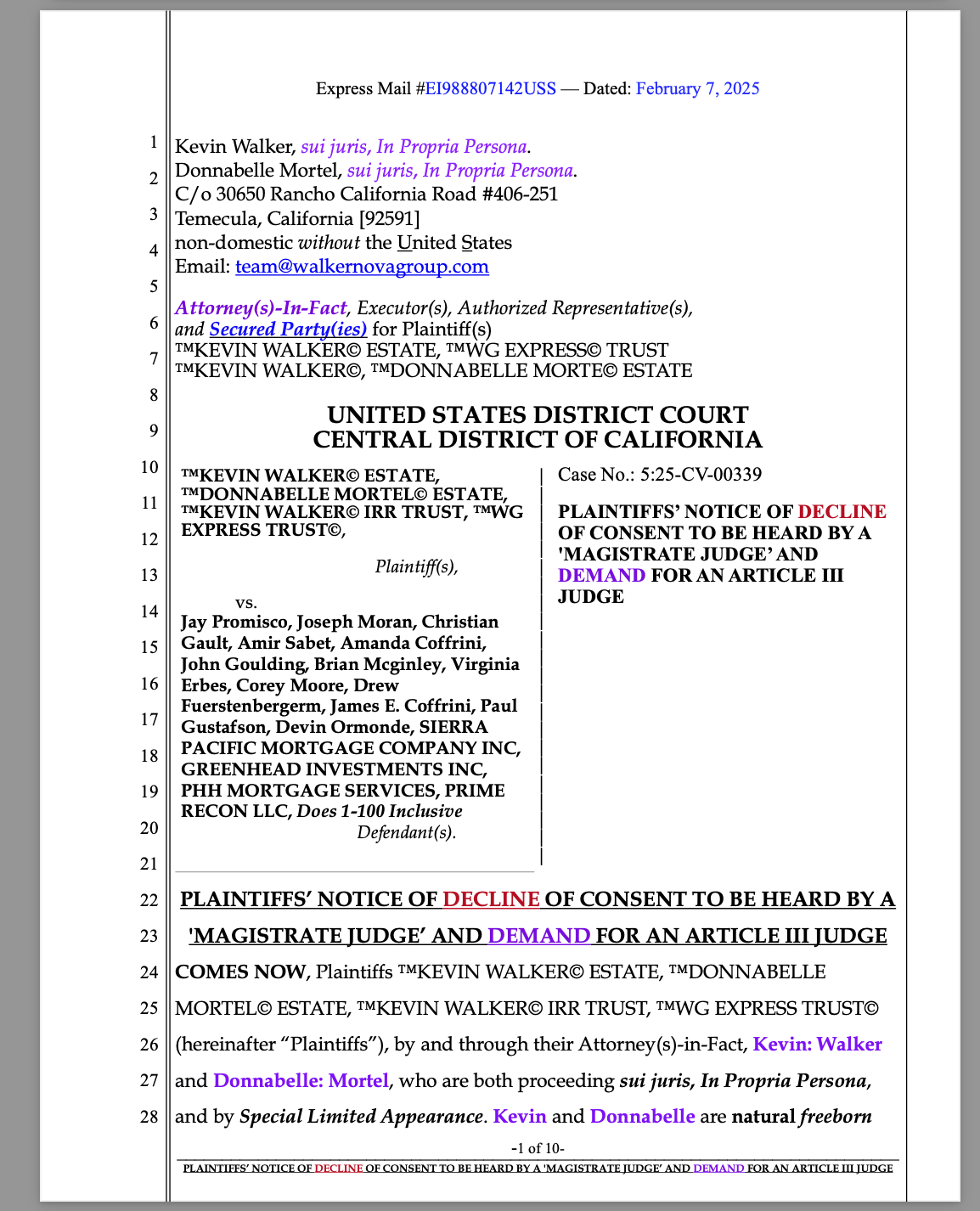

DOWNLOAD DOCUMENT

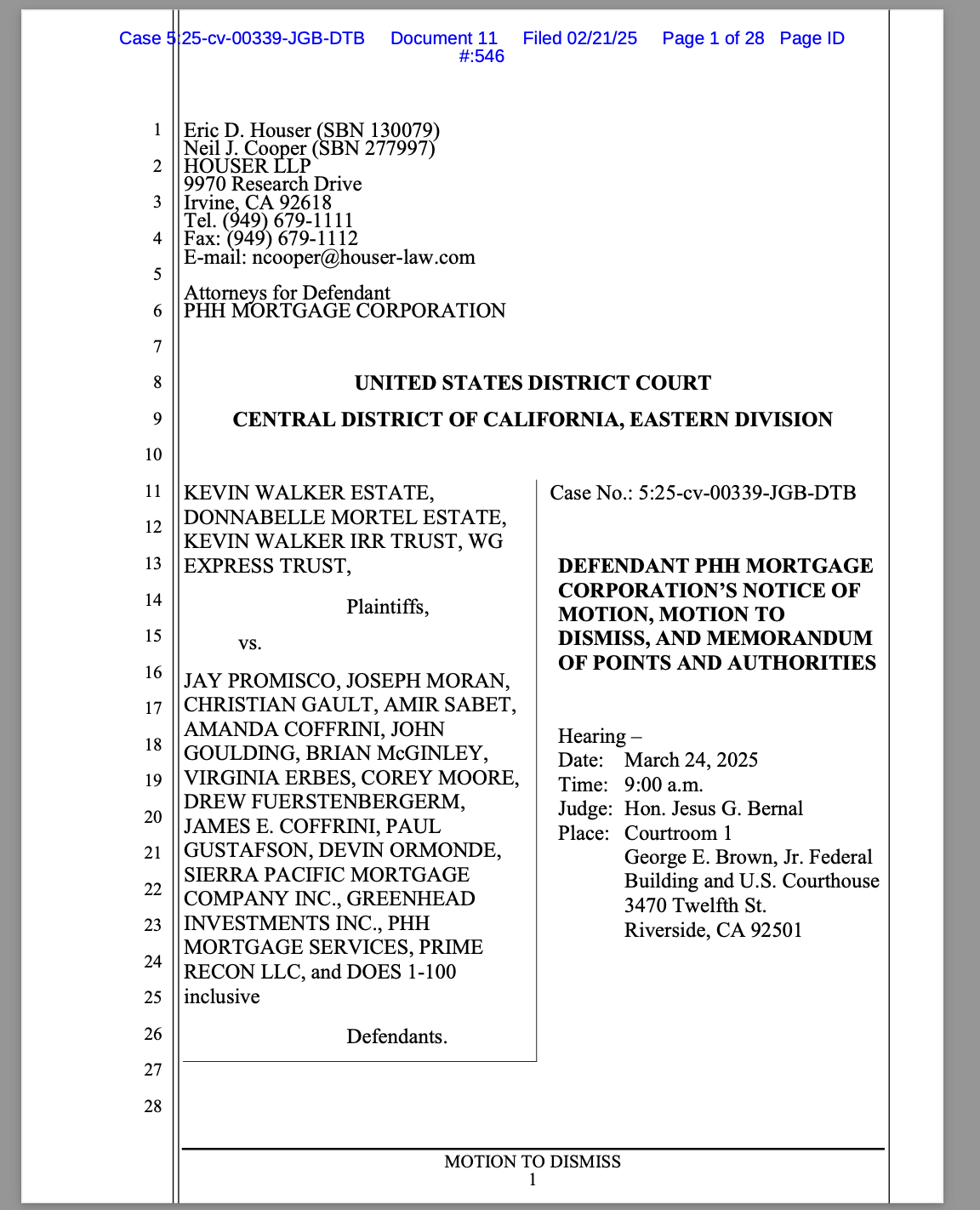

DOWNLOAD DOCUMENT

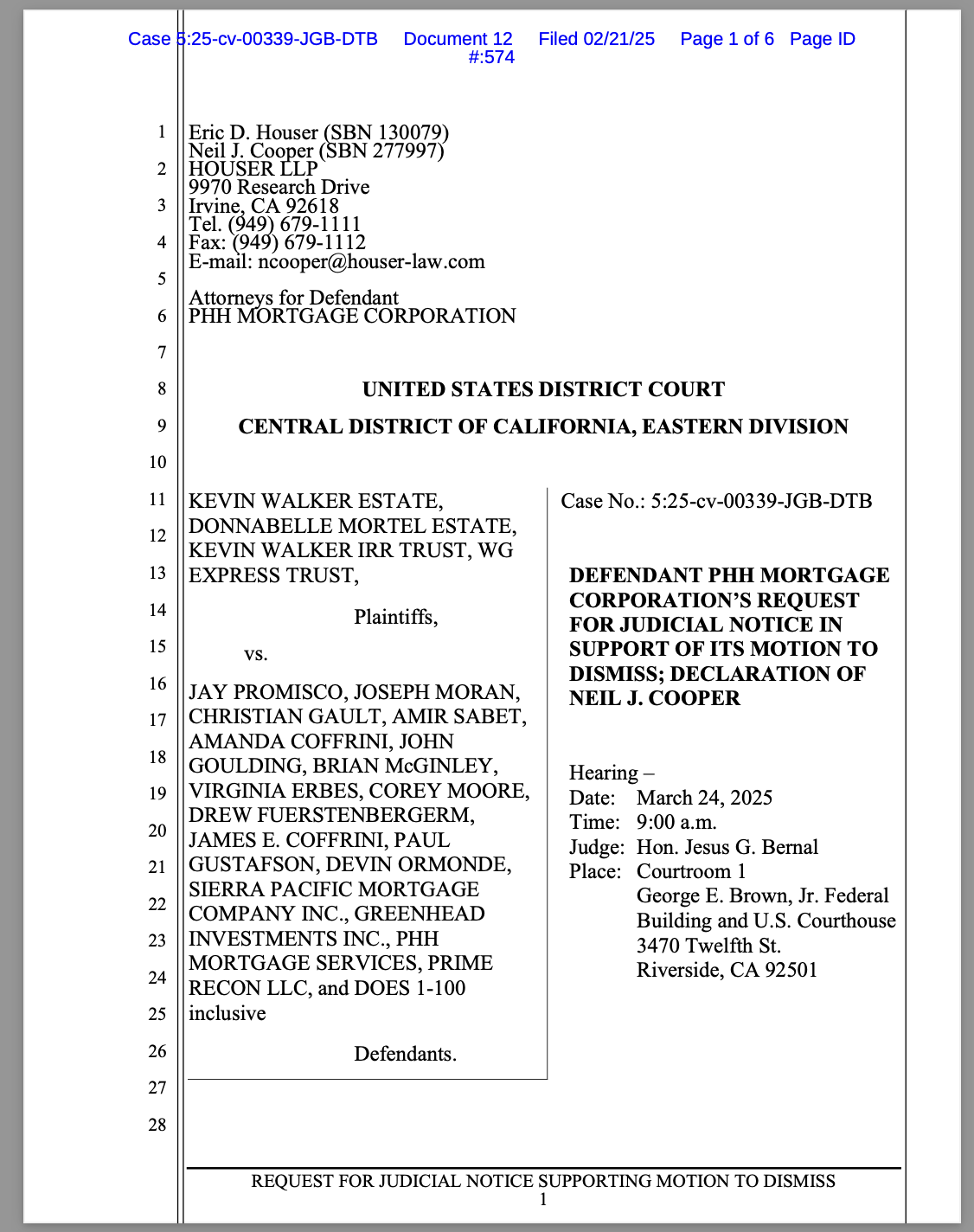

DOWNLOAD DOCUMENT

DOWNLOAD DOCUMENT

PHH Mortgage’s Misuse of Case Law and Bad Faith Legal Tactics

Beyond misrepresenting fundamental legal principles, PHH Mortgage’s legal team has relied on outdated, irrelevant, and discredited case law to support their fraudulent motion. Specifically, they:

- Ignore federal law and UCC provisions that explicitly authorize attorneys-in-fact.

- Cite non-binding, irrelevant, and overturned case law in an attempt to confuse the court.

- Use ad hominem attacks, including the fraudulent “sovereign citizen” label, to distract from the actual legal issues.

This pattern of misrepresentation, deception, and frivolous legal tactics is a direct violation of Rule 8.4 of the ABA Rules of Professional Conduct (Exhibit TT), which prohibits:

- Knowingly making false statements of law.

- Engaging in conduct involving dishonesty, fraud, deceit, or misrepresentation.

- Conduct prejudicial to the administration of justice.

By engaging in these fraudulent tactics, attorney Neil J. Cooper has not only displayed legal incompetence but has committed professional misconduct warranting immediate disciplinary action and disbarment.

The Overturning of the Chevron Doctrine Further Voids PHH’s Arguments

PHH Mortgage’s reliance on judicial deference to administrative agencies is now legally obsolete due to the Supreme Court’s overturning of the Chevron Doctrine. With Chevron deference eliminated, courts must independently interpret statutes instead of relying on agency opinions.

This renders PHH’s arguments completely void, as their case law citations are built on a now-rejected legal framework. Yet, instead of correcting their arguments, Defendants continue pushing legally void claims, further proving their bad faith litigation strategy.

PHH Mortgage and Riverside Court: Smoke and Fire

The evidence of fraud, judicial misconduct, and procedural abuse is overwhelming:

- PHH Mortgage has filed fraudulent and meritless motions.

- Neil J. Cooper has misrepresented the law, violating ethical and legal standards.

- The Riverside Federal Court has obstructed the record, depriving Plaintiffs of due process.

- PHH Mortgage’s legal team continues to cite case law that is irrelevant, inapplicable, or outright overturned.

In any other case, PHH’s motion would have been summarily dismissed with sanctions imposed on their legal team. The fact that the Riverside Federal Court has allowed this to proceed raises serious concerns about a systemic conspiracy to deprive Plaintiffs of their rights.

DOWNLOAD DOCUMENT

Demands for Sanctions, Summary Judgment, and Legal Costs

Given the overwhelming evidence of fraud, misrepresentation, and obstruction, Plaintiffs demand:

- Immediate summary judgment in Plaintiffs’ favor as a matter of law.

- Sanctions against PHH Mortgage and attorney Neil J. Cooper for filing a knowingly fraudulent motion.

- Striking of PHH Mortgage’s filings due to procedural non-compliance and legal incompetence.

- $100,000,000 in damages and legal costs for the egregious violations, obstruction, and frivolous litigation tactics used by PHH Mortgage.

Conclusion: The Court Must Act or Risk Being Complicit

PHH Mortgage’s legal strategy is not rooted in law, fact, or truth—it is a deliberate and fraudulent abuse of the judicial process. Meanwhile, the Riverside Federal Court’s obstruction of filings further proves a coordinated effort to deprive Plaintiffs of justice.

This case is not just about PHH Mortgage—it is about exposing a system that allows corrupt financial institutions to manipulate the courts and deny due process.

The Court must act now to sanction PHH Mortgage, strike their fraudulent filings, and grant judgment in favor of Plaintiffs. Anything less would be a direct endorsement of legal malpractice, fraud, and obstruction of justice.